Question

Letaba has been employed by XYZ as a department supervisor for the past 3 years. Letaba needs help in the 2021 year taxation and he

2. On Dec 13 of 2021, Letaba requested and then received from XYZ an advance of $6500 as part of her 2022 January salary for travel during the latter part of December. A cheque for $6500 was paid through XYZ's department (accounts payable). As a result, $6500 was reduced from Letaba's January pay of 2022 (to pay back the advance).

3. In 2018 XYZ granted Letaba stock purchase options, a total of 7000 shares in the next 6 years. Exercise Price: $44 per share; Fair Market Value (FMV): $40 per share. In 2021, Letaba purchased 1000 shares when the market price per share was $56, and he did not dispose of these shares 2021. It was the first time for him to purchase any stocks/shares.

4. In 2021, XYZ paid Letaba a monthly clothing allowance through accounts payable, $200 each month; a total of $2,400. But Letaba only used $1900 on clothing for work in XYZ.

5. Letaba has to work at home around month ends, with a laptop and printer provided by XYZ; however, Letaba must pay for any supplies & internet access (used at home). Letaba's house is 2,500 square feet in size; the workstation is in a room of about 500 square feet. This room is also used as a den and guest room. Utility costs for the home in 2021 amounted to $1,500.

6. On November 11, 2021, Letaba was injured (in a recreational fencing match) and was unable to work for six weeks, but he returned to work prior to Festivus Day. During this period, Boba received disability payments totaling $13,420 from Royal City Assurance Co. The $1,200 in disability insurance premiums were fully paid by Letaba through payroll deduction.

7. XYZ installed recreational facilities at its head office, which allowed proper distancing protocols to be followed. All employees are permitted to use these facilities free of charge. Letaba used these facilities regularly. The equivalent value for similar facilities at a private club would be $1,800 per year, including applicable taxes.

8. XYZ does not have a company pension plan, and instead, the company paid $13,000 directly into Letaba's personal RSP at the Mos Eisley Credit Union.

9. In August 2021 XYZ paid local CPA Ombud $500 (cash) to complete Letaba's 2020 & 2019 personal tax returns because Letaba had not previously filed them.

10. Letaba also utilized XYZ's counseling services for his son (12-year-old) who received mental health counseling valued at $850 in the 2021 year.

Requirements:

Determine Letaba's employment income and taxable income for 2021 in accordance with the provisions of the Income Tax Act, CRA's administrative position, and related announcements. Briefly explain why the items were included in the calculations. Include your legislated/administrative reference source for each item, referencing the page number in the text is not required.

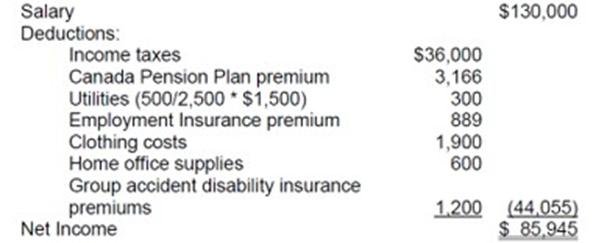

Salary Deductions: Income taxes Canada Pension Plan premium Utilities (500/2,500 * $1,500) Employment Insurance premium Clothing costs Home office supplies Group accident disability insurance premiums Net Income $36,000 3,166 300 889 1,900 600 1,200 $130,000 (44,055) $ 85,945

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To determine Letabas employment income and taxable income for 2021 we need to consider various components of his financial situation Heres a breakdown ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started