let me know if these pictures are readable. please hurry thank yiu will thimbs up!

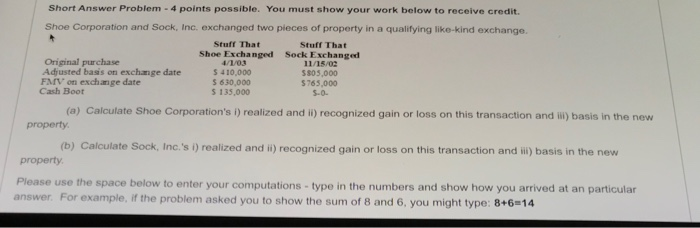

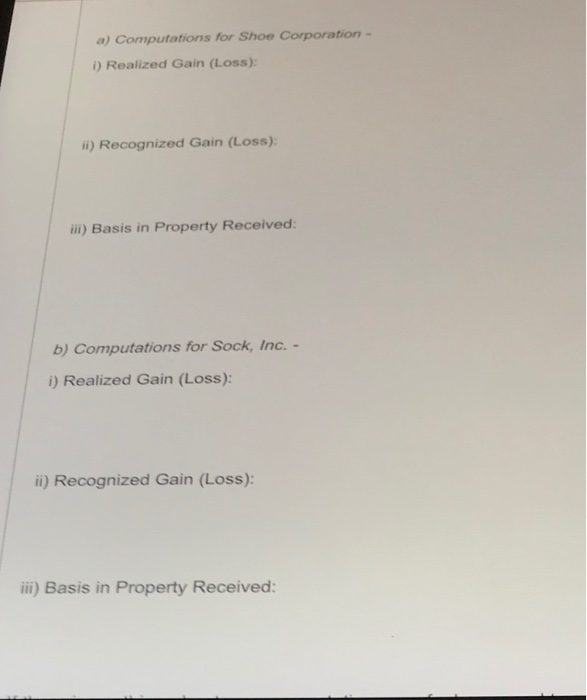

Short Answer Problem - 4 points possible. You must show your work below to receive credit. Shoe Corporation and Sock, Inc. exchanged two pieces of property in a qualifying like kind exchange Stuff That Stuff That Shoe Exchanged Sock Exchanged Original purchase 4/1/03 11/15/02 Adjusted basis on exchange date $ 410,000 5805,000 FMV on exchange date $630,000 5765,000 Cash Boot $ 135,000 5-0 (a) Calculate Shoe Corporation's i) realized and II) recognized gain or loss on this transaction and ill) basis in the new property (b) Calculate Sock, Inc.'s i) realized and it) recognized gain or loss on this transaction and II) basis in the new property Please use the space below to enter your computations - type in the numbers and show how you arrived at an particular answer. For example, if the problem asked you to show the sum of 8 and 6, you might type: 8+6=14 a) Computations for Shoe Corporation - 1) Realized Gain (Loss): ii) Recognized Gain (Loss): iii) Basis in Property Received: b) Computations for Sock, Inc. - i) Realized Gain (Loss): ii) Recognized Gain (Loss): iii) Basis in Property Received: Short Answer Problem - 4 points possible. You must show your work below to receive credit. Shoe Corporation and Sock, Inc. exchanged two pieces of property in a qualifying like kind exchange Stuff That Stuff That Shoe Exchanged Sock Exchanged Original purchase 4/1/03 11/15/02 Adjusted basis on exchange date $ 410,000 5805,000 FMV on exchange date $630,000 5765,000 Cash Boot $ 135,000 5-0 (a) Calculate Shoe Corporation's i) realized and II) recognized gain or loss on this transaction and ill) basis in the new property (b) Calculate Sock, Inc.'s i) realized and it) recognized gain or loss on this transaction and II) basis in the new property Please use the space below to enter your computations - type in the numbers and show how you arrived at an particular answer. For example, if the problem asked you to show the sum of 8 and 6, you might type: 8+6=14 a) Computations for Shoe Corporation - 1) Realized Gain (Loss): ii) Recognized Gain (Loss): iii) Basis in Property Received: b) Computations for Sock, Inc. - i) Realized Gain (Loss): ii) Recognized Gain (Loss): iii) Basis in Property Received