Answered step by step

Verified Expert Solution

Question

1 Approved Answer

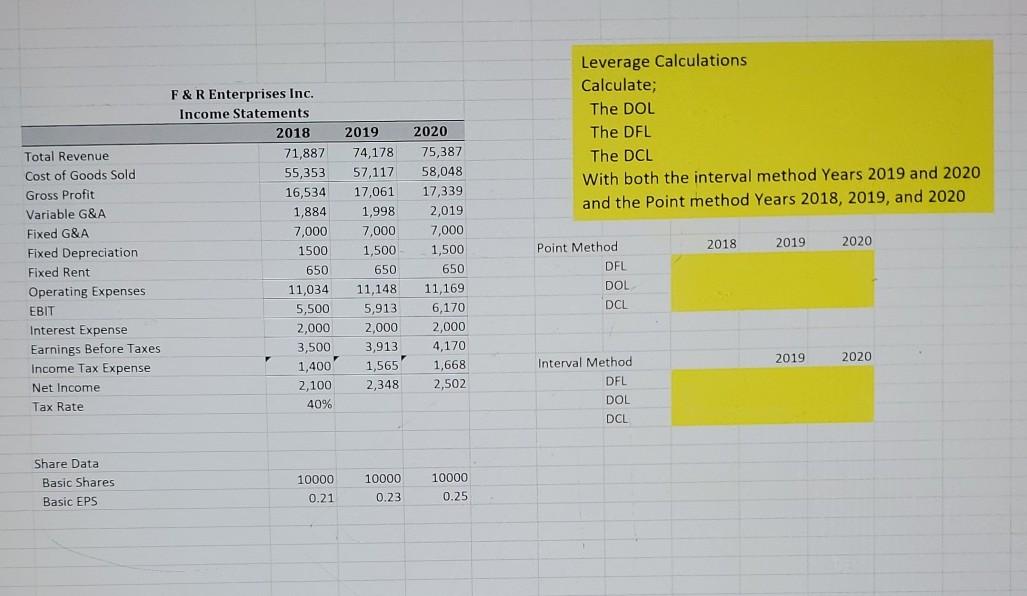

Leverage Calculations Calculate; The DOL The DFL The DCL With both the interval method Years 2019 and 2020 and the Point method Years 2018, 2019,

Leverage Calculations Calculate; The DOL The DFL The DCL With both the interval method Years 2019 and 2020 and the Point method Years 2018, 2019, and 2020 F&R Enterprises Inc. Income Statements 2018 71,887 55,353 16,534 1,884 7,000 1500 650 11,034 5,500 2,000 3,500 2019 74,178 57,117 17,061 1,998 7,000 1,500 650 11,148 5,913 2,000 3,913 1,565) 2018 Total Revenue Cost of Goods Sold Gross Profit Variable G&A Fixed G&A Fixed Depreciation Fixed Rent Operating Expenses EBIT Interest Expense Earnings Before Taxes Income Tax Expense Net Income Tax Rate 2019 2020 2020 75,387 58,048 17,339 2,019 7,000 1,500 650 11,169 6,170 2,000 4,170 1,668 2,502 Point Method DFL DOL DCL 2019 2020 1,400 2,100 2,348 Interval Method DFL DOL DCL 40% Share Data Basic Shares Basic EPS 10000 0.21 10000 0.23 10000 0.25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started