Answered step by step

Verified Expert Solution

Question

1 Approved Answer

let me know what else you need Required information [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at

let me know what else you need

let me know what else you need

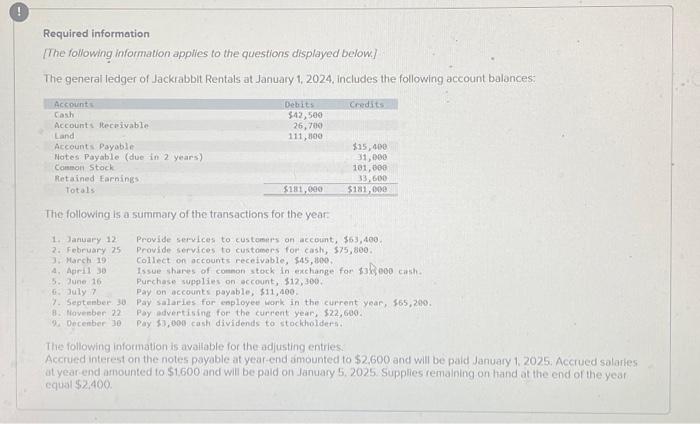

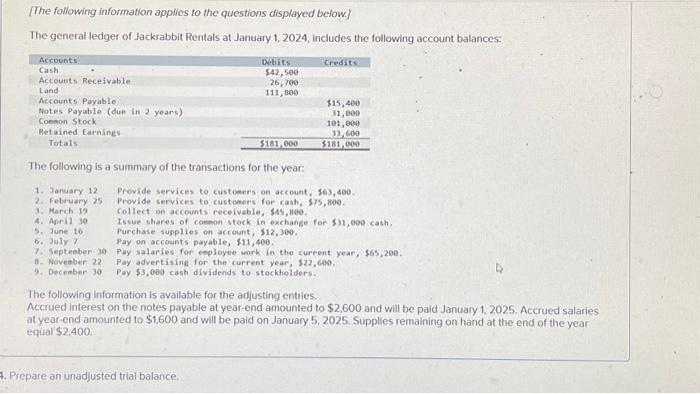

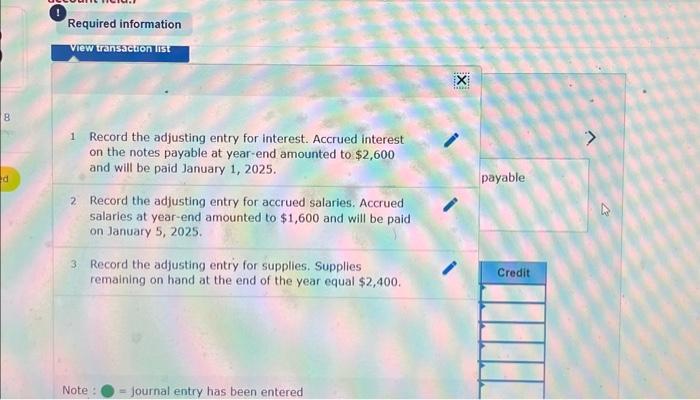

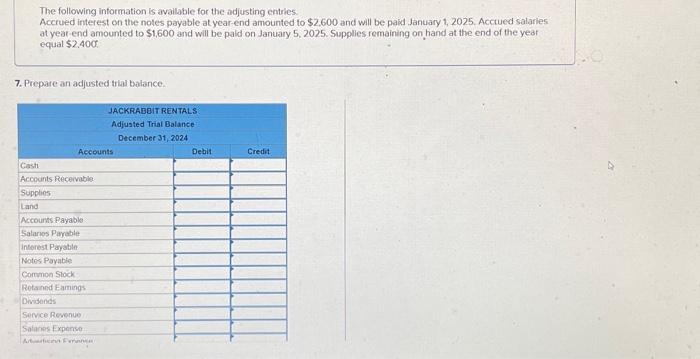

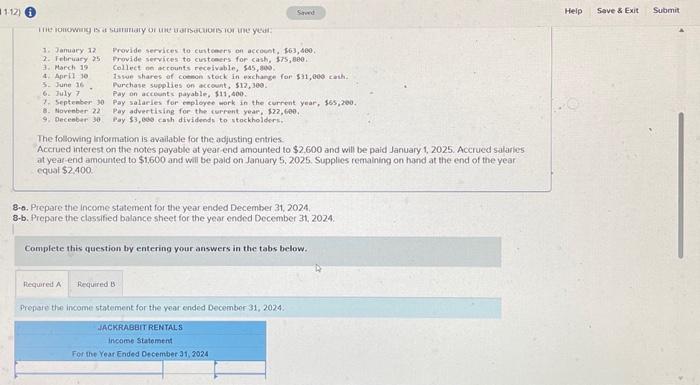

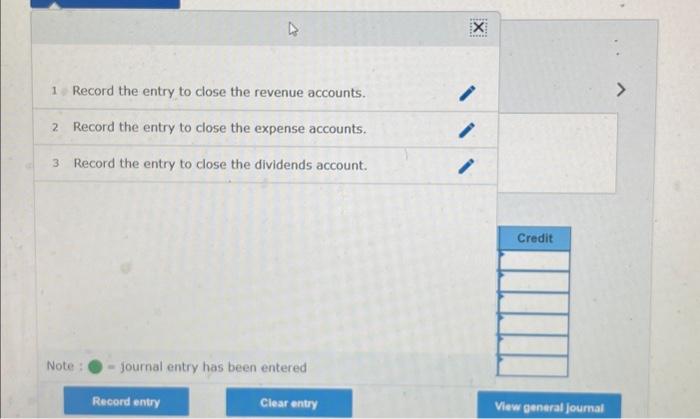

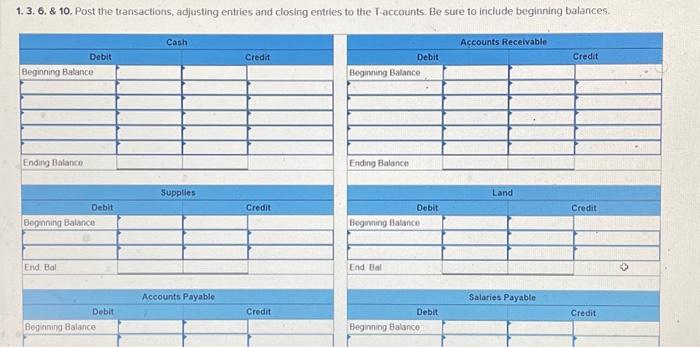

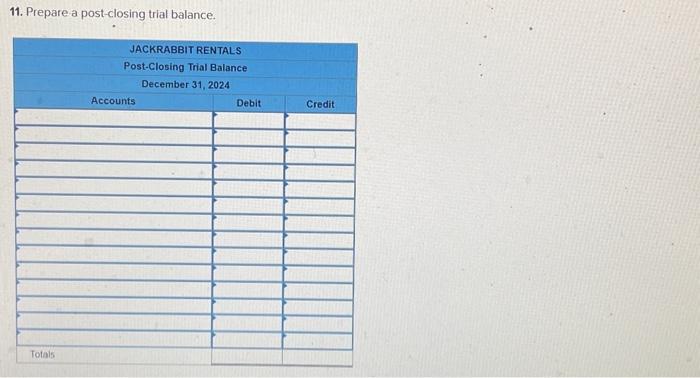

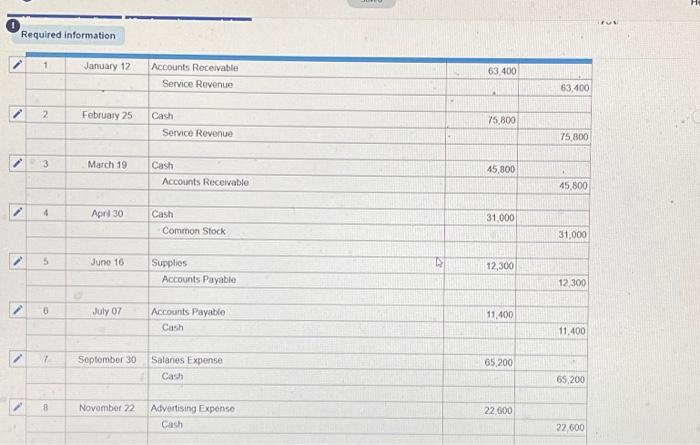

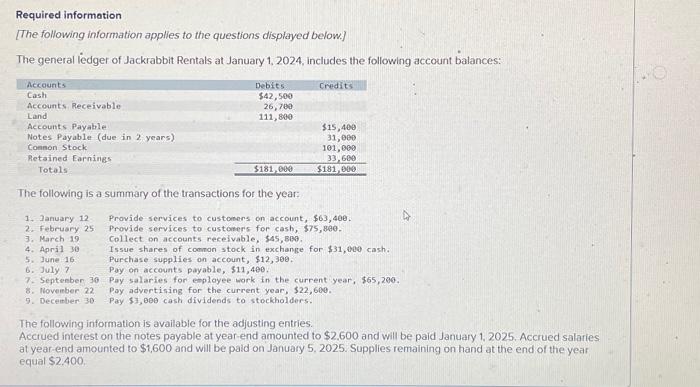

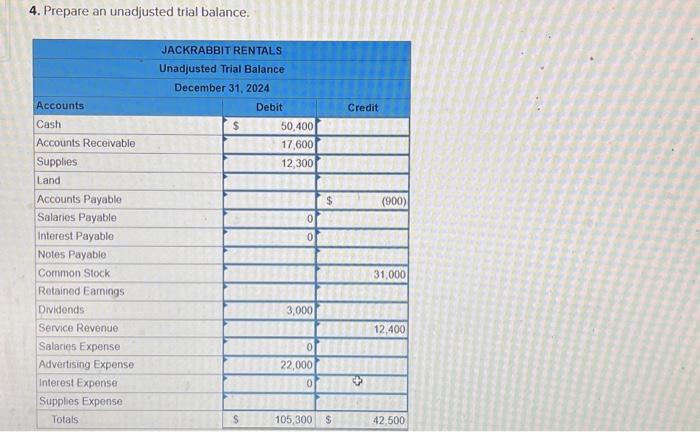

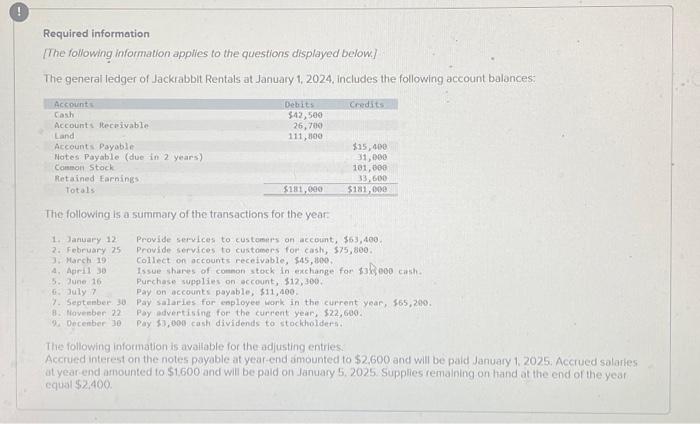

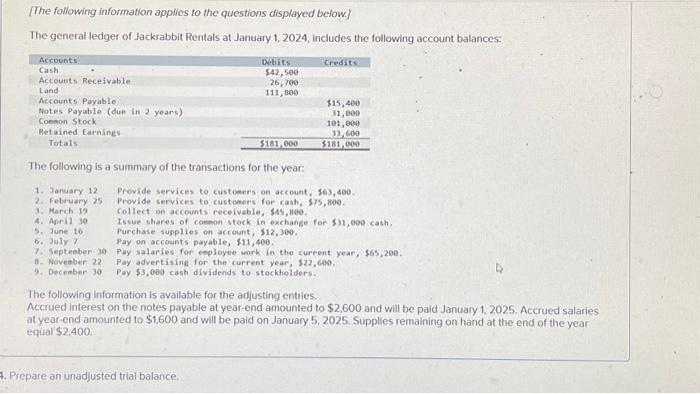

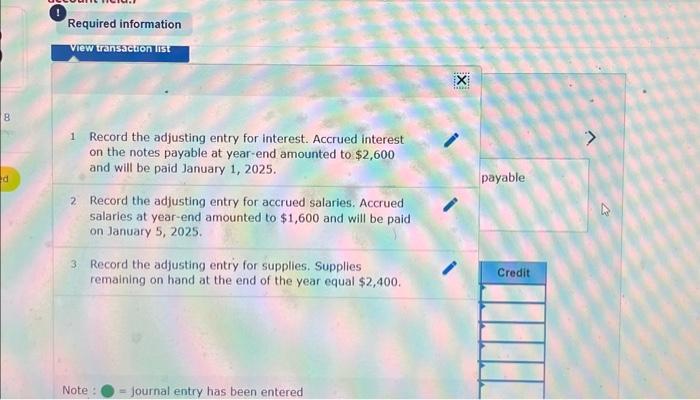

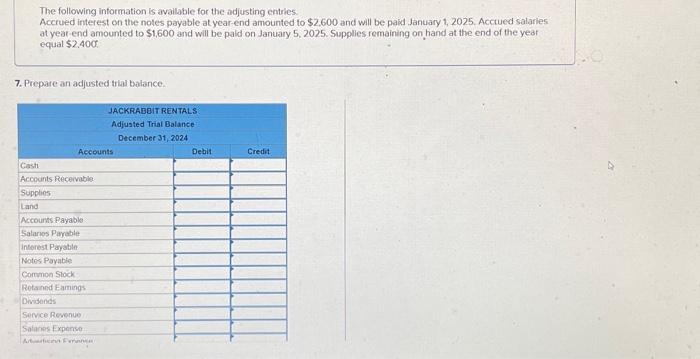

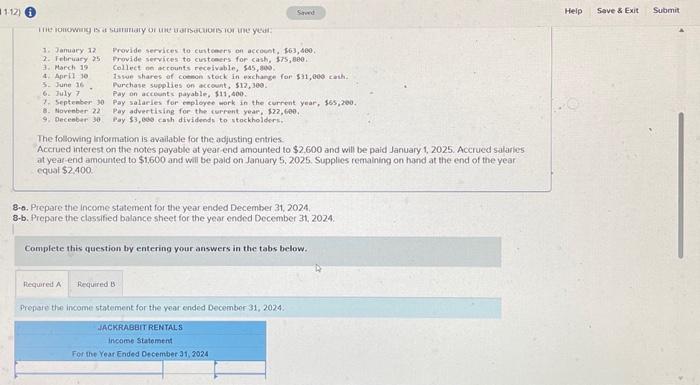

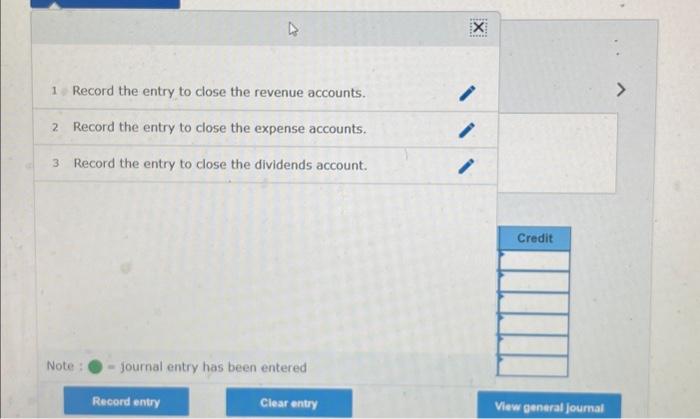

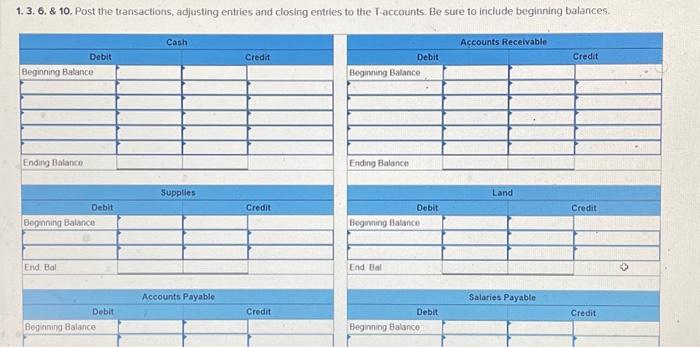

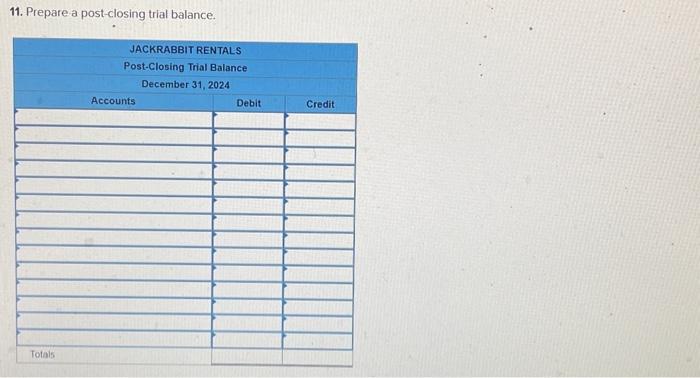

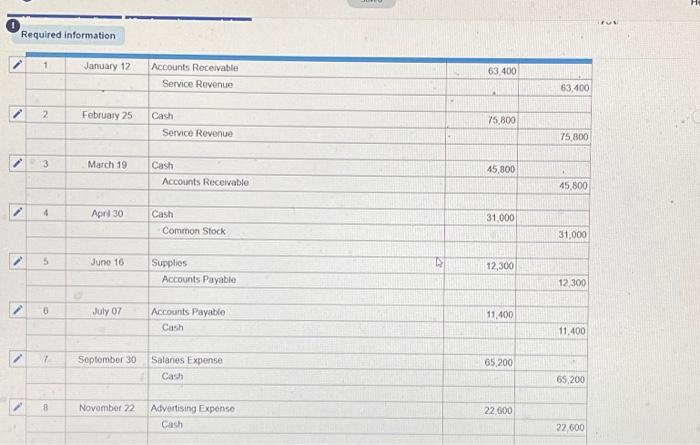

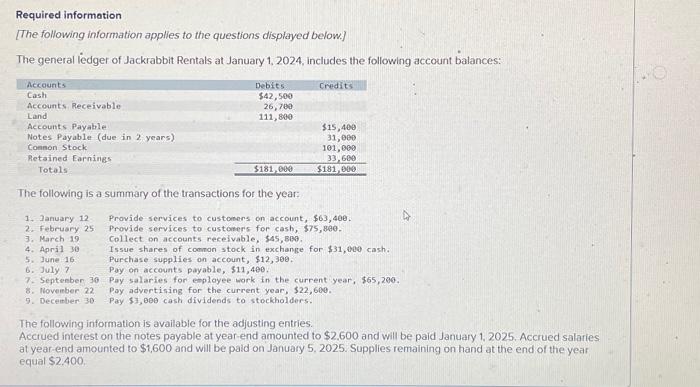

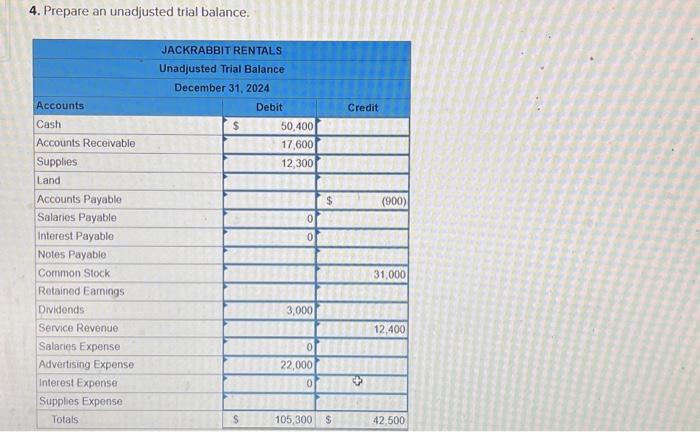

Required information [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year. 1. January 12 Provide serices to custumers of account, $63,400. 2. February 75 Provide services to customers for cash, 575,860 . 3. March 19 collect on accounts receivable, $45,800. 4. Agril 30 Issue shares of comon stock in exchange for $3S000cash. 5. June 16 Purchase supplies on eccount, 312, 3e0. 6. July 7 Pay on accounts payable, $11,200. 7. Septenber 30. Pay salaries for eoployee wark in the current year, 565,200. 8. Havesber 22 Pay advertisine for the current year, 522,600 . 