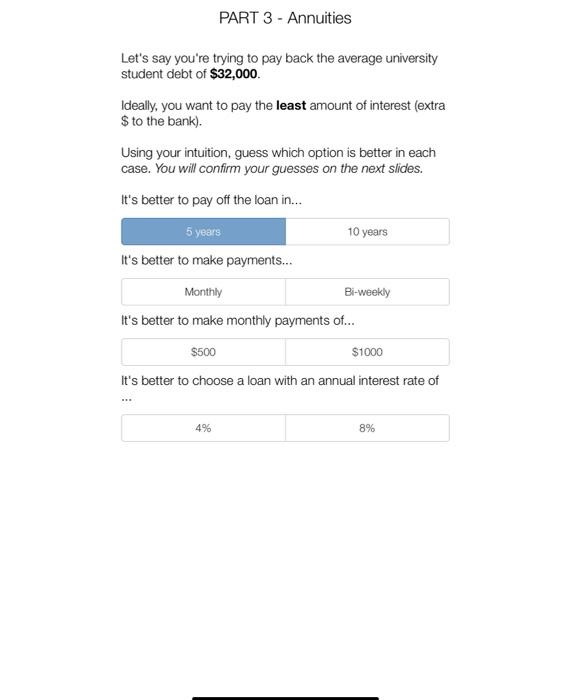

Let's say you're trying to pay back the average university student debt of $32,000.

Ideally, you want to pay the least amount of interest (extra $ to the bank).

Using your intuition, guess which option is better in each case. You will confirm your guesses on the next slides.

