Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Leonardo, who is married but files separately, earns $ 6 6 , 0 0 0 of taxable income. He also has $ 1 7 ,

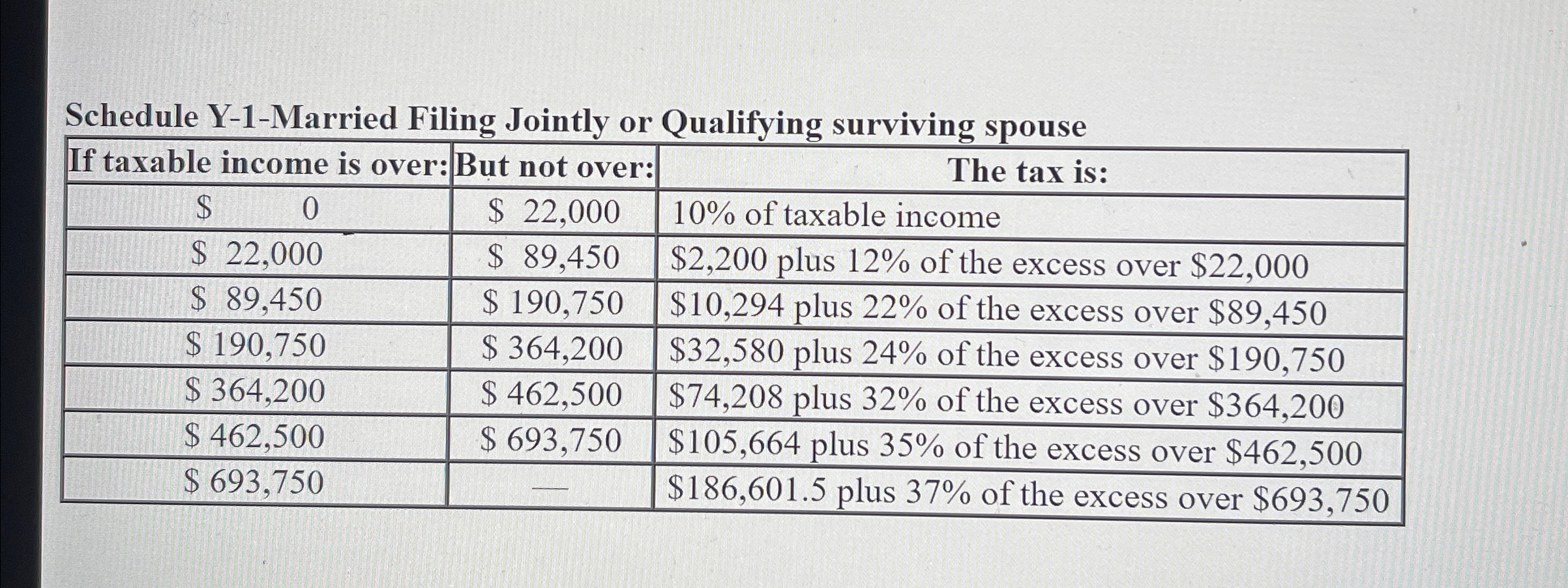

Leonardo, who is married but files separately, earns $ of taxable income. He also has $ in city of Tulsa bonds. His wife, Theresa, earns $ of taxible income. How mych money would Leonardo and Theresa have is they file jointly instead of seperately for Schedule YMarried Filing Jointly or Qualifying surviving spouse

tableIf taxable income is over:,But not over:,The tax is:$$ of taxable income$$$ plus of the excess over $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started