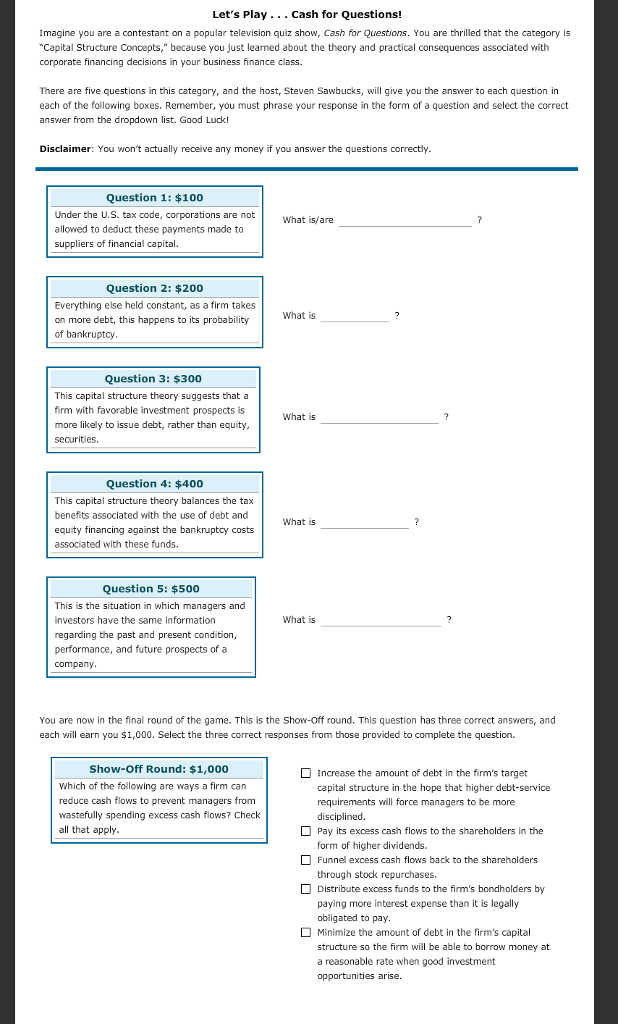

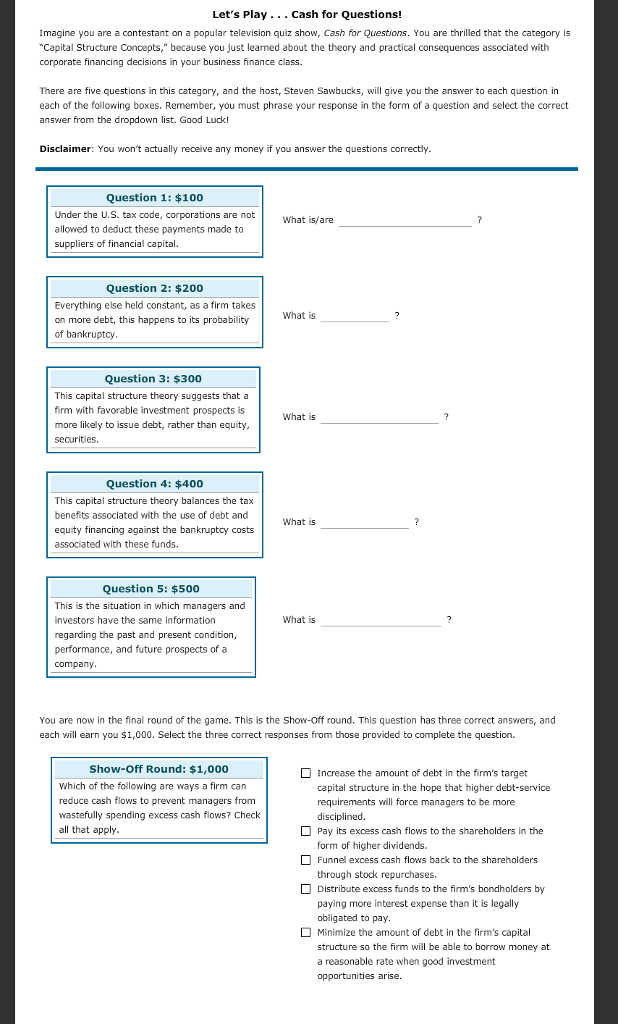

Let's Play. . . Cash for Questions! magine you are a contestant on a popular television quiz show, Cash for Questions. You are thrilled that the category is "Capital Structure Concepts," because you just learned about the theory and practical consequences associated with corporate financing decisions in your business finance class. There are five questions in this category, and the host, Steven Sawbucks, will give you the answer to each question in each of the following boxes. Remember, you must phrase your response in the form of a question and select the correct answer from the dropdown list. Good Luck! Disclaimer: You won't actually receive any money if you answer the questions correctly Question 1: $100 Under the U.S. tax code, corporations are not allowed to deduct these payments made to Supp What is/are liers of financial capital Question 2: $200 Everything else held constant, as a firm takes on more debt, this happens to its probability of bankruptcy What is Question 3: $300 This capital structure theory suggests that a firm with favorable investment prospects is more likely to issue debt, rather than equity securities. What is Question 4: $400 This capital structure theory balances the tax benefits asscciated with the use of debt and equity financing against the bankruptcy costs associated with these funds. What is Question 5: $500 This is the situation in which managers investors have the same information regarding the past and present condition, performance, and future prospects of a company and What is You are now in the final round of the game. This is the show-off round. This question has three correct answers, and each will earn you $1,000. Select the three correct responses from those provided to complete the question. Show-Off Round: $1,000 Which of the following are ways a firm can reduce cash flows to prevent managers from wastefully spending excess cash flows? Check all that apply Increase the amount of debt in the firm's target capital structure in the hope that higher debt-service requirements will force managers to be more disciplined. Pay its excess cash flows to the shareholders in the form of higher dividends. Funnel excess cash flows back to the shareholders through stock repurchases. Distribute excess funds to the firm's bondholders by paying more interest expense than it is legally obligated to pay Minimize the amount of debt in the firm's capital structure so the firm will be able to borrow money at a reasonable rate