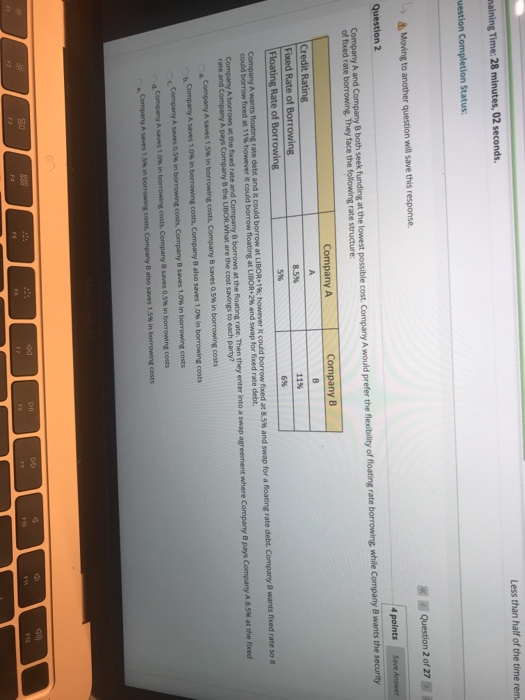

Less than half of the time rem. naining Time: 28 minutes, 02 seconds. uestion Completion Status: Question 2 of 27 Moving to another question will save this response. Question 2 4 points Save Answer Company A and Company B both seek funding at the lowest possible cost. Company A would prefer the flexibility of floating rate borrowing while Company B wants the security of fixed rate borrowing. They face the following rate structure: Company A Company B 8.5% Credit Rating Fixed Rate of Borrowing Floating Rate of Borrowing Company A wants floating rate debt and it could borrow at LIBOR 13; however it could borrow foed at 8.5% and swap for a floating rate debt. Company wants xed race so it could borrow fixed at 11% however it could borrow floating at LIBOR+2% and swap for foxed rate debt. Company A borrows at the foredrate and Company borrows at the floating rate. Then they enter into a swap agreement where Company B pays Company A85W at the forced rate and company A pays company the LIBOR What are the cost savings to each party? Company A saves 15 in borrowing costs, Company B saves om in borrowing costs Company A seves 1.0 in borrowing costs, Company B also saves 1.0% in borrowing costs Company A seves 0.5 in borrowing costs, Company B saves 1.0 in borrowing costs a company A saves 1.0 in borrowing costs, Company saves 0.5 in borrowing costs Company A seves 15 in borrowing costs. Company B also saves 1.5 in borrowing costs DII DD 288 FO Less than half of the time rem. naining Time: 28 minutes, 02 seconds. uestion Completion Status: Question 2 of 27 Moving to another question will save this response. Question 2 4 points Save Answer Company A and Company B both seek funding at the lowest possible cost. Company A would prefer the flexibility of floating rate borrowing while Company B wants the security of fixed rate borrowing. They face the following rate structure: Company A Company B 8.5% Credit Rating Fixed Rate of Borrowing Floating Rate of Borrowing Company A wants floating rate debt and it could borrow at LIBOR 13; however it could borrow foed at 8.5% and swap for a floating rate debt. Company wants xed race so it could borrow fixed at 11% however it could borrow floating at LIBOR+2% and swap for foxed rate debt. Company A borrows at the foredrate and Company borrows at the floating rate. Then they enter into a swap agreement where Company B pays Company A85W at the forced rate and company A pays company the LIBOR What are the cost savings to each party? Company A saves 15 in borrowing costs, Company B saves om in borrowing costs Company A seves 1.0 in borrowing costs, Company B also saves 1.0% in borrowing costs Company A seves 0.5 in borrowing costs, Company B saves 1.0 in borrowing costs a company A saves 1.0 in borrowing costs, Company saves 0.5 in borrowing costs Company A seves 15 in borrowing costs. Company B also saves 1.5 in borrowing costs DII DD 288 FO