please if you can write it on paper , thank you

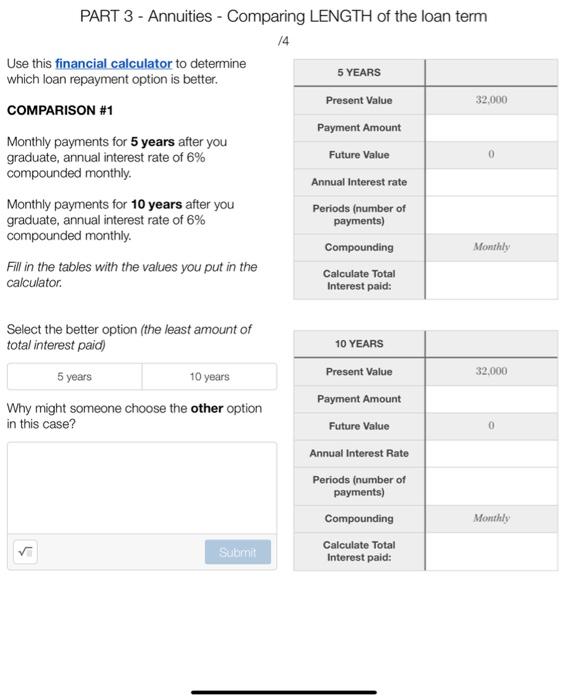

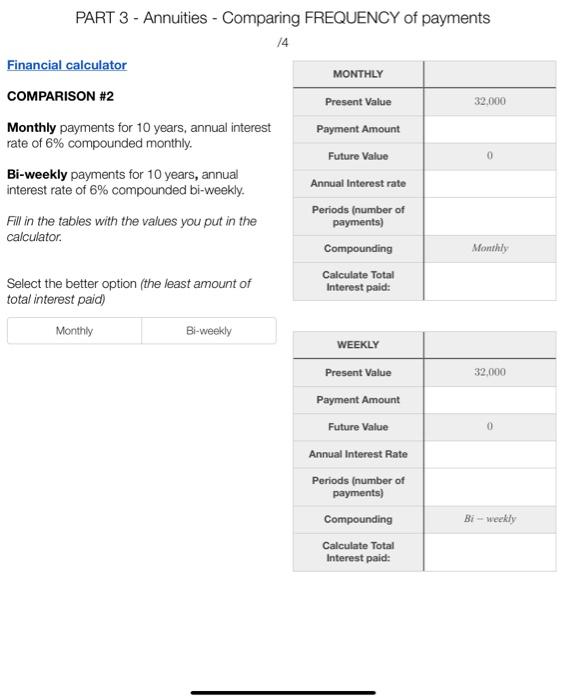

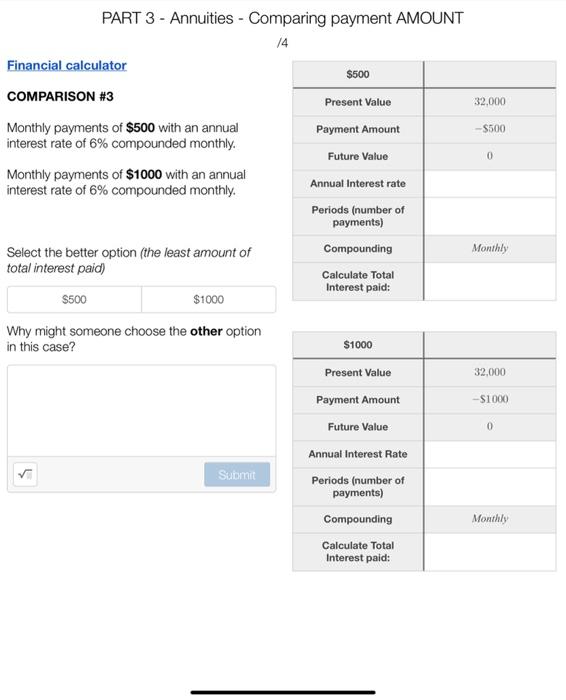

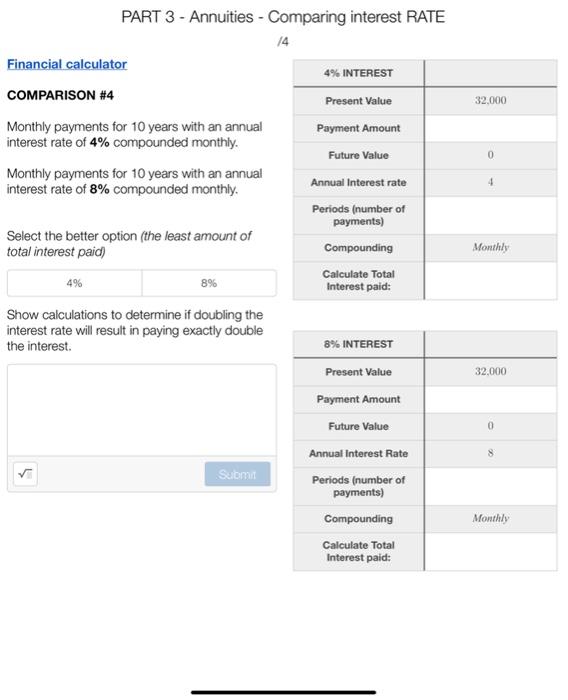

PART 3 - Annuities Let's say you're trying to pay back the average university student debt of $32,000. Ideally, you want to pay the least amount of interest (extra $ to the bank). Using your intuition, guess which option is better in each case. You will confirm your guesses on the next slides. It's better to pay off the loan in... 5 years 10 years It's better to make payments... Monthly Bi-weekly It's better to make monthly payments of... $500 $1000 It's better to choose a loan with an annual interest rate of *** 4% 8% PART 3 - Annuities - Comparing LENGTH of the loan term 1/4 5 YEARS Present Value 32,000 Payment Amount Future Value Annual Interest rate Periods (number of payments) Compounding Monthly Calculate Total Interest paid: 10 YEARS Present Value 32,000 Payment Amount Future Value Annual Interest Rate Periods (number of payments) Compounding Monthly Calculate Total Interest paid: Use this financial calculator to determine which loan repayment option is better. COMPARISON #1 Monthly payments for 5 years after you graduate, annual interest rate of 6% compounded monthly. Monthly payments for 10 years after you graduate, annual interest rate of 6% compounded monthly. Fill in the tables with the values you put in the calculator. Select the better option (the least amount of total interest paid) 5 years 10 years Why might someone choose the other option in this case? Submit 5 PART 3 - Annuities - Comparing FREQUENCY of payments 14 Financial calculator MONTHLY COMPARISON #2 Present Value 32,000 Payment Amount Monthly payments for 10 years, annual interest rate of 6% compounded monthly. Future Value Bi-weekly payments for 10 years, annual interest rate of 6% compounded bi-weekly. Annual Interest rate Fill in the tables with the values you put in the calculator. Periods (number of payments) Compounding Monthly Select the better option (the least amount of total interest paid) Calculate Total Interest paid: Monthly Bi-weekly WEEKLY Present Value 32,000 Payment Amount Future Value Annual Interest Rate Periods (number of payments) Compounding Bi-weekly Calculate Total Interest paid: PART 3 - Annuities - Comparing payment AMOUNT 14 $500 Present Value Payment Amount Future Value Annual Interest rate Periods (number of payments) Compounding Calculate Total Interest paid: $1000 Present Value Payment Amount Future Value Annual Interest Rate Periods (number of payments) Compounding Calculate Total Interest paid: Financial calculator COMPARISON #3 Monthly payments of $500 with an annual interest rate of 6% compounded monthly. Monthly payments of $1000 with an annual interest rate of 6% compounded monthly. Select the better option (the least amount of total interest paid) $500 $1000 Why might someone choose the other option in this case? Submit 3 32,000 -$500 0 Monthly 32,000 -$1000 0 Monthly PART 3 - Annuities - Comparing interest RATE 14 4% INTEREST Present Value Payment Amount Future Value Annual Interest rate Periods (number of payments) Compounding Calculate Total Interest paid: 8% INTEREST Present Value Payment Amount Future Value Annual Interest Rate Periods (number of payments) Compounding Calculate Total Interest paid: Financial calculator COMPARISON #4 Monthly payments for 10 years with an annual interest rate of 4% compounded monthly. Monthly payments for 10 years with an annual interest rate of 8% compounded monthly. Select the better option (the least amount of total interest paid) 4% Show calculations to determine if doubling the interest rate will result in paying exactly double the interest. Submit 32,000 0 4 Monthly 32,000 0 Monthly