Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lewis County had the following transactions for its General Fund for the current fiscal year. LEWIS COUNTY TRANSACTIONS FOR GENERAL FUND FOR CURRENT FISCAL

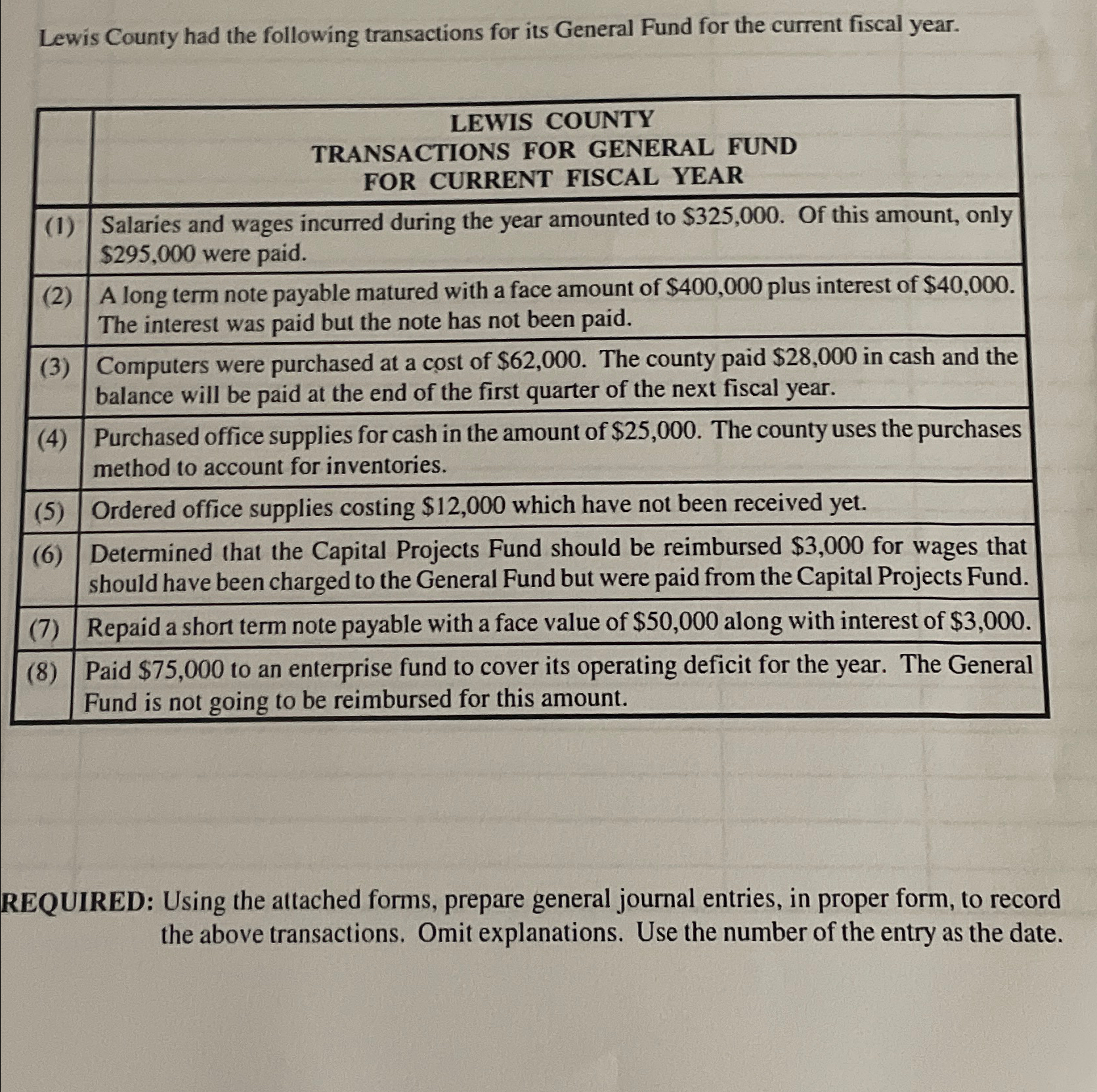

Lewis County had the following transactions for its General Fund for the current fiscal year. LEWIS COUNTY TRANSACTIONS FOR GENERAL FUND FOR CURRENT FISCAL YEAR (1) Salaries and wages incurred during the year amounted to $325,000. Of this amount, only $295,000 were paid. (2) A long term note payable matured with a face amount of $400,000 plus interest of $40,000. The interest was paid but the note has not been paid. (3) Computers were purchased at a cost of $62,000. The county paid $28,000 in cash and the balance will be paid at the end of the first quarter of the next fiscal year. (4) Purchased office supplies for cash in the amount of $25,000. The county uses the purchases method to account for inventories. (5) Ordered office supplies costing $12,000 which have not been received yet. (6) Determined that the Capital Projects Fund should be reimbursed $3,000 for wages that should have been charged to the General Fund but were paid from the Capital Projects Fund. (7) Repaid a short term note payable with a face value of $50,000 along with interest of $3,000. (8) Paid $75,000 to an enterprise fund to cover its operating deficit for the year. The General Fund is not going to be reimbursed for this amount. REQUIRED: Using the attached forms, prepare general journal entries, in proper form, to record the above transactions. Omit explanations. Use the number of the entry as the date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Salaries and wages incurred during the year amounted to 325000 Of this amount only 295000 were paid Explanation This transaction represents the wage...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started