9. Decenber 10 Pay 37,000 cash dividends to stockholders. The following information is available for the adjusting entries: Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025. Accrued salaries at year-end armounted to $1.600 and will be paid on January 5,2025 Supplies remaining on hand at the end of the year cqual $2400 [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1,2024 , includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Provide services to custoens on account, 963,400. 2. February 25 Provide services to custonors for cash, 575,800. 3. March 19 collect on accounts receivable, \$1s, 100 . 4. April 30 Issue shares of comen stock io exchange for 511 , 6e0 cash. 5. June 16 Purchase supplies on account, \$12, 300. 6. July 7 Pay on accounts payable, $11,400. 7. Septeaber 10 Pay salaries for employee work in the current year, 565,200 . i1. Noveaber 22. Pay advertising for the current year, \$22,6a0, 9. Decenber 30 Pay $3,000 cash dividends to stochholders. The following information is available for the adjusting enties. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025, Accrued salarie at year-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 7. Prepare an unadjusted trial balance. 1 Record the adjusting entry for interest. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1,2025. 2. Record the adjusting entry for accrued salaries. Accrued salaries at year-end amounted to $1,600 and will be paid on January 5,2025. 3. Record the adjusting entry for supplies. Supplies remaining on hand at the end of the year equal $2,400. The following information is available for the adjusting entries. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025. Accued salaries at yeat-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 7. Prepare an adjusted trial balance. 