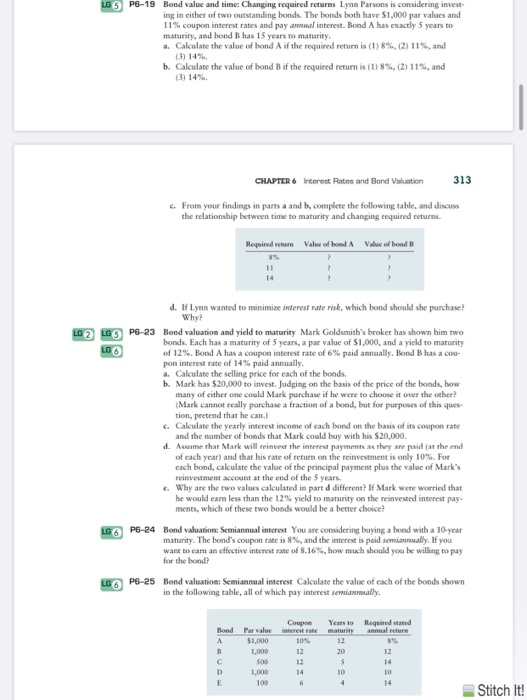

LG 5 P6-19 Bond value and time: Changing required returns Lynn Parsons is considering invest ing in either of two outstanding bonds. The bonds both have $1,000 par values and 11% coupon interest rates and pay ammwal interest. Bond A has exactly 5 years to maturity, and bond B has 15 years to maturity. a. Calculate the value of bond A if the required return is (1) 8%, (2) 11%, and (3) 14% b. Calculate the value of bond B if the required return is (1) 8%, (2) 11%, and CHAPTER 6 Interest Rates and Bond Valuation 313 c. From your findings in parts a and b, complete the following table, and discuss the relationship between time to maturity and changing required returns. Required return value of bad Vale of bond B 11 d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why? LG2 LG P8-23 Bond valuation and yield to maturity Mark Goldsmith's broker has shown him two bonds. Each has a maturity of 5 years, a par value of $1,000, and a yield to maturity LG of 12%. Bond A has a coupon interest rate of 6% paid annually. Bond B has a com pon interest rate of 14% paid annually. a. Calculate the selling price for each of the bonds. b. Mark has $20,000 to invest. Judging on the basis of the price of the bonds, how many of either one could Mark purchase if he were to choose it over the other? (Mark cannot really purchase a fraction of a bond, but for purposes of this ques tion, pretend that he can.) 6. Calculate the yearly interest income of each bond on the basis of its coupon rate and the number of bonds that Mark could buy with his $20,000. d. Assume thar Mark will reinvest the interese payments as they are paid (ar the end of cach year, and that his rate of return on the reinvestment is only 10%. For cach bond, calculate the value of the principal payment plus the value of Mark's reinvestment account at the end of the 5 years c. Why are the two values calculated in part d different? If Mark were worried that he would eam less than the 12% yield to maturity on the reinvested interest pay ments, which of these two bonds would be a better choice? P6-24 Bond valuation: Semiannual interest You are considering buying a bond with a 10-year maturity. The bond's coupon rate is 8%, and the interest is paid semimally. If you want to earn an effective interest rate of 8.16%, how much should you be willing to pay for the bond LG P8-25 Bond valuation: Semiannual interest Calculate the value of each of the bonds shown in the following table, all of which pay interest semiannually. LG 6 Coupon Years to Required stated Bond Par value interest rate maturity and return A $1,000 12 1,000 12 20 12 C 500 5 D 1,000 10 10 E 100 4 14 Stitch It