when good investment opportunities arise Let's Play. . . Cash for Questions! magine you are a contestant on a popular television quiz show, Cash for Questions. You are thrilled that the category is "Capital Structure Concepts," because you just learned about the theory and practical consequences associated with corporate financing decisions in your business finance class. There are five questions in this category, and the host, Steven Sawbucks, will give you the answer to each question in each of the following boxes. Remember, you must phrase your response in the form of a question and select the correct answer from the dropdown list. Good Luck! Disclaimer: You won't actually receive any money if you answer the questions correctly Question 1: $100 Under the U.S. tax code, corporations are not allowed to deduct these payments made to Supp What is/are liers of financial capital Question 2: $200 Everything else held constant, as a firm takes on more debt, this happens to its probability of bankruptcy What is Question 3: $300 This capital structure theory suggests that a firm with favorable investment prospects is more likely to issue debt, rather than equity securities. What is Question 4: $400 This capital structure theory balances the tax benefits asscciated with the use of debt and equity financing against the bankruptcy costs associated with these funds. What is Question 5: $500 This is the situation in which managers investors have the same information regarding the past and present condition, performance, and future prospects of a company and What is You are now in the final round of the game. This is the show-off round. This question has three correct answers, and each will earn you $1,000. Select the three correct responses from those provided to complete the question. Show-Off Round: $1,000 Which of the following are ways a firm can reduce cash flows to prevent managers from wastefully spending excess cash flows? Check all that apply Increase the amount of debt in the firm's target capital structure in the hope that higher debt-service requirements will force managers to be more disciplined. Pay its excess cash flows to the shareholders in the form of higher dividends. Funnel excess cash flows back to the shareholders through stock repurchases. Distribute excess funds to the firm's bondholders by paying more interest expense than it is legally obligated to pay Minimize the amount of debt in the firm's capital structure so the firm will be able to borrow money at a reasonable rate when good investment opportunities arise