Answered step by step

Verified Expert Solution

Question

1 Approved Answer

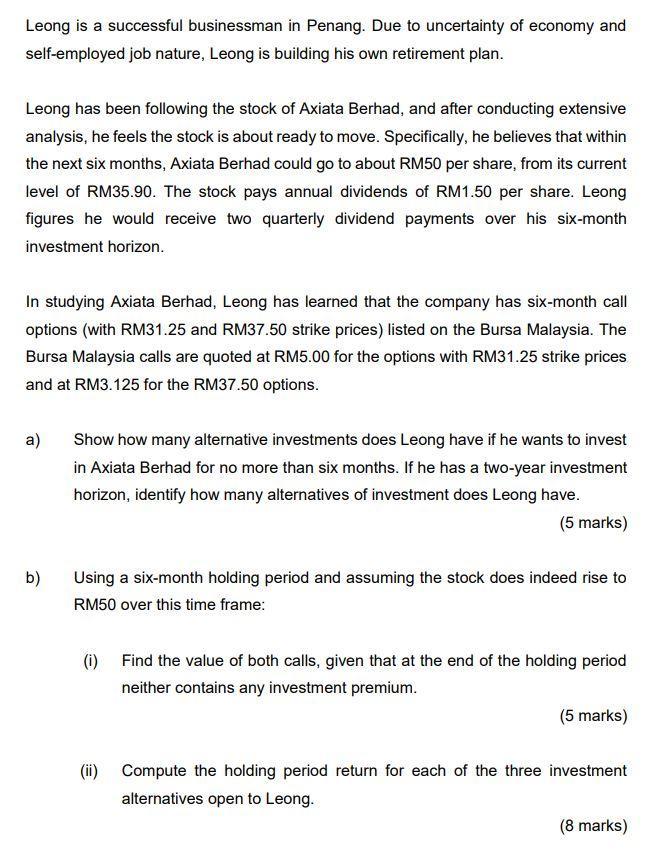

Leong is a successful businessman in Penang. Due to uncertainty of economy and self-employed job nature, Leong is building his own retirement plan. Leong

Leong is a successful businessman in Penang. Due to uncertainty of economy and self-employed job nature, Leong is building his own retirement plan. Leong has been following the stock of Axiata Berhad, and after conducting extensive analysis, he feels the stock is about ready to move. Specifically, he believes that within the next six months, Axiata Berhad could go to about RM50 per share, from its current level of RM35.90. The stock pays annual dividends of RM1.50 per share. Leong figures he would receive two quarterly dividend payments over his six-month investment horizon. In studying Axiata Berhad, Leong has learned that the company has six-month call options (with RM31.25 and RM37.50 strike prices) listed on the Bursa Malaysia. The Bursa Malaysia calls are quoted at RM5.00 for the options with RM31.25 strike prices and at RM3.125 for the RM37.50 options. a) Show how many alternative investments does Leong have if he wants to invest in Axiata Berhad for no more than six months. If he has a two-year investment horizon, identify how many alternatives of investment does Leong have. (5 marks) b) Using a six-month holding period and assuming the stock does indeed rise to RM50 over this time frame: (i) Find the value of both calls, given that at the end of the holding period neither contains any investment premium. (5 marks) Compute the holding period return for each of the three investment alternatives open to Leong. (8 marks) c) Recommend which course of action that Leong would want to maximize profit. Justify whether your answer would change if other factors (e.g., comparative risk exposure) were considered along with return. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started