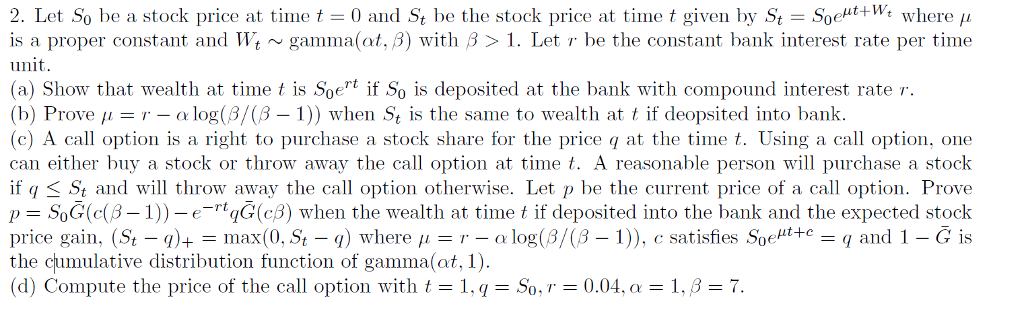

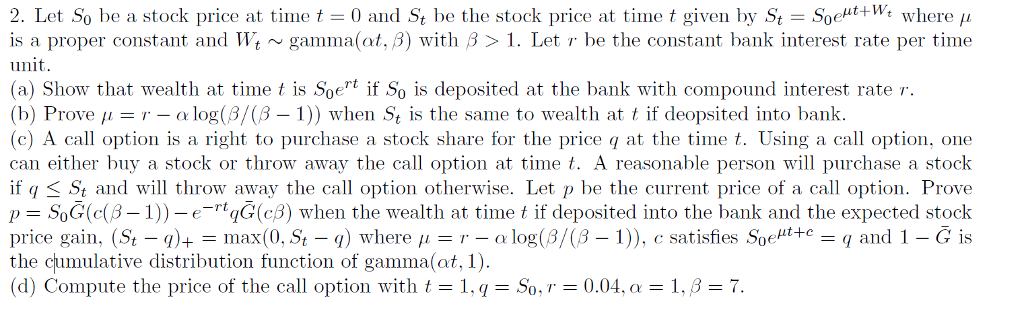

Let So be a stock price at time t = 0 and S_t be the stock price at time t given by S_t = S_0 e^mu t+W_t where mu is a proper constant and W_t ~ gamma(alpha t, beta) with beta > 1. Let r be the constant bank interest rate per time unit. (a) Show that wealth at time t is S_0 e^rt if S_0 is deposited at the bank with compound interest rate r. (b) Prove mu = r - alpha log(beta/(beta - 1)) when S_t is the same to wealth at t if deposited into bank. (c) A call option is a right to purchase a stock share for the price q at the time t. Using a call option, one can either buy a stock or throw away the call option at time t. A reasonable person will purchase a stock if q lessthanorequalto S_t and will throw away the call option otherwise. Let p be the current price of a call option. Prove p = S_0 G(c(beta - 1)) - e^-rt qG(c beta) when the wealth at time t if deposited into the bank and the expected stock price gain, (S_t - q)_+ = max(0, St - q) where mu = r - alpha log(beta/(beta - 1)), c satisfies S_0 e^mu t+c = q and 1 - G is the cumulative distribution function of gamma(alpha t, 1). (d) Compute the price of the call option with t = 1, q = S_0, r = 0.04, alpha = 1, beta = 7. Let So be a stock price at time t = 0 and S_t be the stock price at time t given by S_t = S_0 e^mu t+W_t where mu is a proper constant and W_t ~ gamma(alpha t, beta) with beta > 1. Let r be the constant bank interest rate per time unit. (a) Show that wealth at time t is S_0 e^rt if S_0 is deposited at the bank with compound interest rate r. (b) Prove mu = r - alpha log(beta/(beta - 1)) when S_t is the same to wealth at t if deposited into bank. (c) A call option is a right to purchase a stock share for the price q at the time t. Using a call option, one can either buy a stock or throw away the call option at time t. A reasonable person will purchase a stock if q lessthanorequalto S_t and will throw away the call option otherwise. Let p be the current price of a call option. Prove p = S_0 G(c(beta - 1)) - e^-rt qG(c beta) when the wealth at time t if deposited into the bank and the expected stock price gain, (S_t - q)_+ = max(0, St - q) where mu = r - alpha log(beta/(beta - 1)), c satisfies S_0 e^mu t+c = q and 1 - G is the cumulative distribution function of gamma(alpha t, 1). (d) Compute the price of the call option with t = 1, q = S_0, r = 0.04, alpha = 1, beta = 7