Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work neatly Robbie plans to retire in 35 years and has just established a personal retirement account where the annual return rate is

please show work neatly

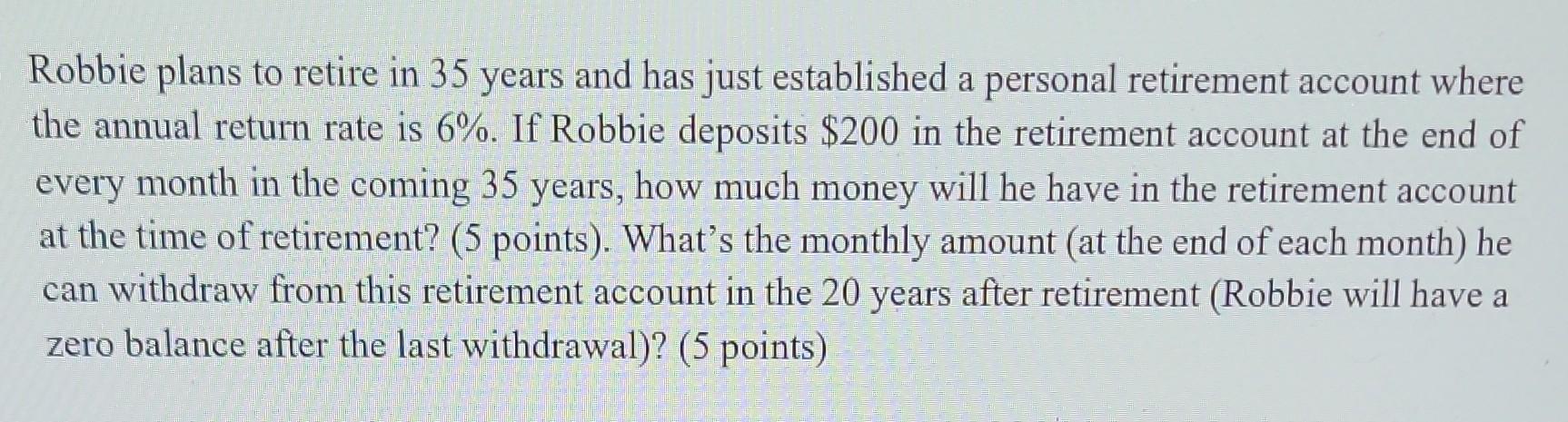

Robbie plans to retire in 35 years and has just established a personal retirement account where the annual return rate is 6%. If Robbie deposits $200 in the retirement account at the end of every month in the coming 35 years, how much money will he have in the retirement account at the time of retirement? (5 points). What's the monthly amount (at the end of each month) he can withdraw from this retirement account in the 20 years after retirement (Robbie will have a zero balance after the last withdrawal)? (5 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started