Lesson 8: Review Lessons 17 Payroll Project - Please help

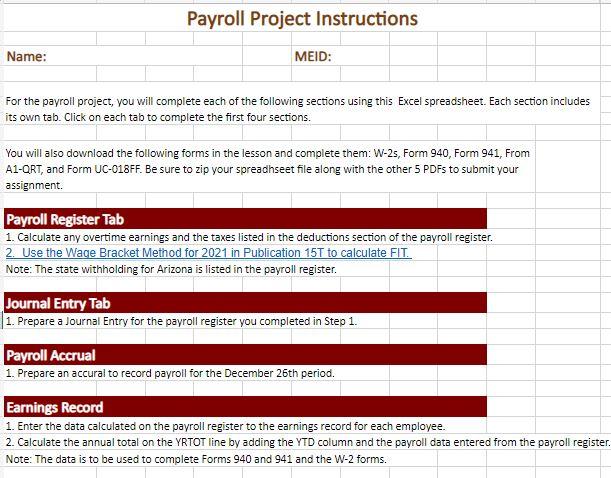

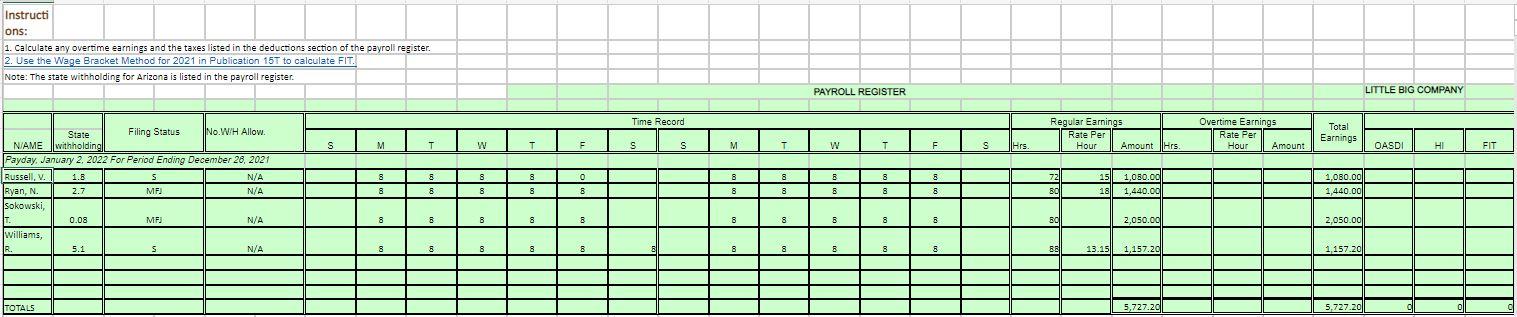

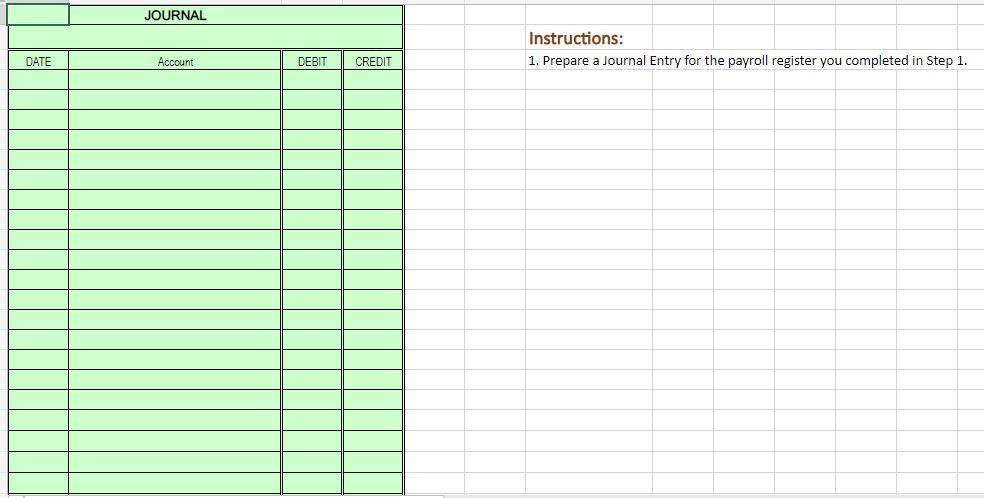

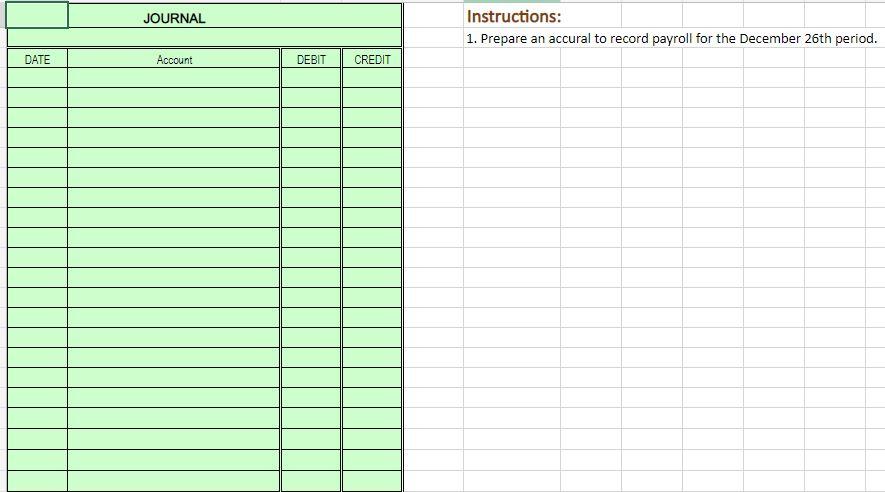

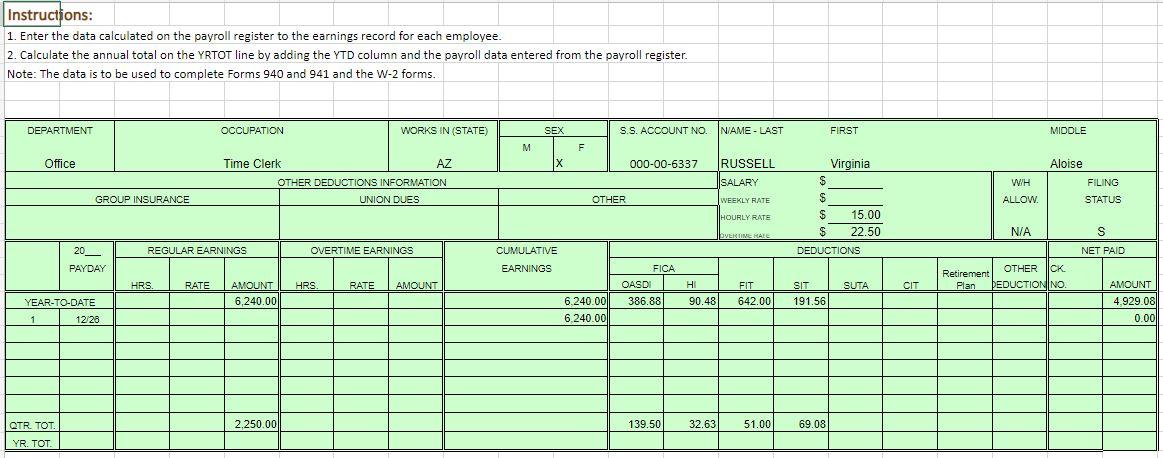

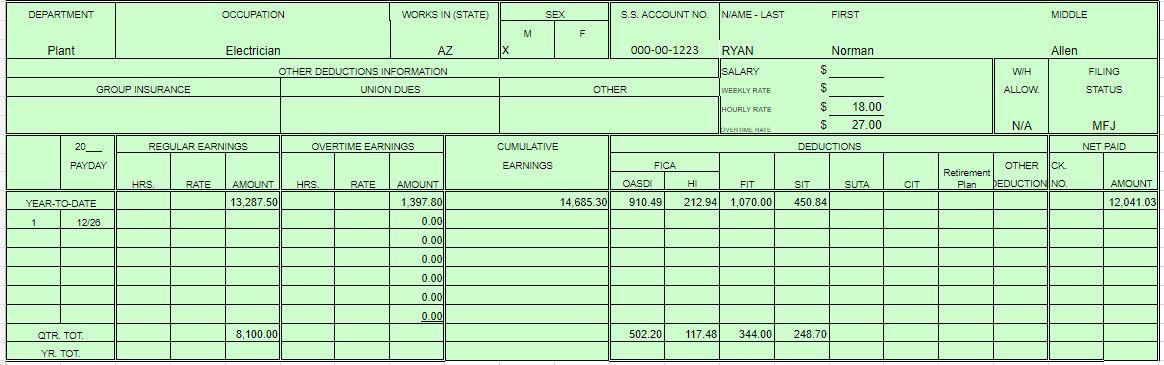

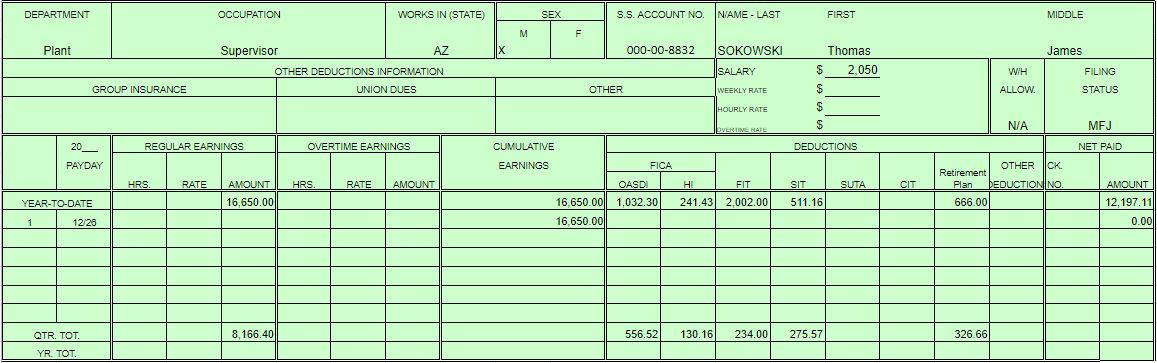

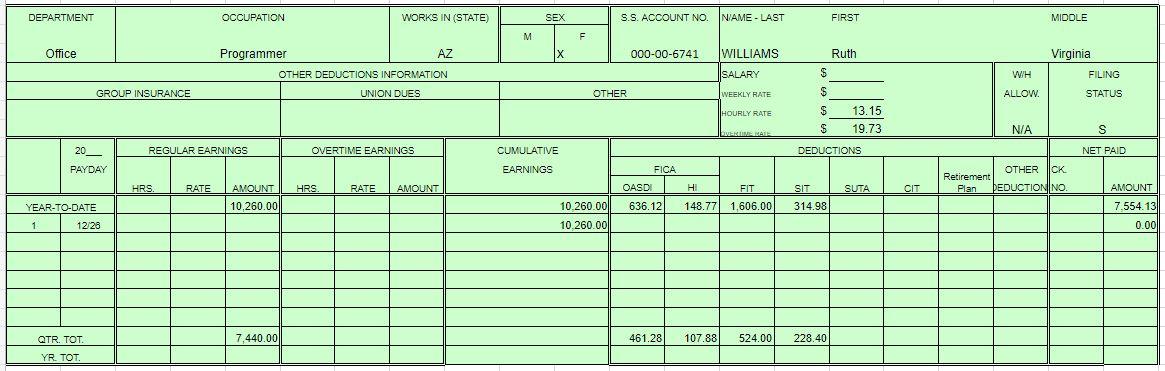

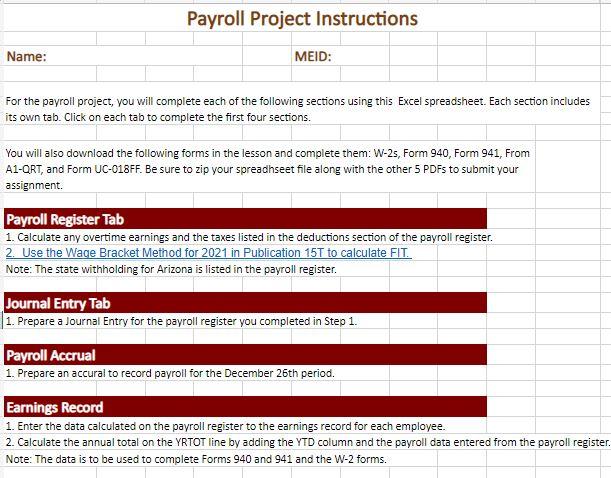

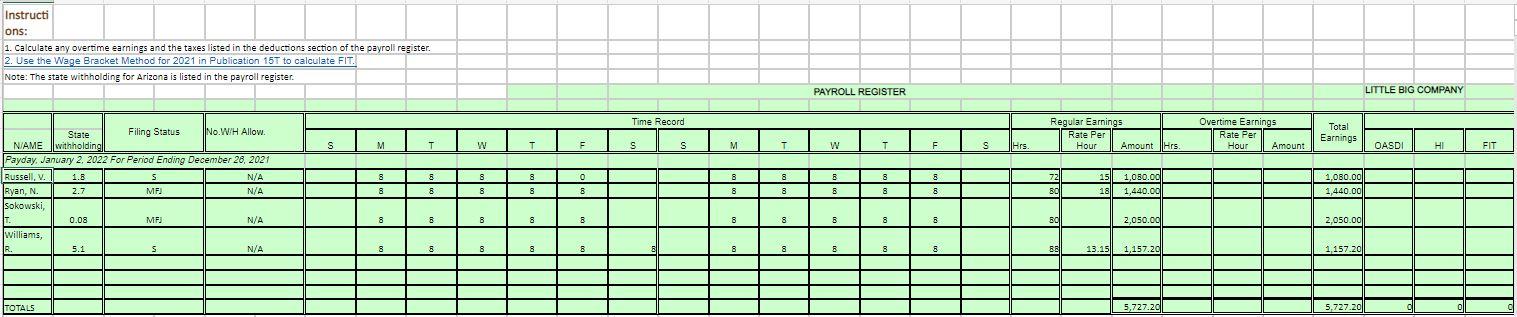

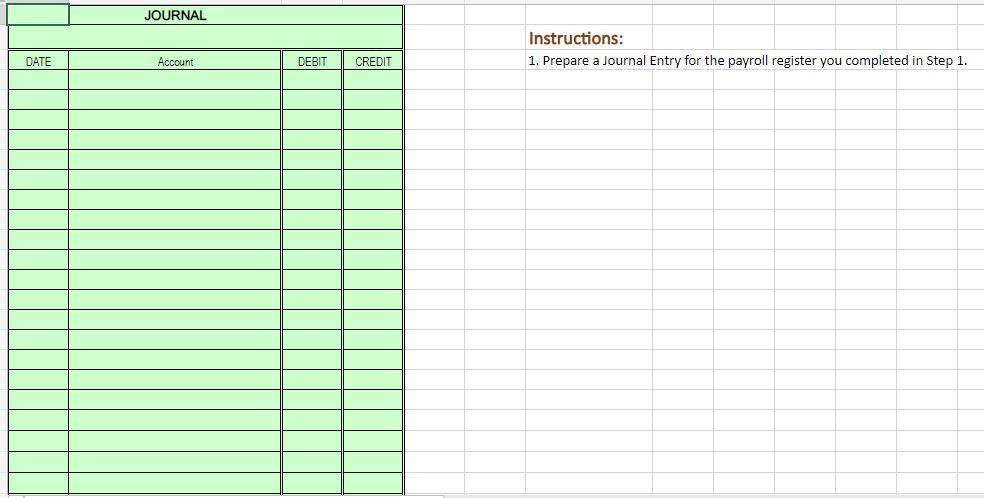

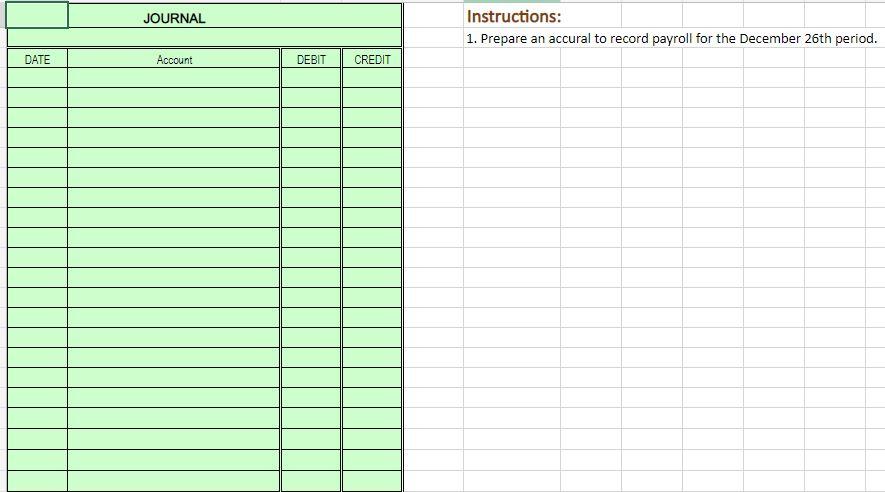

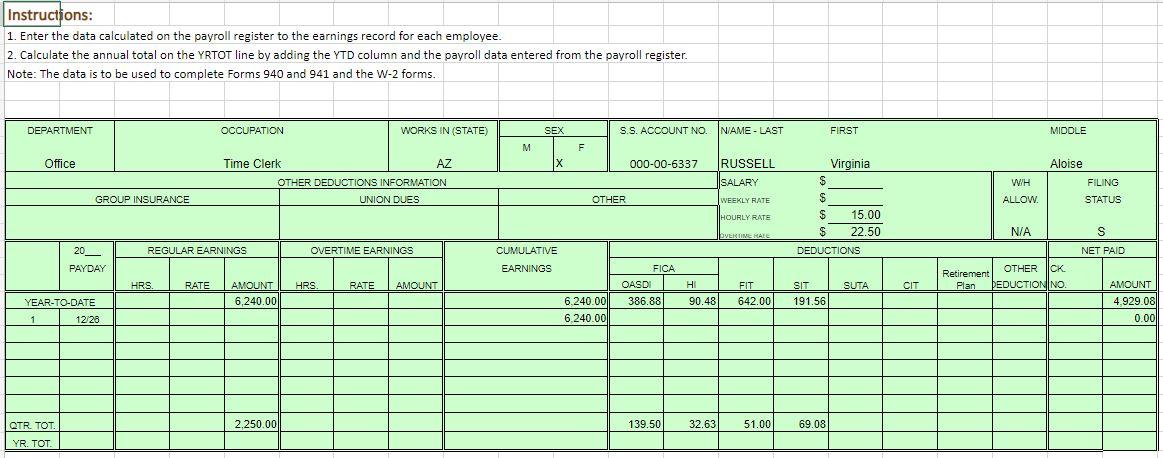

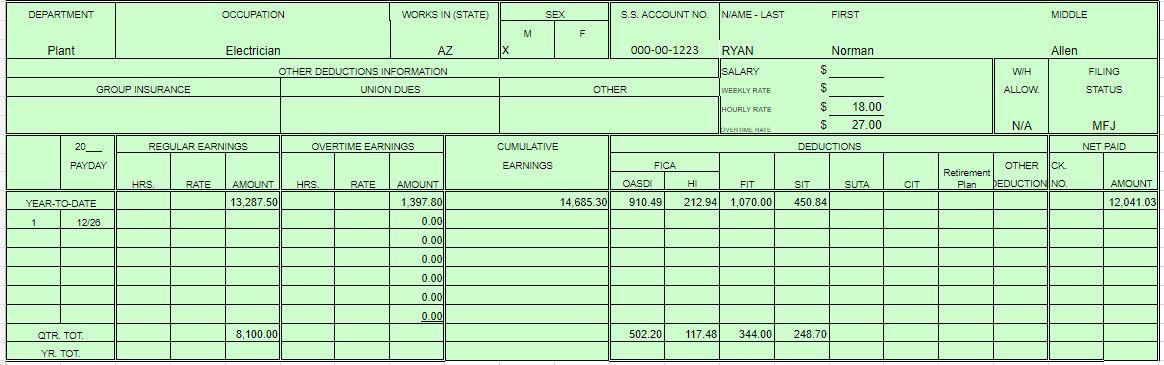

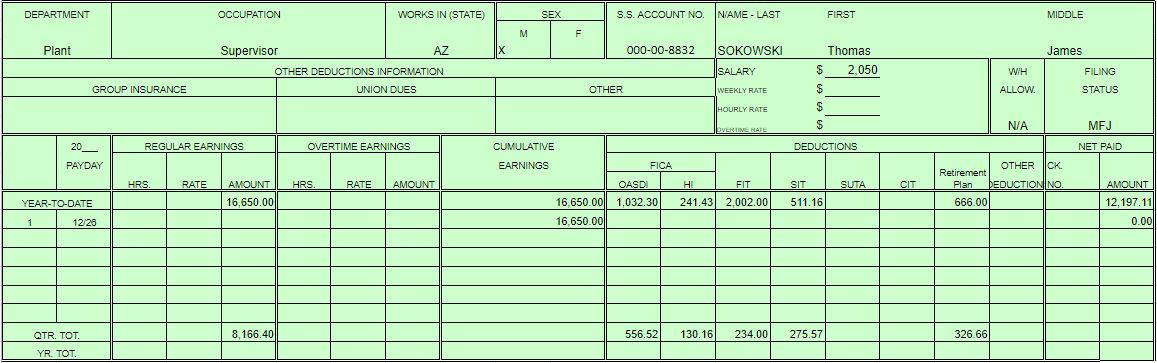

