Question

Li Company produces a product that sells for $110 per unit. The product cost per unit using absorption costing is $70. A customer contacts

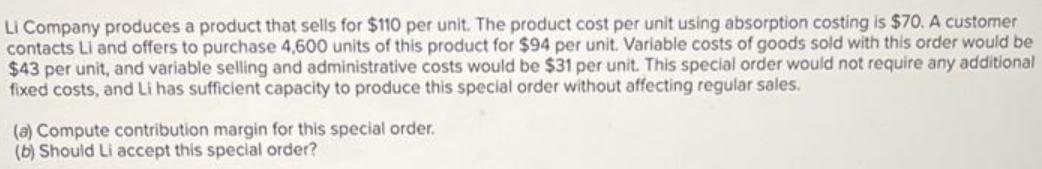

Li Company produces a product that sells for $110 per unit. The product cost per unit using absorption costing is $70. A customer contacts Li and offers to purchase 4,600 units of this product for $94 per unit. Variable costs of goods sold with this order would be $43 per unit, and variable selling and administrative costs would be $31 per unit. This special order would not require any additional fixed costs, and Li has sufficient capacity to produce this special order without affecting regular sales. (a) Compute contribution margin for this special order. (b) Should Li accept this special order?

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Ans Requirement A Special Order Anal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting Information for Decisions

Authors: John Wild, Ken Shaw, Barbara Chiappetta

6th edition

78025761, 978-0078025761

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App