Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Let's assume a simple model of consumption and demand in real balances described by max s.t. Eo t=0 3 u (Cr Ft) PC + B

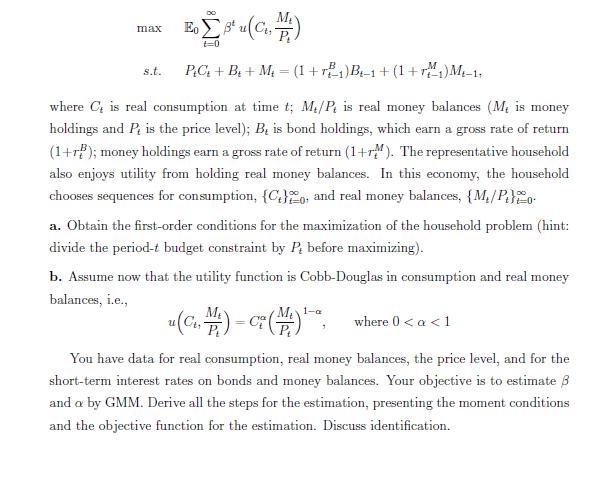

Let's assume a simple model of consumption and demand in real balances described by

max s.t. Eo t=0 3 u (Cr Ft) PC + B + M = (1 + r) B-1 + (1+1) Mt-11 where C, is real consumption at time t; M/P, is real money balances (M, is money holdings and P, is the price level); B, is bond holdings, which earn a gross rate of return (1+r); money holdings earn a gross rate of return (1+r). The representative household also enjoys utility from holding real money balances. In this economy, the household chooses sequences for consumption, {C}, and real money balances, {M/Po a. Obtain the first-order conditions for the maximization of the household problem (hint: divide the period-t budget constraint by P, before maximizing). b. Assume now that the utility function is Cobb-Douglas in consumption and real money balances, i.e., 1-a u(C)C(M) where 0

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A To obtain the firstorder conditions for the maximization of the household problem we need to set up the Lagrangian function and then differentiate it with respect to the choice variables Lets define ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started