1. Jamuary 12 Provide services to curteaers on accoent, 163,400 , 2. Febiuaty 25 Frovide-services to cunteaers for cash, 575,800 , 3. Hacch 19 Collect on accounts rece ivable, $45, 8le0. 4. Apel1-10 1ssue shares of coemon, stock in exchange for $11, 90o cath. 3. June 16. Purchase supplies on account, 512,300 . 6. July 7 . Bay on accecint payable, $11,400. In September 10 Pay salaeles for eeployee work in the current year, $65,200. 8. Hpvenber 22 Pay advertising for the cerrent yeari 122,600 , 9. 0eceober 30 Pay 53, Bos cash divideeds to stockholders. The fosowing infowmation is available for the adjusting entries. Accrued interest on the notes payable at yeat end amounted to $2.600 and will be paid January 1,2025 . Accrucd salaries at year erid arnounted to $1,600 and will be paid on January 5,2025 . Supplies remaining on hand at the end of the year cquat 52400 8.0. Prepare the income statement for tie year enched December 31, 2024, 8.b. Frepare the clossified balance sheet for the year ended December 31, 2024. Complete this question by entering your anwwers in the tabs below. Prepaie the income statement for the wear ended December 31,2024 : 1 Record the entry to close the revenue accounts. 2 Record the entry to close the expense accounts. 3 Record the entry to close the dividends account. Note : 3 = journal entry has been entered 1. 3. 6. \& 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to indude beginning balances. 11. Prepare a post-closing trial balance. 1) Required information Required information [The following information applles to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1,2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Provide services to customens on account, $63,40e. 2. February 25 Provide services to customers for cash, $75,80e. 3. March 19 collect on accounts receivable, $45,B09. 4. April 30 Issue shares of comnon stock in exchange for $31,000 cash. 5. June 16 Purchase supplies on account, $12,300. 