Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Let ANZ common shares be the selected underlying asset. Choose one particular time-to-expiry between one to nine months, for example, you choose a series

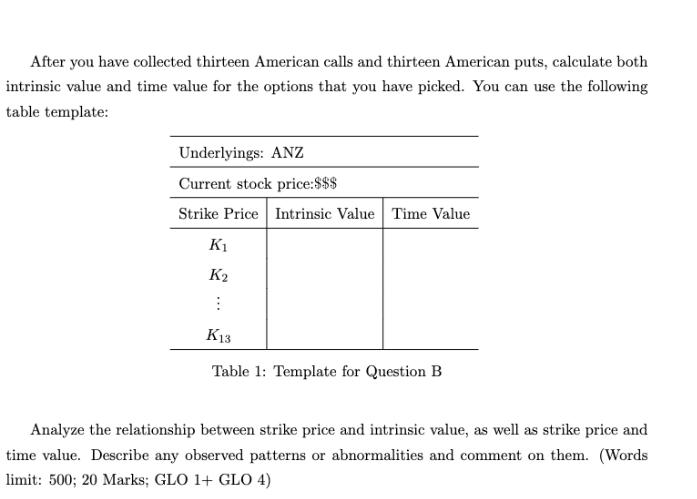

Let ANZ common shares be the selected underlying asset. Choose one particular time-to-expiry between one to nine months, for example, you choose a series of contracts expiring in 2-month's time. Choose thirteen different strike prices spread between a level of Sox (1-30%) and Sox (1+30%) where So is the last-trade-price of underlying common shares. Collect both American calls and American puts. (The instruction for data download can be found in the document titled "Assessment Task 2 Instruction for Data Download and Implied Volatility Estimation"). You need both non-zero bid and offer prices to complete the question. Change the time-to-expiry until you find the dataset that meets the requirements. After you have collected thirteen American calls and thirteen American puts, calculate both intrinsic value and time value for the options that you have picked. You can use the following table template: Underlyings: ANZ Current stock price:$$$ Strike Price Intrinsic Value Time Value K2 K13 Table 1: Template for Question B Analyze the relationship between strike price and intrinsic value, as well as strike price and time value. Describe any observed patterns or abnormalities and comment on them. (Words limit: 500; 20 Marks; GLO 1+ GLO 4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started