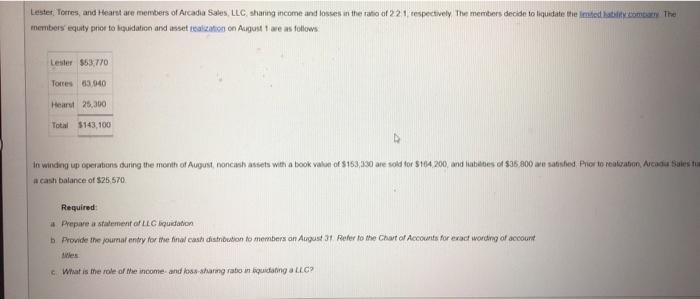

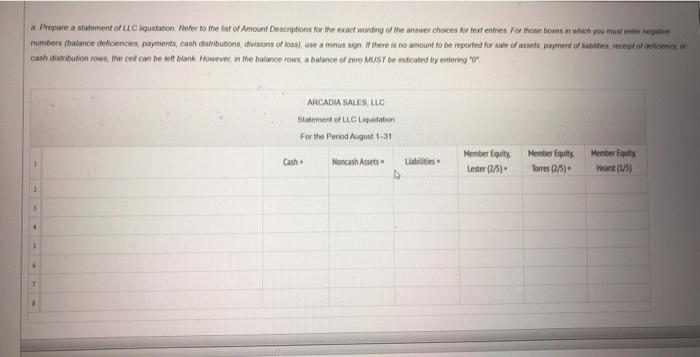

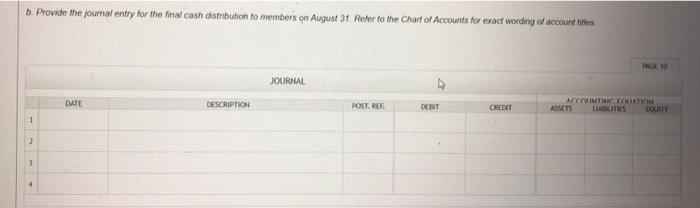

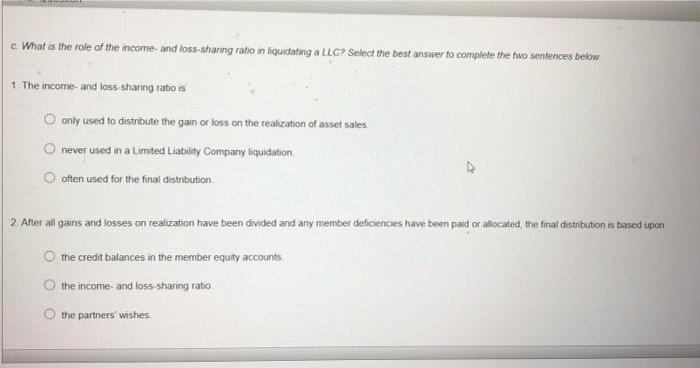

Lester Torres, and Heart are members of Arcadia Sales, LLC, shuning income and losses in the ratio of 221 respectively The members decide to liquidate the medicama The members equity prior to liquidation and asset realization on August toe as follows Lester $53770 Torres 03.940 Heart 25,300 Total $143.100 D In winding up operations during the month of August, noncash assets with a book valut of 153,130 are sold for $164.200, and liabilities of $35.800 ale satuled. Prior to realisation Acadia Sales a cash balance of $25,570 Required: Prepare a statement of Liquidation b Provide the journal entry for the final cash disbution to members on August 31 Refer to the Chart of Accounts for exact wording of account Alles What is the role of the income and loss sharing rato in quating a LLC a Prepare a statement of Liquidation Refer to the list of Amount Descriptions for the exact wording of the answer choices for text entries For Moseboxes in which you must enter nepie numbers (balance deficios payments, cash distributions divisions of fosse amnus on there is no amount to be reported for sale of assets, payment of the recepto define cash debution town, the cw can be eitt block. However, the balance row, awance of 200 MUST be indicated by entering ARCADIA SALES, LLC Statement of LLC Liquidation For the Period August 1-31 Cash Moncash Assets D 1 Labi Member Equity Lester 0/5) Member Equity Torres0/5) Member Equity Hast (1/5) 3 1 bProvide the journal entry for the final cash dibution to members on August 31. Refer to the Chart of Accounts for exact wording of account oties WWE JOURNAL DATE DESCRIPTION POSTRES DERIT CREDIT ACCION COUNTY LAINS 1 2 3 c. What is the role of the income and loss-sharing ratio in liquidating a LLC? Select the best answer to complete the two sentences below 1 The income and loss sharing ratio is O only used to distrbute the gain or loss on the realization of asset sales never used in a Limited Liability Company liquidation, often used for the final distribution 2 After all gains and losses on realization have been divided and any member deficiencies have been paid or allocated, the final distribution is based upon the credit balances in the member equity accounts the income and loss sharing ratio the partners' wishes