6. July 7 Pay on accounts payable, $11,400. 7. Septenber 30 Pay salaries for enplayee work in the current year, $65,200. 8. November 22 Pay advertising for the current year, $22,600. 9. Decenber 30 . Pay $3,0 cash dividends to stockholders. The following information is availabie for the adjusting entries. Accrued interest on the notes payable at year-end amounted to $2.600 and will be paid January 1, 2025, Accrued salaries at year-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 4. Prepare an unadjusted trial balance. Required information [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year. 1. January 12 Provide serices to custumers of account, $63,400. 2. February 75 Provide services to customers for cash, 575,860 . 3. March 19 collect on accounts receivable, $45,800. 4. Agril 30 Issue shares of comon stock in exchange for $3S000cash. 5. June 16 Purchase supplies on eccount, 312, 3e0. 6. July 7 Pay on accounts payable, $11,200. 7. Septenber 30. Pay salaries for eoployee wark in the current year, 565,200. 8. Havesber 22 Pay advertisine for the current year, 522,600 . 9. Decenber 10 Pay 37,000 cash dividends to stockholders. The following information is available for the adjusting entries: Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025. Accrued salaries at year-end armounted to $1.600 and will be paid on January 5,2025 Supplies remaining on hand at the end of the year cqual $2400 [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1,2024 , includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Provide services to custoens on account, 963,400. 2. February 25 Provide services to custonors for cash, 575,800. 3. March 19 collect on accounts receivable, \$1s, 100 . 