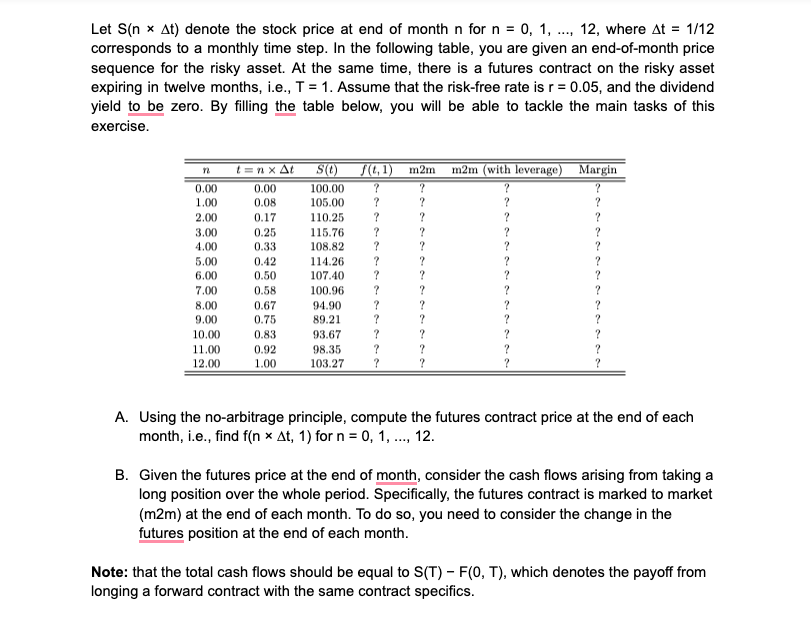

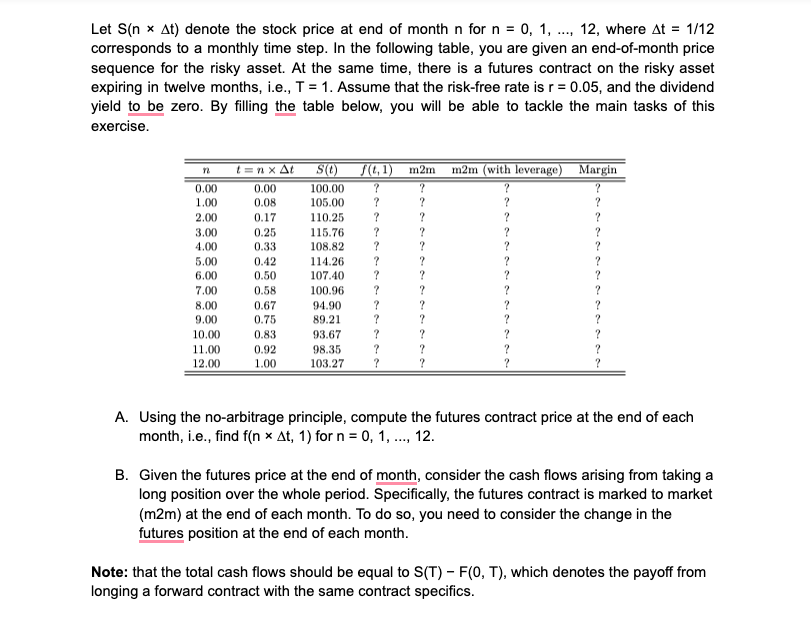

Let S(nt) denote the stock price at end of month n for n=0,1,,12, where t=1/12 corresponds to a monthly time step. In the following table, you are given an end-of-month price sequence for the risky asset. At the same time, there is a futures contract on the risky asset expiring in twelve months, i.e., T=1. Assume that the risk-free rate is r=0.05, and the dividend yield to be zero. By filling the table below, you will be able to tackle the main tasks of this exercise. A. Using the no-arbitrage principle, compute the futures contract price at the end of each month, i.e., find f(nt,1) for n=0,1,,12. B. Given the futures price at the end of month, consider the cash flows arising from taking a long position over the whole period. Specifically, the futures contract is marked to market (m2m) at the end of each month. To do so, you need to consider the change in the futures position at the end of each month. Note: that the total cash flows should be equal to S(T)F(0,T), which denotes the payoff from longing a forward contract with the same contract specifics. Let S(nt) denote the stock price at end of month n for n=0,1,,12, where t=1/12 corresponds to a monthly time step. In the following table, you are given an end-of-month price sequence for the risky asset. At the same time, there is a futures contract on the risky asset expiring in twelve months, i.e., T=1. Assume that the risk-free rate is r=0.05, and the dividend yield to be zero. By filling the table below, you will be able to tackle the main tasks of this exercise. A. Using the no-arbitrage principle, compute the futures contract price at the end of each month, i.e., find f(nt,1) for n=0,1,,12. B. Given the futures price at the end of month, consider the cash flows arising from taking a long position over the whole period. Specifically, the futures contract is marked to market (m2m) at the end of each month. To do so, you need to consider the change in the futures position at the end of each month. Note: that the total cash flows should be equal to S(T)F(0,T), which denotes the payoff from longing a forward contract with the same contract specifics