Answered step by step

Verified Expert Solution

Question

1 Approved Answer

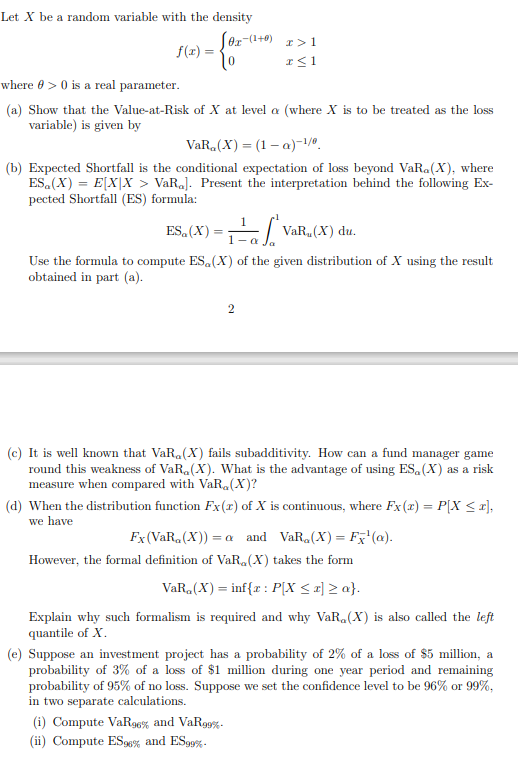

Let X be a random variable with the density f(x)={x(1+)0x>1x1 where >0 is a real parameter. (a) Show that the Value-at-Risk of X at level

Let X be a random variable with the density f(x)={x(1+)0x>1x1 where >0 is a real parameter. (a) Show that the Value-at-Risk of X at level (where X is to be treated as the loss variable) is given by VaR(X)=(1)1/ (b) Expected Shortfall is the conditional expectation of loss beyond VaR(X), where ES(X)=E[XX>VaR]. Present the interpretation behind the following Expected Shortfall (ES) formula: ES(X)=111VaRu(X)du Use the formula to compute ES(X) of the given distribution of X using the result obtained in part (a). 2 (c) It is well known that VaRa(X) fails subadditivity. How can a fund manager game round this weakness of VaR(X). What is the advantage of using ES(X) as a risk measure when compared with VaR(X) ? (d) When the distribution function FX(x) of X is continuous, where FX(x)=P[Xx], we have FX(VaR(X))=andVaR(X)=FX1(). However, the formal definition of VaR(X) takes the form VaR(X)=inf{x:P[Xx]}. Explain why such formalism is required and why VaR(X) is also called the left quantile of X. (e) Suppose an investment project has a probability of 2% of a loss of $5 million, a probability of 3% of a loss of $1 million during one year period and remaining probability of 95% of no loss. Suppose we set the confidence level to be 96% or 99%, in two separate calculations. (i) Compute VaR96% and VaR99%. (ii) Compute ES96% and ES99%. Let X be a random variable with the density f(x)={x(1+)0x>1x1 where >0 is a real parameter. (a) Show that the Value-at-Risk of X at level (where X is to be treated as the loss variable) is given by VaR(X)=(1)1/ (b) Expected Shortfall is the conditional expectation of loss beyond VaR(X), where ES(X)=E[XX>VaR]. Present the interpretation behind the following Expected Shortfall (ES) formula: ES(X)=111VaRu(X)du Use the formula to compute ES(X) of the given distribution of X using the result obtained in part (a). 2 (c) It is well known that VaRa(X) fails subadditivity. How can a fund manager game round this weakness of VaR(X). What is the advantage of using ES(X) as a risk measure when compared with VaR(X) ? (d) When the distribution function FX(x) of X is continuous, where FX(x)=P[Xx], we have FX(VaR(X))=andVaR(X)=FX1(). However, the formal definition of VaR(X) takes the form VaR(X)=inf{x:P[Xx]}. Explain why such formalism is required and why VaR(X) is also called the left quantile of X. (e) Suppose an investment project has a probability of 2% of a loss of $5 million, a probability of 3% of a loss of $1 million during one year period and remaining probability of 95% of no loss. Suppose we set the confidence level to be 96% or 99%, in two separate calculations. (i) Compute VaR96% and VaR99%. (ii) Compute ES96% and ES99%

Let X be a random variable with the density f(x)={x(1+)0x>1x1 where >0 is a real parameter. (a) Show that the Value-at-Risk of X at level (where X is to be treated as the loss variable) is given by VaR(X)=(1)1/ (b) Expected Shortfall is the conditional expectation of loss beyond VaR(X), where ES(X)=E[XX>VaR]. Present the interpretation behind the following Expected Shortfall (ES) formula: ES(X)=111VaRu(X)du Use the formula to compute ES(X) of the given distribution of X using the result obtained in part (a). 2 (c) It is well known that VaRa(X) fails subadditivity. How can a fund manager game round this weakness of VaR(X). What is the advantage of using ES(X) as a risk measure when compared with VaR(X) ? (d) When the distribution function FX(x) of X is continuous, where FX(x)=P[Xx], we have FX(VaR(X))=andVaR(X)=FX1(). However, the formal definition of VaR(X) takes the form VaR(X)=inf{x:P[Xx]}. Explain why such formalism is required and why VaR(X) is also called the left quantile of X. (e) Suppose an investment project has a probability of 2% of a loss of $5 million, a probability of 3% of a loss of $1 million during one year period and remaining probability of 95% of no loss. Suppose we set the confidence level to be 96% or 99%, in two separate calculations. (i) Compute VaR96% and VaR99%. (ii) Compute ES96% and ES99%. Let X be a random variable with the density f(x)={x(1+)0x>1x1 where >0 is a real parameter. (a) Show that the Value-at-Risk of X at level (where X is to be treated as the loss variable) is given by VaR(X)=(1)1/ (b) Expected Shortfall is the conditional expectation of loss beyond VaR(X), where ES(X)=E[XX>VaR]. Present the interpretation behind the following Expected Shortfall (ES) formula: ES(X)=111VaRu(X)du Use the formula to compute ES(X) of the given distribution of X using the result obtained in part (a). 2 (c) It is well known that VaRa(X) fails subadditivity. How can a fund manager game round this weakness of VaR(X). What is the advantage of using ES(X) as a risk measure when compared with VaR(X) ? (d) When the distribution function FX(x) of X is continuous, where FX(x)=P[Xx], we have FX(VaR(X))=andVaR(X)=FX1(). However, the formal definition of VaR(X) takes the form VaR(X)=inf{x:P[Xx]}. Explain why such formalism is required and why VaR(X) is also called the left quantile of X. (e) Suppose an investment project has a probability of 2% of a loss of $5 million, a probability of 3% of a loss of $1 million during one year period and remaining probability of 95% of no loss. Suppose we set the confidence level to be 96% or 99%, in two separate calculations. (i) Compute VaR96% and VaR99%. (ii) Compute ES96% and ES99% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started