4. April 30 Issue shares of comen stock io exchange for 511 , 6e0 cash. 5. June 16 Purchase supplies on account, \$12, 300. 6. July 7 Pay on accounts payable, $11,400. 7. Septeaber 10 Pay salaries for employee work in the current year, 565,200 . i1. Noveaber 22. Pay advertising for the current year, \$22,6a0, 9. Decenber 30 Pay $3,000 cash dividends to stochholders. The following information is available for the adjusting enties. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025, Accrued salarie at year-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 7. Prepare an unadjusted trial balance. 1 Record the adjusting entry for interest. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1,2025. 2. Record the adjusting entry for accrued salaries. Accrued salaries at year-end amounted to $1,600 and will be paid on January 5,2025. 3. Record the adjusting entry for supplies. Supplies remaining on hand at the end of the year equal $2,400. The following information is available for the adjusting entries. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025. Accued salaries at yeat-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 7. Prepare an adjusted trial balance. 1. Jamuary 12 Provide services to curteaers on accoent, 163,400 , 2. Febiuaty 25 Frovide-services to cunteaers for cash, 575,800 , 3. Hacch 19 Collect on accounts rece ivable, $45, 8le0. 4. Apel1-10 1ssue shares of coemon, stock in exchange for $11, 90o cath. 3. June 16. Purchase supplies on account, 512,300 . 6. July 7 . Bay on accecint payable, $11,400. In September 10 Pay salaeles for eeployee work in the current year, $65,200. 8. Hpvenber 22 Pay advertising for the cerrent yeari 122,600 , 9. 