Question

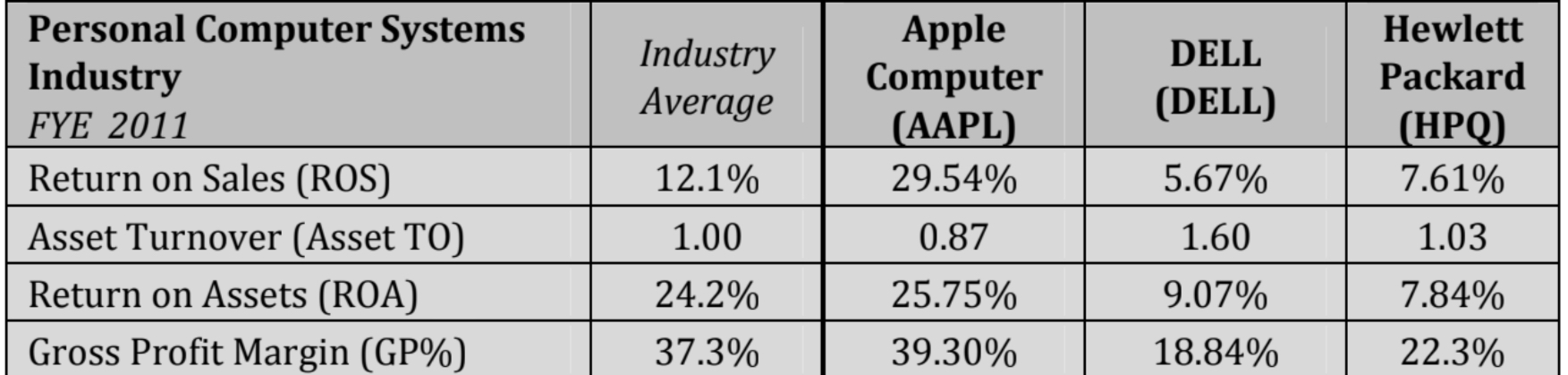

Lets examine three companies within the Personal Computer Systems industry. Use the chart below to answer the following questions. Stock symbols are shown in parentheses.

Lets examine three companies within the Personal Computer Systems industry. Use the chart below to answer the following questions. Stock symbols are shown in parentheses.

A. For AAPL, profits were __________ cents of each revenue dollar, while __________ cents of each revenue dollar were used to pay for the costs of running the business.

B. One measure of sales volume is the (ROS / Asset Turnover / ROA) ratio.

C. Companies invest in assets to generate additional revenue, to increase net income. AAPL earned _____ cent(s) in profit from each dollar invested in assets. Is a company with a greater ROA ratio using assets more efficiently to generate profits than a company with a lower ROA ratio? (Yes / No / Cant tell), because ROA (is / is not) comparable among industries.

D. It was shown in Activity 8 that Wal-Mart makes profits by generating a large volume of sales on items with low profitability. ROS for Wal-Mart is relatively (low / high), whereas Asset Turnover is relatively (low / high / cant tell). ROS x Asset T/O = (ROA / GP% / debt ratio), which is considered the (least / most) comprehensive measure of profitability.

E. During 2010, it cost AAPL _______ cents of each revenue dollar to produce Mac computers, iPods, iPhones, iPads, iTunes, and other related products and services leaving __________ cents of each revenue dollar to cover all remaining operating expenses, nonoperating expenses, and profits. The Gross Profit Margin (GP%) is the (first / second / last) indication of profitability shown on the income statement. The information for both the numerator and denominator of the GP% ratio come from the (balance sheet / income statement / statement of cash flows).

F. For profitability ratios a (high / low) ratio indicates greater profitability and an increasing trend is considered (favorable / unfavorable). On the previous page, for each ratio, circle the strongest among the three companies in the Personal Computer Systems industry.

G. Meaning is added to a ratio by comparing that ratio to industry norms because success may vary by industry. On the previous page, cross out each ratio that is weaker than the Personal Computer Systems industry average.

H. Review the ratios that were circled as the strongest and those ratios that were crossed out for being lower than the industry average to answer the following questions.

1.Which company has the greatest markup on products sold? (AAPL / DELL / HPQ)

Which ratio reveals this information? (ROS / Asset TO / ROA / GP%)

2.Which company appears to sell at a low markup to generate a greater volume of sales? (AAPL / DELL / HPQ)

Which two ratios reveal this information? (ROS / Asset TO / ROA / GP%)

3.According to the most comprehensive measure of profitability, which company is the most profitable? (AAPL / DELL / HPQ)

Which ratio reveals this information? (ROS / Asset TO / ROA / GP%)

4.Which company has the lowest product costs compared to sales revenue? (AAPL / DELL / HPQ)

Which ratio reveals this information? (ROS / Asset TO / ROA / GP%)

5.Which company has the strongest profitability? (AAPL / DELL / HPQ) Why?

6.Which company has the weakest profitability? (AAPL / DELL / HPQ) Why?

Industry Average Personal Computer Systems Industry FYE 2011 Return on Sales (ROS) Asset Turnover (Asset TO) Return on Assets (ROA) Gross Profit Margin (GP%) Apple Computer (AAPL) 29.54% DELL (DELL) Hewlett Packard (HPQ) 7.61% 12.1% 5.67% 1.00 0.87 1.60 1.03 9.07% 7.84% 24.2% 37.3% 25.75% 39.30% 18.84% 22.3%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started