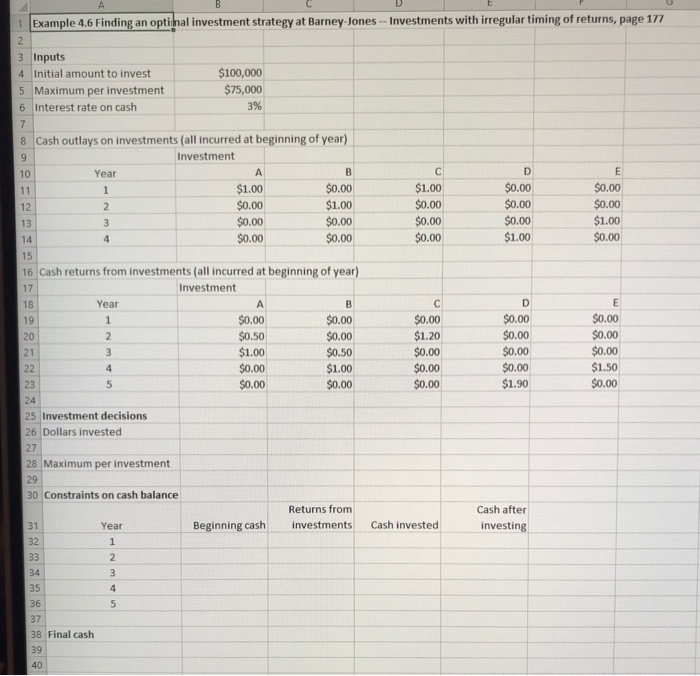

Level A 37. Modify the Barney-Jones investment problem so that there is a minimum amount that must be put into any investment, although this minimum can vary by invest- ment. For example, the minimum amount for invest- ment A might be $0, whereas the minimum amount for investment D might be $50,000. These minimum amounts should be inputs; you can make up any values you like. Run Solver on your modified model. Problem 37 (Investing file) Problem 371 Replace the Maximum per investment" with a "Minimum investment" (you could use 50,000 for each investment. Modify the constraint so that Dollars invested" is greater than "Minimum Investment" Run Solver and provide new value of "Final cash" 1 Example 4.6 Finding an optional investment strategy at Barney-Jones -- Investments with irregular timing of returns, page 177 3 Inputs 4 Initial amount to invest 5 Maximum per investment 6 Interest rate on cash $100,000 $75,000 3% 8 Cash outlays on investments (all incurred at beginning of year) Investment Year $1.00 $0.00 $0.00 $1.00 $0.00 $0.00 $0.00 $0.00 $1.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $1.00 $0.00 $0.00 $1.00 $0.00 16 Cash returns from investments (all incurred at beginning of year) Investment Year $0.00 $0.00 $0.50 $0.00 $1.00 $0.50 $0.00 $1.00 $0.00 $0.00 WN $0.00 $1.20 $0.00 $0.00 $0.00 D $0.00 $0.00 $0.00 $0.00 $1.90 $0.00 $0.00 $0.00 $1.50 $0.00 25 Investment decisions 26 Dollars invested 28 Maximum per investment 30 Constraints on cash balance Returns from investments Cash after investing Year Beginning cash Cash invested 38 Final cash Level A 37. Modify the Barney-Jones investment problem so that there is a minimum amount that must be put into any investment, although this minimum can vary by invest- ment. For example, the minimum amount for invest- ment A might be $0, whereas the minimum amount for investment D might be $50,000. These minimum amounts should be inputs; you can make up any values you like. Run Solver on your modified model. Problem 37 (Investing file) Problem 371 Replace the Maximum per investment" with a "Minimum investment" (you could use 50,000 for each investment. Modify the constraint so that Dollars invested" is greater than "Minimum Investment" Run Solver and provide new value of "Final cash" 1 Example 4.6 Finding an optional investment strategy at Barney-Jones -- Investments with irregular timing of returns, page 177 3 Inputs 4 Initial amount to invest 5 Maximum per investment 6 Interest rate on cash $100,000 $75,000 3% 8 Cash outlays on investments (all incurred at beginning of year) Investment Year $1.00 $0.00 $0.00 $1.00 $0.00 $0.00 $0.00 $0.00 $1.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $1.00 $0.00 $0.00 $1.00 $0.00 16 Cash returns from investments (all incurred at beginning of year) Investment Year $0.00 $0.00 $0.50 $0.00 $1.00 $0.50 $0.00 $1.00 $0.00 $0.00 WN $0.00 $1.20 $0.00 $0.00 $0.00 D $0.00 $0.00 $0.00 $0.00 $1.90 $0.00 $0.00 $0.00 $1.50 $0.00 25 Investment decisions 26 Dollars invested 28 Maximum per investment 30 Constraints on cash balance Returns from investments Cash after investing Year Beginning cash Cash invested 38 Final cash