0eceober 30 Pay 53, Bos cash divideeds to stockholders. The fosowing infowmation is available for the adjusting entries. Accrued interest on the notes payable at yeat end amounted to $2.600 and will be paid January 1,2025 . Accrucd salaries at year erid arnounted to $1,600 and will be paid on January 5,2025 . Supplies remaining on hand at the end of the year cquat 52400 8.0. Prepare the income statement for tie year enched December 31, 2024, 8.b. Frepare the clossified balance sheet for the year ended December 31, 2024. Complete this question by entering your anwwers in the tabs below. Prepaie the income statement for the wear ended December 31,2024 : 1 Record the entry to close the revenue accounts. 2 Record the entry to close the expense accounts. 3 Record the entry to close the dividends account. Note : 3 = journal entry has been entered 1. 3. 6. \& 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to indude beginning balances. 11. Prepare a post-closing trial balance. 1) Required information Required information [The following information applles to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1,2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Provide services to customens on account, $63,40e. 2. February 25 Provide services to customers for cash, $75,80e. 3. March 19 collect on accounts receivable, $45,B09. 4. April 30 Issue shares of comnon stock in exchange for $31,000 cash. 5. June 16 Purchase supplies on account, $12,300. 6. July 7 Pay on accounts payable, $11,400. 7. Septenber 30 Pay salaries for enplayee work in the current year, $65,200. 8. November 22 Pay advertising for the current year, $22,600. 9. Decenber 30 . Pay $3,0 cash dividends to stockholders. The following information is availabie for the adjusting entries. Accrued interest on the notes payable at year-end amounted to $2.600 and will be paid January 1, 2025, Accrued salaries at year-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 4. Prepare an unadjusted trial balance

