Answered step by step

Verified Expert Solution

Question

1 Approved Answer

let me know true or force. 1. Long-term bonds have more interest rate risk than short-term bonds 2. In Zero Coupon Bonds, the entire return/profit

let me know true or force.

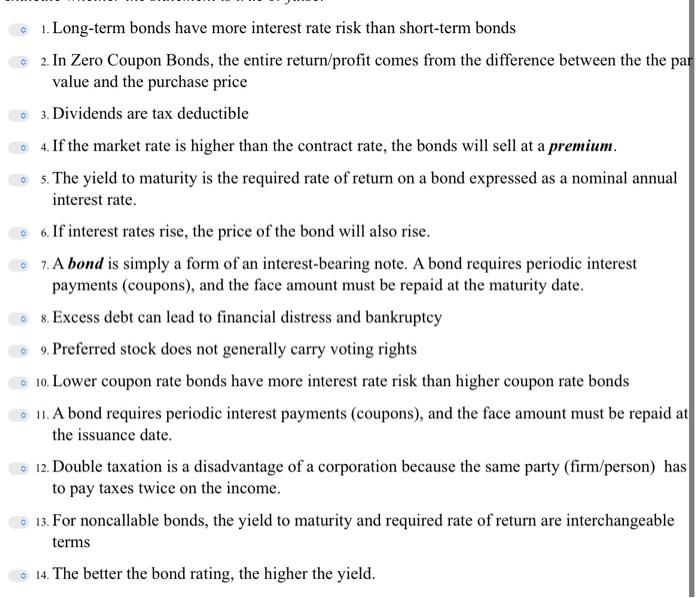

1. Long-term bonds have more interest rate risk than short-term bonds 2. In Zero Coupon Bonds, the entire return/profit comes from the difference between the the p value and the purchase price 3. Dividends are tax deductible 4. If the market rate is higher than the contract rate, the bonds will sell at a premium. 5. The yield to maturity is the required rate of return on a bond expressed as a nominal annual interest rate. 6. If interest rates rise, the price of the bond will also rise. 7. A bond is simply a form of an interest-bearing note. A bond requires periodic interest payments (coupons), and the face amount must be repaid at the maturity date. 8. Excess debt can lead to financial distress and bankruptcy 9. Preferred stock does not generally carry voting rights 10. Lower coupon rate bonds have more interest rate risk than higher coupon rate bonds 11. A bond requires periodic interest payments (coupons), and the face amount must be repaid a the issuance date. 12. Double taxation is a disadvantage of a corporation because the same party (firm/person) has to pay taxes twice on the income. 13. For noncallable bonds, the yield to maturity and required rate of return are interchangeable terms 14. The better the bond rating, the higher the yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started