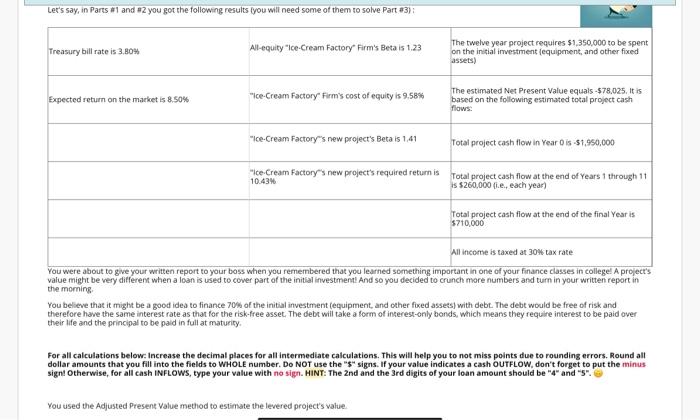

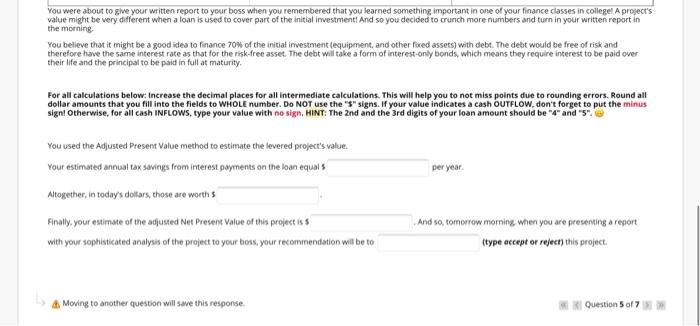

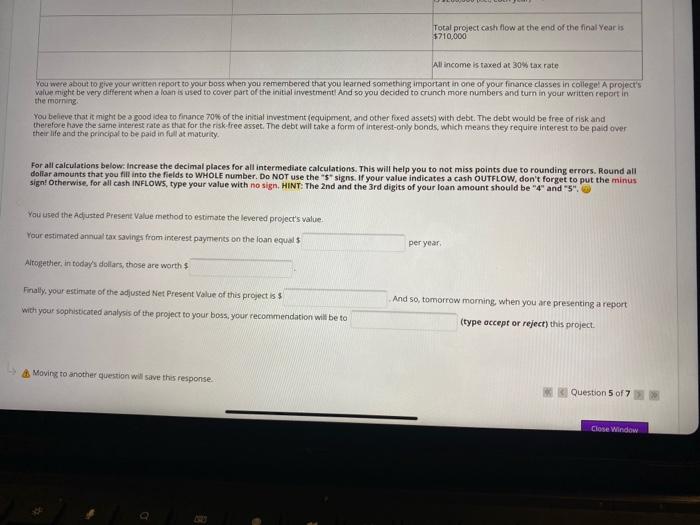

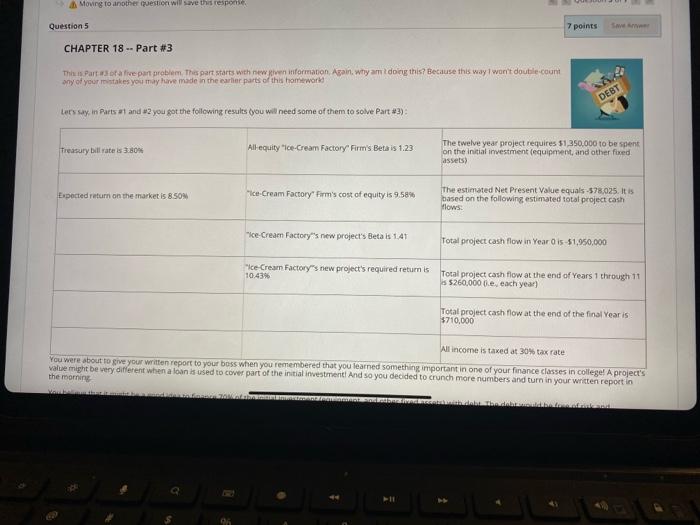

Let's say, in Parts #1 and 2 you got the following results you will need some of them to solve Part 3): Treasury bill rate is 3.80% All-equity"Ice-Cream Factory Firm's Betais 1.23 The twelve year project requires $1,350,000 to be spent on the initial investment equipment, and other fixed assets) Expected return on the market is 8.50% nice-Cream Factory Firm's cost of equity is 9,58% The estimated Net Present Value equals-578,025. It is based on the following estimated total project cash flows: Ice-Cream Factorys new project's Beta is 1.41 Total project cash flow in Year Ois -$1,950,000 ce-Cream Factory's new project's required return is Total project cash flow at the end of years through 11 10.43 s $260,000 ( e, each year) Total project cash flow at the end of the final Year is 5710.000 All income is taxed at 30% tax rate You were about to give your written report to your boss when you remembered that you learned something important in one of your finance classes in collegel A project's value might be very different when a loan is used to cover part of the initial investment And so you decided to crunch more numbers and turn in your written report in the morning You believe that it might be a good idea to finance 70% of the initial investment (equipment, and other fixed assets) with debt. The debt would be free of risk and therefore have the same interest rate as that for the risk-free asset. The debt will take a form of interest-only bonds, which means they require interest to be paid over their life and the principal to be paid in full at maturity For all calculations below. Increase the decimal places for all intermediate calculations. This will help you to not miss points due to rounding errors. Round all dollar amounts that you fill into the fields to WHOLE number. Do NOT use the "s" signs. If your value indicates a cash OUTFLOW, don't forget to put the minus sign! Otherwise, for all cash INFLOWS, type your value with no sign. HINT: The 2nd and the 3rd digits of your loan amount should be "4" and "S". You used the Adjusted Present Value method to estimate the levered project's value You were about to give your written report to your boss when you remembered that you learned something important in one of your finance classes in collegel A project's value might be very different when a loan is used to cover part of the initial investment And so you decided to crunch more numbers and turn in your written report in the morning You believe that it might be a good idea to finance 70% of the initial investment (equipment, and other fored assets) with debt. The debt would be free of risk and therefore have the same interest rate as that for the risk-free asset. The debt will take a form of interest-only bonds, which means they require interest to be paid over their life and the principal to be paid in full at maturity For all calculations below. Increase the decimal places for all intermediate calculations. This will help you to not miss points due to rounding errors. Round all dollar amounts that you fill into the fields to WHOLE number. Do NOT use the "S" signs. If your value indicates a cash OUTFLOW, don't forget to put the minus sign Otherwise, for all cash INFLOWS, type your value with no sign. HINT: The 2nd and the 3rd digits of your loan amount should be "4" and "5". per year. You used the Adjusted Present Value method to estimate the levered project's value. Your estimated annual tax savings from interest