Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CSL is considering the expansion of its COVID-19 vaccine production due to high demand. The new production facility is expected to cost $300 million

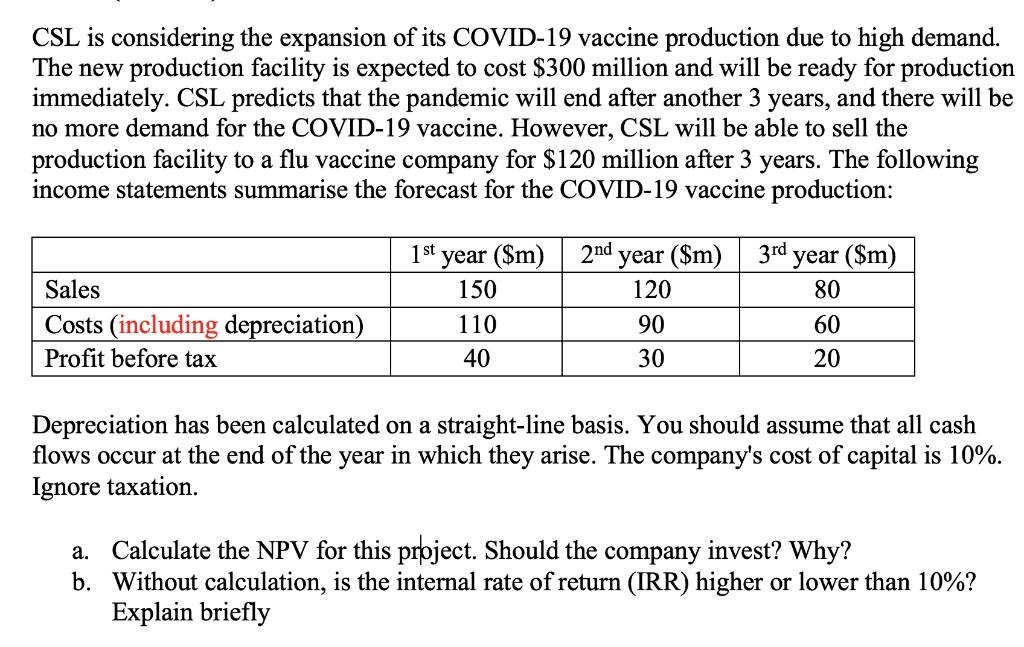

CSL is considering the expansion of its COVID-19 vaccine production due to high demand. The new production facility is expected to cost $300 million and will be ready for production immediately. CSL predicts that the pandemic will end after another 3 years, and there will be no more demand for the COVID-19 vaccine. However, CSL will be able to sell the production facility to a flu vaccine company for $120 million after 3 years. The following income statements summarise the forecast for the COVID-19 vaccine production: Sales Costs (including depreciation) Profit before tax 1st year ($m) 150 110 40 2nd year ($m) 3rd year ($m) 120 80 90 60 30 20 Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation. a. Calculate the NPV for this project. Should the company invest? Why? b. Without calculation, is the internal rate of return (IRR) higher or lower than 10%? Explain briefly

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started