Answered step by step

Verified Expert Solution

Question

1 Approved Answer

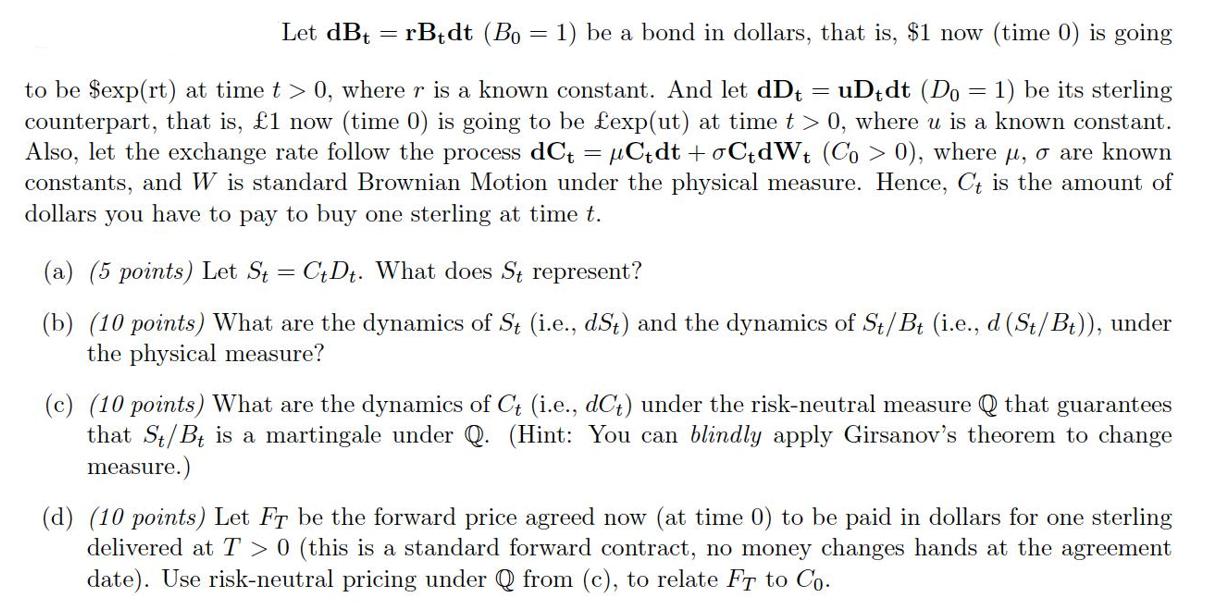

Let dBtrBedt (Bo = 1) be a bond in dollars, that is, $1 now (time 0) is going to be Sexp(rt) at time t

Let dBtrBedt (Bo = 1) be a bond in dollars, that is, $1 now (time 0) is going to be Sexp(rt) at time t > 0, where r is a known constant. And let dDt = uDdt (Do = 1) be its sterling counterpart, that is, 1 now (time 0) is going to be exp(ut) at time t > 0, where u is a known constant. Also, let the exchange rate follow the process dCt = Ctdt + oCtdWt (Co > 0), where , o are known constants, and W is standard Brownian Motion under the physical measure. Hence, Ct is the amount of dollars you have to pay to buy one sterling at time t. (a) (5 points) Let St=CtDt. What does St represent? (b) (10 points) What are the dynamics of St (i.e., d.St) and the dynamics of St/Bt (i.e., d (St/Bt)), under the physical measure? (c) (10 points) What are the dynamics of Ct (i.e., dCt) under the risk-neutral measure Q that guarantees that St/B is a martingale under Q. (Hint: You can blindly apply Girsanov's theorem to change measure.) (d) (10 points) Let Fr be the forward price agreed now (at time 0) to be paid in dollars for one sterling delivered at T> 0 (this is a standard forward contract, no money changes hands at the agreement date). Use risk-neutral pricing under Q from (c), to relate FT to Co.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Solution a St represents the spot price of one sterling in dollars b T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started