payments on the loan equals Altogether, in today's dollars, those are worth Finally, your estimate of the adjusted Net Present Value of this project is with your sophisticated analysis of the project to your boss, your recommendation will be to And so, tomorrow morning when you are presenting a report (type accept or reject) this project Moving to another question will save this response Question 5 of 7 Moving to another question will save this response Question 5 7 points Sve CHAPTER 18 - Part #3 This Parts of five part problem. This part starts with new live information Again, why am doing this? Because this way I won't double-count any of your stakes you may have made in the earlier parts of this homeworld DEBT Lots say in Parts and you got the following results you will need some of them to solve Part #3) Treasury bill rates 3.80% All equity "ice-Cream Factory Firm's Beta is 1.23 The twelve year project requires 51,350.000 to be spent on the initial investment equipment, and other fixed assets) Expected return on the market is 8.50 "Ice-Cream Factory' Firm's cost of equity is 9.58% The estimated Net Present Value equals-378,025. It is based on the following estimated total project cash Mlows: Ice-Cream Factory's new project's Betais 1.41 Total project cash flow in Year Ois 51,950,000 "Ice Cream Factory's new project's required return is 10.4396 Total project cash flow at the end of Years 1 through 11 is 5260,000 1.e. each year) Total project cash flow at the end of the final Year is $710,000 All income is taxed at 30% tax rate You were about to give your written report to your boss when you remembered that you learned something important in one of your finance classes in collegel A project's vale might be very different when a loan is used to cover part of the initial investment And so you decided to crunch more numbers and turn in your written reportin the morning Wom Let's say, in Parts #1 and 2 you got the following results you will need some of them to solve Part 3): Treasury bill rate is 3.80% All-equity"Ice-Cream Factory Firm's Betais 1.23 The twelve year project requires $1,350,000 to be spent on the initial investment equipment, and other fixed assets) Expected return on the market is 8.50% nice-Cream Factory Firm's cost of equity is 9,58% The estimated Net Present Value equals-578,025. It is based on the following estimated total project cash flows: Ice-Cream Factorys new project's Beta is 1.41 Total project cash flow in Year Ois -$1,950,000 ce-Cream Factory's new project's required return is Total project cash flow at the end of years through 11 10.43 s $260,000 ( e, each year) Total project cash flow at the end of the final Year is 5710.000 All income is taxed at 30% tax rate You were about to give your written report to your boss when you remembered that you learned something important in one of your finance classes in collegel A project's value might be very different when a loan is used to cover part of the initial investment And so you decided to crunch more numbers and turn in your written report in the morning You believe that it might be a good idea to finance 70% of the initial investment (equipment, and other fixed assets) with debt. The debt would be free of risk and therefore have the same interest rate as that for the risk-free asset. The debt will take a form of interest-only bonds, which means they require interest to be paid over their life and the principal to be paid in full at maturity For all calculations below. Increase the decimal places for all intermediate calculations. This will help you to not miss points due to rounding errors. Round