Required information [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year. 1. January 12 Provide serices to custumers of account, $63,400. 2. February 75 Provide services to customers for cash, 575,860 . 3. March 19 collect on accounts receivable, $45,800. 4. Agril 30 Issue shares of comon stock in exchange for $3S000cash. 5. June 16 Purchase supplies on eccount, 312, 3e0. 6. July 7 Pay on accounts payable, $11,200. 7. Septenber 30. Pay salaries for eoployee wark in the current year, 565,200. 8. Havesber 22 Pay advertisine for the current year, 522,600 . 9. Decenber 10 Pay 37,000 cash dividends to stockholders. The following information is available for the adjusting entries: Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025. Accrued salaries at year-end armounted to $1.600 and will be paid on January 5,2025 Supplies remaining on hand at the end of the year cqual $2400 [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1,2024 , includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Provide services to custoens on account, 963,400. 2. February 25 Provide services to custonors for cash, 575,800. 3. March 19 collect on accounts receivable, \$1s, 100 . 4. April 30 Issue shares of comen stock io exchange for 511 , 6e0 cash. 5. June 16 Purchase supplies on account, \$12, 300. 6. July 7 Pay on accounts payable, $11,400. 7. Septeaber 10 Pay salaries for employee work in the current year, 565,200 . i1. Noveaber 22. Pay advertising for the current year, \$22,6a0, 9. Decenber 30 Pay $3,000 cash dividends to stochholders. The following information is available for the adjusting enties. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025, Accrued salarie at year-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 7. Prepare an unadjusted trial balance. 1 Record the adjusting entry for interest. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1,2025. 2. Record the adjusting entry for accrued salaries. Accrued salaries at year-end amounted to $1,600 and will be paid on January 5,2025. 3. Record the adjusting entry for supplies. Supplies remaining on hand at the end of the year equal $2,400. The following information is available for the adjusting entries. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025. Accued salaries at yeat-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 7. Prepare an adjusted trial balance. 1. Jamuary 12 Provide services to curteaers on accoent, 163,400 , 2. Febiuaty 25 Frovide-services to cunteaers for cash, 575,800 , 3. Hacch 19 Collect on accounts rece ivable, $45, 8le0. 4. Apel1-10 1ssue shares of coemon, stock in exchange for $11, 90o cath. 3. June 16. Purchase supplies on account, 512,300 . 6. July 7 . Bay on accecint payable, $11,400. In September 10 Pay salaeles for eeployee work in the current year, $65,200. 8. Hpvenber 22 Pay advertising for the cerrent yeari 122,600 , 9. 0eceober 30 Pay 53, Bos cash divideeds to stockholders. The fosowing infowmation is available for the adjusting entries. Accrued interest on the notes payable at yeat end amounted to $2.600 and will be paid January 1,2025 . Accrucd salaries at year erid arnounted to $1,600 and will be paid on January 5,2025 . Supplies remaining on hand at the end of the year cquat 52400 8.0. Prepare the income statement for tie year enched December 31, 2024, 8.b. Frepare the clossified balance sheet for the year ended December 31, 2024. Complete this question by entering your anwwers in the tabs below. Prepaie the income statement for the wear ended December 31,2024 : 1 Record the entry to close the revenue accounts. 2 Record the entry to close the expense accounts. 3 Record the entry to close the dividends account. Note : 3 = journal entry has been entered 1. 3. 6. \& 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to indude beginning balances. 11. Prepare a post-closing trial balance. 1) Required information Required information [The following information applles to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1,2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Provide services to customens on account, $63,40e. 2. February 25 Provide services to customers for cash, $75,80e. 3. March 19 collect on accounts receivable, $45,B09. 4. April 30 Issue shares of comnon stock in exchange for $31,000 cash. 5. June 16 Purchase supplies on account, $12,300. 6. July 7 Pay on accounts payable, $11,400. 7. Septenber 30 Pay salaries for enplayee work in the current year, $65,200. 8. November 22 Pay advertising for the current year, $22,600. 9. Decenber 30 . Pay $3,0 cash dividends to stockholders. The following information is availabie for the adjusting entries. Accrued interest on the notes payable at year-end amounted to $2.600 and will be paid January 1, 2025, Accrued salaries at year-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 4. Prepare an unadjusted trial balance. Required information [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year. 1. January 12 Provide serices to custumers of account, $63,400. 