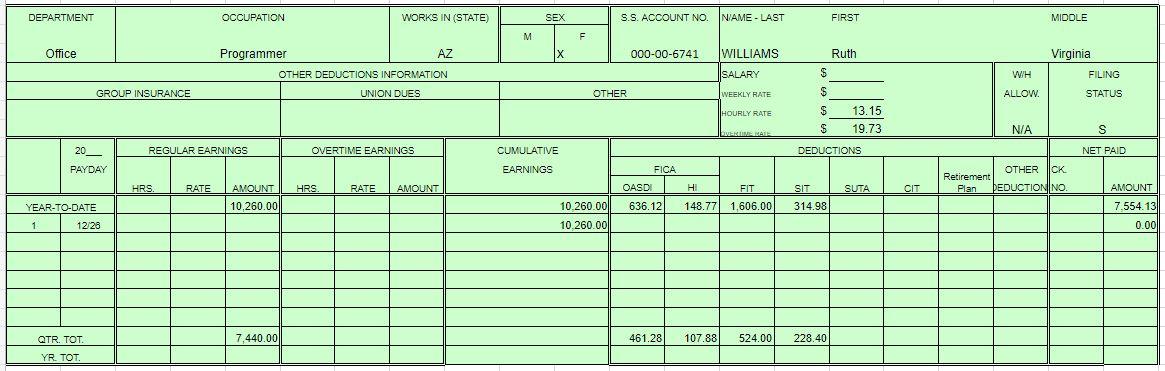

Payroll Project Instructions Name: MEID: For the payroll project, you will complete each of the following sections using this Excel spreadsheet. Each section includes its own tab. Click on each tab to complete the first four sections. You will also download the following forms in the lesson and complete them: W-25, Form 940, Form 941 , from A1-QRT, and Form UC-018FF. Be sure to zip your spreadhseet file along with the other 5 PDFs to submit your assignment. Payroll Register Tab 1. Calculate any overtime earnings and the taxes listed in the deductions section of the payroll register. 