Question

(Lessee-Lessor Entries; Sales-Type Lease) On January 1, 2011, Palmer Company leased equipment to Woods Corporation. The following information pertains to this lease. The term of

(Lessee-Lessor Entries; Sales-Type Lease)

On January 1, 2011, Palmer Company leased equipment to Woods Corporation. The following information pertains to this lease.

- The term of the noncancelable lease is 6 years, with no renewal option. The equipment reverts to the lessor at the termination of the lease.

- Equal rental payments are due on January 1 of each year, beginning in 2011.

- The fair value of the equipment on January 1, 2011, is $200,000, and its cost is $150,000.

- The equipment has an economic life of 8 years, with an unguaranteed residual value of $10,000. Woods depreciates all of its equipment on a straight-line basis.

- Palmer set the annual rental to ensure an 11% rate of return. Woods's incremental borrowing rate is 12%, and the implicit rate of the lessor is unknown.

- Collectibility of lease payments is reasonably predictable, and no important uncertainties surround the amount of costs yet to be incurred by the lessor.

Instructions (Both the lessor and the lessee's accounting period ends on December 31.)

(a) Answer the following questions.

What type of lease is recorded by Palmer? ________________

What type of lease is recorded by Woods? ________________

(b) Calculate the amount of the annual rental payment. (Round your answer to the nearest dollar eg 58,971.)

$ ____________

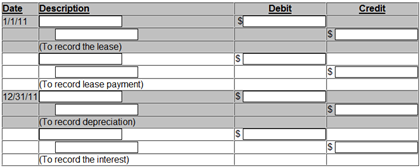

(c) Prepare all the necessary journal entries for Woods for 2011. (Round your answer to the nearest dollar eg 58,971.)

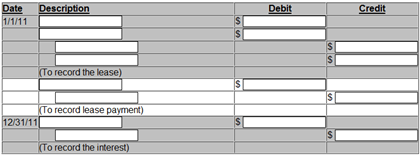

(d) Prepare all the necessary journal entries for Palmer for 2011. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2. Round your answer to the nearest dollar eg 58,971.)

Please help

Thanks

(Lessee-Lessor Entries; Sales-Type Lease) On January 1, 2011, Palmer Company leased equipment to Woods Corporation. The following information pertains to this lease. The term of the noncancelable lease is 6 years, with no renewal option. The equipment reverts to the lessor at the termination of the lease. Equal rental payments are due on January 1 of each year, beginning in 2011. The fair value of the equipment on January 1, 2011, is $200,000, and its cost is $150,000. The equipment has an economic life of 8 years, with an unguaranteed residual value of $10,000. Woods depreciates all of its equipment on a straight-line basis. Palmer set the annual rental to ensure an 11% rate of return. Woods's incremental borrowing rate is 12%, and the implicit rate of the lessor is unknown. Collectibility of lease payments is reasonably predictable, and no important uncertainties surround the amount of costs yet to be incurred by the lessor. Instructions (Both the lessor and the lessee's accounting period ends on December 31.) (a) Answer the following questions. What type of lease is recorded by Palmer? ________________ What type of lease is recorded by Woods? ________________ (b) Calculate the amount of the annual rental payment. (Round your answer to the nearest dollar eg 58,971.) $ ____________ (c) Prepare all the necessary journal entries for Woods for 2011. (Round your answer to the nearest dollar eg 58,971.)(d) Prepare all the necessary journal entries for Palmer for 2011. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2. Round your answer to the nearest dollar eg 58,971.)Please help ThanksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started