Answered step by step

Verified Expert Solution

Question

1 Approved Answer

lew File Edit View Go Tools Window Help finance.pdf (page 594 of 1.102)- Q Seard INTERNET APPLICATION QUESTIONS (C The following problems are interrelated and

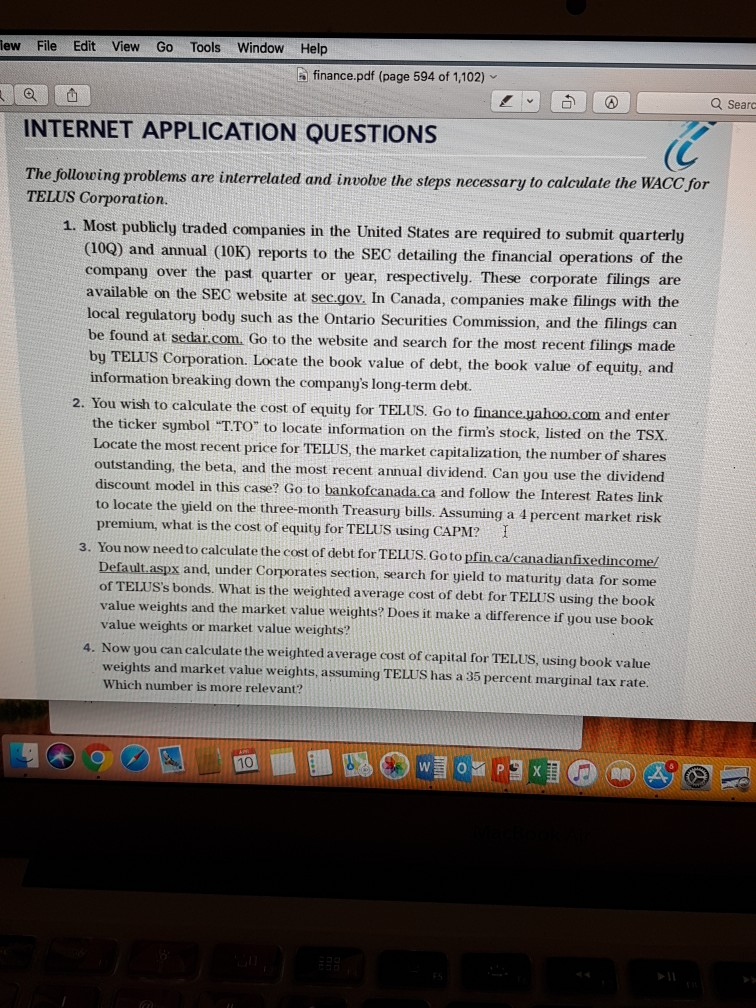

lew File Edit View Go Tools Window Help finance.pdf (page 594 of 1.102)- Q Seard INTERNET APPLICATION QUESTIONS (C The following problems are interrelated and involve the steps necessary to calculate the WACC for TELUS Corporation. 1. Most pubicly traded companies in the United States are required to submit quarterly (100) and annual (10K) reports to the SEC detailing the financial operations of the company over the past quarter or year, respectively. These corporate filings are on the SEC website at sec.gov. In Canada, companies make filings with the local regulatory body such as the Ontario Securities Commission, and the filings can be found at sedar.com. Go to the website and search for the most recent filings made by TELUS Corporation. Locate the book value of debt, the book value of equity, and information breaking down the company's long-term debt. the ticker symbol TTO" to locate information on the firm's stock outstanding, 2. You wish to calculate the cost of equity for TELUS. Go to finance.uahoo.com and enter listed on the TSX. Locate the most recent price for TELUS, the market capitalization, the number of shares the beta, and the most recent annual dividend. Can you use the dividend discount model in this case? Go to bankofcanada.ca and follow the Interest Rates li to locate the yield on the three-month Treasury bills. Assuming a 4 percent market risk premium, what is the cost of equity for TELUS using CAPM I 3. You now needto calculate the cost of debt for TELLUS. Goto pfinca/canadianfixedincome/ Default.aspx and, under Corporates section, search for gield to maturity data for some of TELUS's bonds. What is the weighted average cost of debt for TELUS using the book value weights and the market value weights? Does it make a difference if you use book value weights or market value weights? 4. Now you can calculate the weighted average cost of capital for TELUS, using book value weights and market value weights, assuming TELUS has a 35 percent marginal tax rate. Which number is more relevant? 10 lew File Edit View Go Tools Window Help finance.pdf (page 594 of 1.102)- Q Seard INTERNET APPLICATION QUESTIONS (C The following problems are interrelated and involve the steps necessary to calculate the WACC for TELUS Corporation. 1. Most pubicly traded companies in the United States are required to submit quarterly (100) and annual (10K) reports to the SEC detailing the financial operations of the company over the past quarter or year, respectively. These corporate filings are on the SEC website at sec.gov. In Canada, companies make filings with the local regulatory body such as the Ontario Securities Commission, and the filings can be found at sedar.com. Go to the website and search for the most recent filings made by TELUS Corporation. Locate the book value of debt, the book value of equity, and information breaking down the company's long-term debt. the ticker symbol TTO" to locate information on the firm's stock outstanding, 2. You wish to calculate the cost of equity for TELUS. Go to finance.uahoo.com and enter listed on the TSX. Locate the most recent price for TELUS, the market capitalization, the number of shares the beta, and the most recent annual dividend. Can you use the dividend discount model in this case? Go to bankofcanada.ca and follow the Interest Rates li to locate the yield on the three-month Treasury bills. Assuming a 4 percent market risk premium, what is the cost of equity for TELUS using CAPM I 3. You now needto calculate the cost of debt for TELLUS. Goto pfinca/canadianfixedincome/ Default.aspx and, under Corporates section, search for gield to maturity data for some of TELUS's bonds. What is the weighted average cost of debt for TELUS using the book value weights and the market value weights? Does it make a difference if you use book value weights or market value weights? 4. Now you can calculate the weighted average cost of capital for TELUS, using book value weights and market value weights, assuming TELUS has a 35 percent marginal tax rate. Which number is more relevant? 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started