2. Use the Wage Bracket Method for 2021 in Publication 15T to calculate FIT. Note: The state withholding for Arizona is listed in the payroll register. Journal Entry Tab 1. Prepare a Journal Entry for the payroll register you completed in Step 1. Payroll Accrual 1. Prepare an accural to record payroll for the December 2 th period. Earnings Record 1. Enter the data calculated on the payroll register to the earnings record for each employee. 2. Calculate the annual total on the YRTOT line by adding the YTD column and the payroll data entered from the payroll register. Note: The data is to be used to complete Forms 940 and 941 and the W-2 forms. Instructions: 1. Prepare a Journal Entry for the payroll register you completed in Step 1. Instructions: 1. Prepare an accural to record payroll for the December 26th period. Instructions: 1. Enter the data calculated on the payroll register to the earnings record for each employee. 2. Calculate the annual total on the YRTOT line by adding the YTD column and the payroll data entered from the payroll register. Note: The data is to be used to complete Forms 940 and 941 and the W-2 forms. Payroll Project Instructions Name: MEID: For the payroll project, you will complete each of the following sections using this Excel spreadsheet. Each section includes its own tab. Click on each tab to complete the first four sections. You will also download the following forms in the lesson and complete them: W-25, Form 940, Form 941 , from A1-QRT, and Form UC-018FF. Be sure to zip your spreadhseet file along with the other 5 PDFs to submit your assignment. Payroll Register Tab 1. Calculate any overtime earnings and the taxes listed in the deductions section of the payroll register. 2. Use the Wage Bracket Method for 2021 in Publication 15T to calculate FIT. Note: The state withholding for Arizona is listed in the payroll register. Journal Entry Tab 1. Prepare a Journal Entry for the payroll register you completed in Step 1. Payroll Accrual 1. Prepare an accural to record payroll for the December 2 th period. Earnings Record 1. Enter the data calculated on the payroll register to the earnings record for each employee. 2. Calculate the annual total on the YRTOT line by adding the YTD column and the payroll data entered from the payroll register. Note: The data is to be used to complete Forms 940 and 941 and the W-2 forms. Instructions: 1. Prepare a Journal Entry for the payroll register you completed in Step 1. Instructions: 1. Prepare an accural to record payroll for the December 26th period. Instructions: 1. Enter the data calculated on the payroll register to the earnings record for each employee. 2. Calculate the annual total on the YRTOT line by adding the YTD column and the payroll data entered from the payroll register. Note: The data is to be used to complete Forms 940 and 941 and the W-2 forms