Answered step by step

Verified Expert Solution

Question

1 Approved Answer

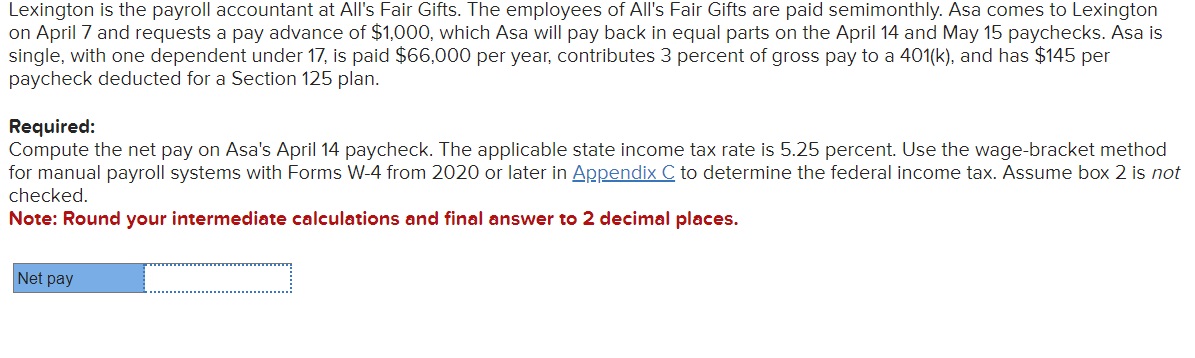

Lexington is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Asa comes to Lexington on April 7

Lexington is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Asa comes to Lexington on April and requests a pay advance of $ which Asa will pay back in equal parts on the April and May paychecks. Asa is single, with one dependent under is paid $ per year, contributes percent of gross pay to a k and has $ per paycheck deducted for a Section plan.

Required:

Compute the net pay on Asa's April paycheck. The applicable state income tax rate is percent. Use the wagebracket method for manual payroll systems with Forms W from or later in Appendix C to determine the federal income tax. Assume box is not checked.

Note: Round your intermediate calculations and final answer to decimal places.Lexington is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Asa comes to Lexington

on April and requests a pay advance of $ which Asa will pay back in equal parts on the April and May paychecks. Asa is

single, with one dependent under is paid $ per year, contributes percent of gross pay to a and has $ per

paycheck deducted for a Section plan.

Required:

Compute the net pay on Asa's April paycheck. The applicable state income tax rate is percent. Use the wagebracket method

for manual payroll systems with Forms W from or later in Appendix C to determine the federal income tax. Assume box is not

checked.

Note: Round your intermediate calculations and final answer to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started