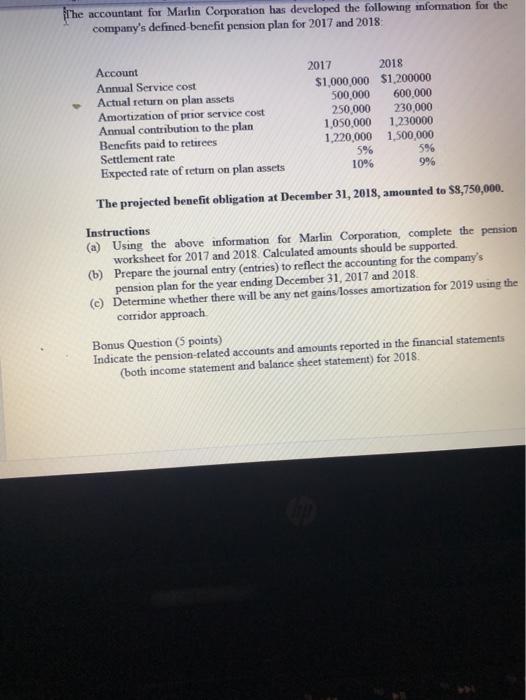

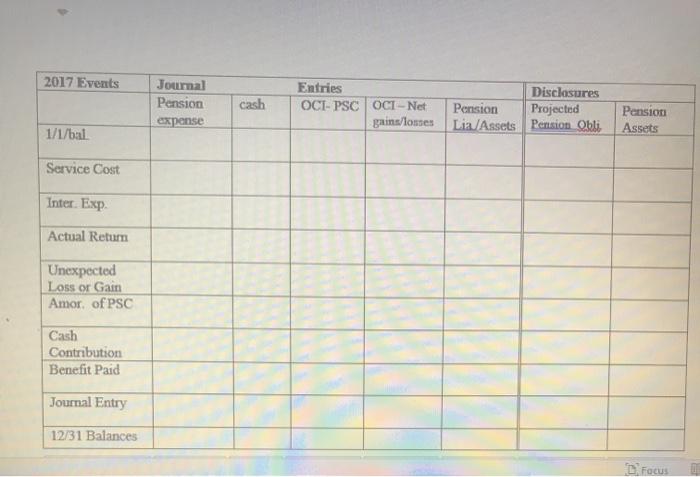

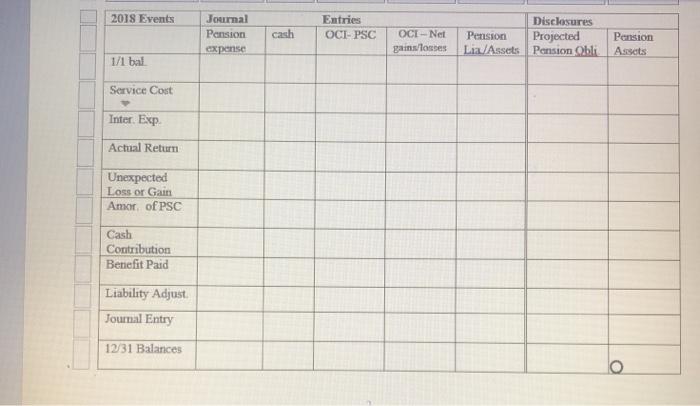

l'he accountant for Marlin Corporation has developed the following information for the company's defined benefit pension plan for 2017 and 2018 Account Annual Service cost Actual return on plan assets Amortization of prior service cost Annual contribution to the plan Benefits paid to retirees Settlement rate Expected rate of return on plan assets 2017 2018 $1,000,000 $1,200000 500,000 600,000 250.000 230,000 1,050,000 1.230000 1,220,000 1,500,000 5% 10% 996 596 The projected benefit obligation at December 31, 2018, amounted to $8,750,000. Instructions (a) Using the above information for Marlin Corporation, complete the pension worksheet for 2017 and 2018. Calculated amounts should be supported (b) Prepare the journal entry (entries) to reflect the accounting for the company's pension plan for the year ending December 31, 2017 and 2018 (e) Determine whether there will be any net gains losses amortization for 2019 using the corridor approach Bonus Question (5 points) Indicate the pension-related accounts and amounts reported in the financial statements (both income statement and balance sheet statement) for 2018 2017 Events Journal Pension expense cash Entries OCI-PSC OCT-Net gains/losses Disclosures Pension Projected Lia/Assets Pension Ohli Pension Assets 1/1/bal Service Cost Inter. Exp Actual Return Unexpected Loss or Gain Amor of PSC Cash Contribution Benefit Paid Journal Entry 12/31 Balances Focus 2018 Events Journal Pension expense Entries OCI- PSC cash OCI -Net gains/losses Pension La Assets Disclosures Projected Pension Obli Pension Assets 1/1 bal Service Cost Inter. Exp Actual Return Unexpected Loss or Gain Amor of PSC Cash Contribution Benefit Paid Liability Adjust Journal Entry 1231 Balances o l'he accountant for Marlin Corporation has developed the following information for the company's defined benefit pension plan for 2017 and 2018 Account Annual Service cost Actual return on plan assets Amortization of prior service cost Annual contribution to the plan Benefits paid to retirees Settlement rate Expected rate of return on plan assets 2017 2018 $1,000,000 $1,200000 500,000 600,000 250.000 230,000 1,050,000 1.230000 1,220,000 1,500,000 5% 10% 996 596 The projected benefit obligation at December 31, 2018, amounted to $8,750,000. Instructions (a) Using the above information for Marlin Corporation, complete the pension worksheet for 2017 and 2018. Calculated amounts should be supported (b) Prepare the journal entry (entries) to reflect the accounting for the company's pension plan for the year ending December 31, 2017 and 2018 (e) Determine whether there will be any net gains losses amortization for 2019 using the corridor approach Bonus Question (5 points) Indicate the pension-related accounts and amounts reported in the financial statements (both income statement and balance sheet statement) for 2018 2017 Events Journal Pension expense cash Entries OCI-PSC OCT-Net gains/losses Disclosures Pension Projected Lia/Assets Pension Ohli Pension Assets 1/1/bal Service Cost Inter. Exp Actual Return Unexpected Loss or Gain Amor of PSC Cash Contribution Benefit Paid Journal Entry 12/31 Balances Focus 2018 Events Journal Pension expense Entries OCI- PSC cash OCI -Net gains/losses Pension La Assets Disclosures Projected Pension Obli Pension Assets 1/1 bal Service Cost Inter. Exp Actual Return Unexpected Loss or Gain Amor of PSC Cash Contribution Benefit Paid Liability Adjust Journal Entry 1231 Balances o