Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lessor Co. and Lessee Co. signed a 4-year lease on Jan. 1, 2020 The leased property cost Lessor Co. $65,000, which was also its

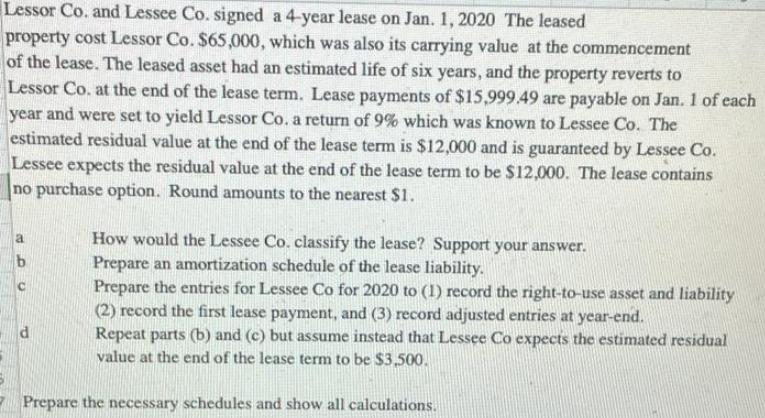

Lessor Co. and Lessee Co. signed a 4-year lease on Jan. 1, 2020 The leased property cost Lessor Co. $65,000, which was also its carrying value at the commencement of the lease. The leased asset had an estimated life of six years, and the property reverts to Lessor Co. at the end of the lease term. Lease payments of $15,999.49 are payable on Jan. 1 of each year and were set to yield Lessor Co. a return of 9% which was known to Lessee Co. The estimated residual value at the end of the lease term is $12,000 and is guaranteed by Lessee Co. Lessee expects the residual value at the end of the lease term to be $12,000. The lease contains no purchase option. Round amounts to the nearest $1. How would the Lessee Co. classify the lease? Support your answer. Prepare an amortization schedule of the lease liability. Prepare the entries for Lessee Co for 2020 to (1) record the right-to-use asset and liability (2) record the first lease payment, and (3) record adjusted entries at year-end. Repeat parts (b) and (c) but assume instead that Lessee Co expects the estimated residual value at the end of the lease term to be $3,500. Prepare the necessary schedules and show all calculations.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Lease rental s Payable Per Anum is 1599949 Estimated Residual Value at the End of Lease is 12000 Interst Rate Implicit is 9 Lease Term is 4 Years Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started