2. February 75 Provide services to customers for cash, 575,860 . 3. March 19 collect on accounts receivable, $45,800. 4. Agril 30 Issue shares of comon stock in exchange for $3S000cash. 5. June 16 Purchase supplies on eccount, 312, 3e0. 6. July 7 Pay on accounts payable, $11,200. 7. Septenber 30. Pay salaries for eoployee wark in the current year, 565,200. 8. Havesber 22 Pay advertisine for the current year, 522,600 . 9. Decenber 10 Pay 37,000 cash dividends to stockholders. The following information is available for the adjusting entries: Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025. Accrued salaries at year-end armounted to $1.600 and will be paid on January 5,2025 Supplies remaining on hand at the end of the year cqual $2400 [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1,2024 , includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Provide services to custoens on account, 963,400. 2. February 25 Provide services to custonors for cash, 575,800. 3. March 19 collect on accounts receivable, \$1s, 100 . 4. April 30 Issue shares of comen stock io exchange for 511 , 6e0 cash. 5. June 16 Purchase supplies on account, \$12, 300. 6. July 7 Pay on accounts payable, $11,400. 7. Septeaber 10 Pay salaries for employee work in the current year, 565,200 . i1. Noveaber 22. Pay advertising for the current year, \$22,6a0, 9. Decenber 30 Pay $3,000 cash dividends to stochholders. The following information is available for the adjusting enties. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025, Accrued salarie at year-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 7. Prepare an unadjusted trial balance. 1 Record the adjusting entry for interest. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1,2025. 2. Record the adjusting entry for accrued salaries. Accrued salaries at year-end amounted to $1,600 and will be paid on January 5,2025. 3. Record the adjusting entry for supplies. Supplies remaining on hand at the end of the year equal $2,400. The following information is available for the adjusting entries. Accrued interest on the notes payable at year-end amounted to $2,600 and will be paid January 1, 2025. Accued salaries at yeat-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 7. Prepare an adjusted trial balance. 1. Jamuary 12 Provide services to curteaers on accoent, 163,400 , 2. Febiuaty 25 Frovide-services to cunteaers for cash, 575,800 , 3. Hacch 19 Collect on accounts rece ivable, $45, 8le0. 4. Apel1-10 1ssue shares of coemon, stock in exchange for $11, 90o cath. 3. June 16. Purchase supplies on account, 512,300 . 6. July 7 . Bay on accecint payable, $11,400. In September 10 Pay salaeles for eeployee work in the current year, $65,200. 8. Hpvenber 22 Pay advertising for the cerrent yeari 122,600 , 9. 0eceober 30 Pay 53, Bos cash divideeds to stockholders. The fosowing infowmation is available for the adjusting entries. Accrued interest on the notes payable at yeat end amounted to $2.600 and will be paid January 1,2025 . Accrucd salaries at year erid arnounted to $1,600 and will be paid on January 5,2025 . Supplies remaining on hand at the end of the year cquat 52400 8.0. Prepare the income statement for tie year enched December 31, 2024, 8.b. Frepare the clossified balance sheet for the year ended December 31, 2024. Complete this question by entering your anwwers in the tabs below. Prepaie the income statement for the wear ended December 31,2024 : 1 Record the entry to close the revenue accounts. 2 Record the entry to close the expense accounts. 3 Record the entry to close the dividends account. Note : 3 = journal entry has been entered 1. 3. 6. \& 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to indude beginning balances. 11. Prepare a post-closing trial balance. 1) Required information Required information [The following information applles to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1,2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Provide services to customens on account, $63,40e. 2. February 25 Provide services to customers for cash, $75,80e. 3. March 19 collect on accounts receivable, $45,B09. 4. April 30 Issue shares of comnon stock in exchange for $31,000 cash. 5. June 16 Purchase supplies on account, $12,300. 6. July 7 Pay on accounts payable, $11,400. 7. Septenber 30 Pay salaries for enplayee work in the current year, $65,200. 8. November 22 Pay advertising for the current year, $22,600. 9. Decenber 30 . Pay $3,0 cash dividends to stockholders. The following information is availabie for the adjusting entries. Accrued interest on the notes payable at year-end amounted to $2.600 and will be paid January 1, 2025, Accrued salaries at year-end amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 4. Prepare an unadjusted trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started