Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lets say you are 23 years old and planning on retiring when you are 70. You plan on saving and depositing into an account that

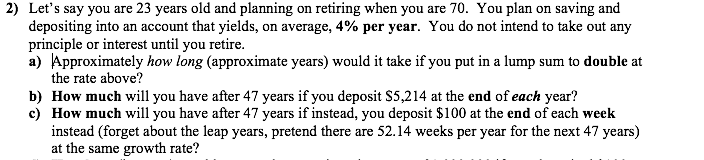

Lets say you are 23 years old and planning on retiring when you are 70. You plan on saving and depositing into an account that yields, on average, 4% per year. You do not intend to take out any principle or interest until you retire.Lets say you are 23 years old and planning on retiring when you are 70. You plan on saving and depositing into an account that yields, on average, 4% per year. You do not intend to take out any principle or interest until you retire.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started