all dollar amounts that you fill into the fields to WHOLE number. Do NOT use the "s" signs. If your value indicates a cash OUTFLOW, don't forget to put the minus sign! Otherwise, for all cash INFLOWS, type your value with no sign. HINT: The 2nd and the 3rd digits of your loan amount should be "4" and "S". You used the Adjusted Present Value method to estimate the levered project's value You were about to give your written report to your boss when you remembered that you learned something important in one of your finance classes in collegel A project's value might be very different when a loan is used to cover part of the initial investment And so you decided to crunch more numbers and turn in your written report in the morning You believe that it might be a good idea to finance 70% of the initial investment (equipment, and other fored assets) with debt. The debt would be free of risk and therefore have the same interest rate as that for the risk-free asset. The debt will take a form of interest-only bonds, which means they require interest to be paid over their life and the principal to be paid in full at maturity For all calculations below. Increase the decimal places for all intermediate calculations. This will help you to not miss points due to rounding errors. Round all dollar amounts that you fill into the fields to WHOLE number. Do NOT use the "S" signs. If your value indicates a cash OUTFLOW, don't forget to put the minus sign Otherwise, for all cash INFLOWS, type your value with no sign. HINT: The 2nd and the 3rd digits of your loan amount should be "4" and "5". per year. You used the Adjusted Present Value method to estimate the levered project's value. Your estimated annual tax savings from interest payments on the loan equals Altogether, in today's dollars, those are worth Finally, your estimate of the adjusted Net Present Value of this project is with your sophisticated analysis of the project to your boss, your recommendation will be to And so, tomorrow morning when you are presenting a report (type accept or reject) this project Moving to another question will save this response Question 5 of 7 Moving to another question will save this response Question 5 7 points Sve CHAPTER 18 - Part #3 This Parts of five part problem. This part starts with new live information Again, why am doing this? Because this way I won't double-count any of your stakes you may have made in the earlier parts of this homeworld DEBT Lots say in Parts and you got the following results you will need some of them to solve Part #3) Treasury bill rates 3.80% All equity "ice-Cream Factory Firm's Beta is 1.23 The twelve year project requires 51,350.000 to be spent on the initial investment equipment, and other fixed assets) Expected return on the market is 8.50 "Ice-Cream Factory' Firm's cost of equity is 9.58% The estimated Net Present Value equals-378,025. It is based on the following estimated total project cash Mlows: Ice-Cream Factory's new project's Betais 1.41 Total project cash flow in Year Ois 51,950,000 "Ice Cream Factory's new project's required return is 10.4396 Total project cash flow at the end of Years 1 through 11 is 5260,000 1.e. each year) Total project cash flow at the end of the final Year is $710,000 All income is taxed at 30% tax rate You were about to give your written report to your boss when you remembered that you learned something important in one of your finance classes in collegel A project's vale might be very different when a loan is used to cover part of the initial investment And so you decided to crunch more numbers and turn in your written reportin the morning Wom