Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lessee and Lessor entered into a lease agreement for equipment beginning on January 1, 2020. The term of the lease is five years, beginning

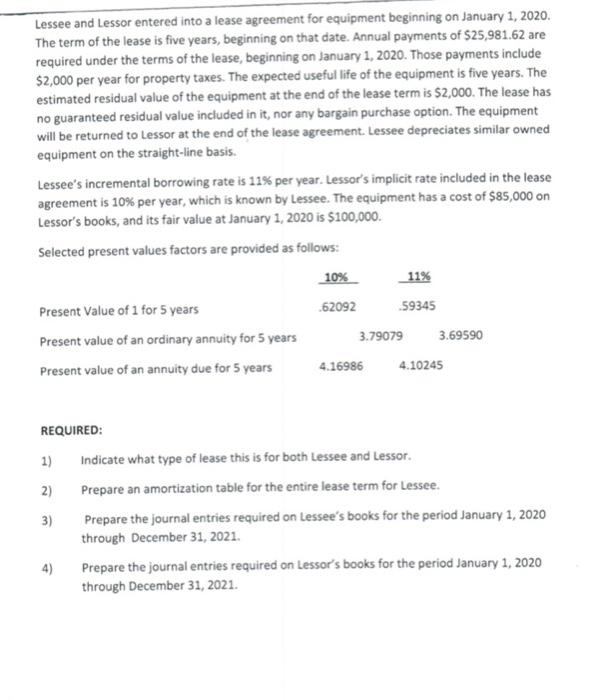

Lessee and Lessor entered into a lease agreement for equipment beginning on January 1, 2020. The term of the lease is five years, beginning on that date. Annual payments of $25,981.62 are required under the terms of the lease, beginning on January 1, 2020. Those payments include $2,000 per year for property taxes. The expected useful life of the equipment is five years. The estimated residual value of the equipment at the end of the lease term is $2,000. The lease has no guaranteed residual value included in it, nor any bargain purchase option. The equipment will be returned to Lessor at the end of the lease agreement. Lessee depreciates similar owned equipment on the straight-line basis. Lessee's incremental borrowing rate is 11% per year. Lessor's implicit rate included in the lease agreement is 10% per year, which is known by Lessee. The equipment has a cost of $85,000 on Lessor's books, and its fair value at January 1, 2020 is $100,000. Selected present values factors are provided as follows: Present Value of 1 for 5 years Present value of an ordinary annuity for 5 years Present value of an annuity due for 5 years REQUIRED: 1) 2) 3) 4) 10% 62092 11% 59345 3.79079 4.16986 3.69590 4.10245 Indicate what type of lease this is for both Lessee and Lessor. Prepare an amortization table for the entire lease term for Lessee. Prepare the journal entries required on Lessee's books for the period January 1, 2020 through December 31, 2021. Prepare the journal entries required on Lessor's books for the period January 1, 2020 through December 31, 2021.

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started