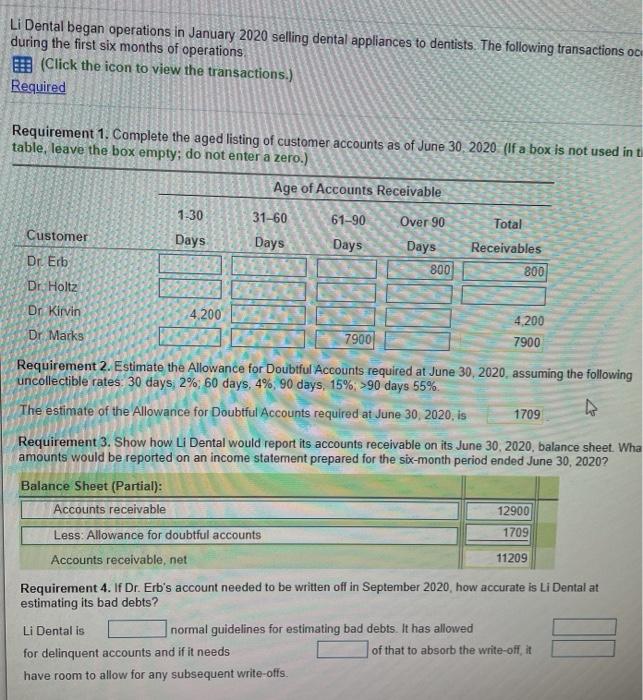

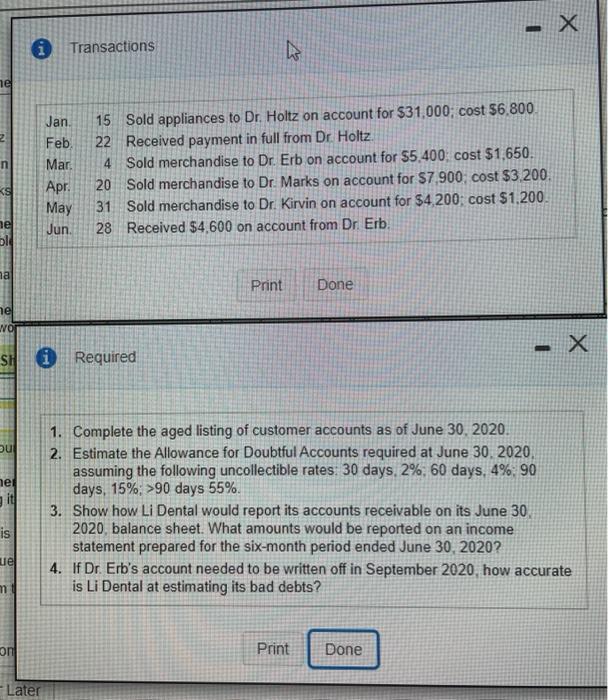

Li Dental began operations in January 2020 selling dental appliances to dentists. The following transactions och during the first six months of operations E (Click the icon to view the transactions.) Required Requirement 1. Complete the aged listing of customer accounts as of June 30, 2020 (If a box is not used in t table, leave the box empty; do not enter a zero.) Age of Accounts Receivable 1-30 Customer 31-60 Days 61-90 Days Days Over 90 Days 800 Total Receivables Dr. Erb 800 Dr. Holtz Dr Kirvin 4,200 4200 Dr Marks 7900 7900 Requirement 2. Estimate the Allowance for Doubtful Accounts required at June 30, 2020, assuming the following uncollectible rates 30 days 2% 60 days, 4%, 90 days, 15% >90 days 55%. The estimate of the Allowance for Doubtful Accounts required at June 30, 2020, is 1709 Requirement 3. Show how Li Dental would report its accounts receivable on its June 30, 2020, balance sheet. Wha amounts would be reported on an income statement prepared for the six-month period ended June 30, 2020? Balance Sheet (Partial): Accounts receivable 12900 Less: Allowance for doubtful accounts 1709 Accounts receivable, net 11209 Requirement 4. If Dr. Erb's account needed to be written off in September 2020, how accurate is LI Dental at estimating its bad debts? Li Dental is normal guidelines for estimating bad debts. It has allowed for delinquent accounts and if it needs of that to absorb the write-off, it have room to allow for any subsequent write-offs. X 0 Transactions he n Jan Feb Mar. Apr. May Jun. 15 Sold appliances to Dr. Holtz on account for $31,000; cost 56,800 22 Received payment in full from Dr. Holtz 4 Sold merchandise to Dr. Erb on account for 55.400 cost $1,650. 20 Sold merchandise to Dr. Marks on account for $7.900, cost $3,200. 31 Sold merchandise to Dr. Kirvin on account for $4,200, cost $1.200 28 Received $4,600 on account from Dr. Erb. ks nel ha Print Done nel WO SH i Required bul nel 1. Complete the aged listing of customer accounts as of June 30, 2020. 2. Estimate the Allowance for Doubtful Accounts required at June 30, 2020, assuming the following uncollectible rates 30 days, 2% 60 days, 4%, 90 days, 15%; >90 days 55%. 3. Show how Li Dental would report its accounts receivable on its June 30 2020, balance sheet. What amounts would be reported on an income statement prepared for the six-month period ended June 30, 2020? 4. If Dr. Erb's account needed to be written off in September 2020, how accurate is Li Dental at estimating its bad debts? is uel on Print Done Later Li Dental began operations in January 2020 selling dental appliances to dentists. The following transactions och during the first six months of operations E (Click the icon to view the transactions.) Required Requirement 1. Complete the aged listing of customer accounts as of June 30, 2020 (If a box is not used in t table, leave the box empty; do not enter a zero.) Age of Accounts Receivable 1-30 Customer 31-60 Days 61-90 Days Days Over 90 Days 800 Total Receivables Dr. Erb 800 Dr. Holtz Dr Kirvin 4,200 4200 Dr Marks 7900 7900 Requirement 2. Estimate the Allowance for Doubtful Accounts required at June 30, 2020, assuming the following uncollectible rates 30 days 2% 60 days, 4%, 90 days, 15% >90 days 55%. The estimate of the Allowance for Doubtful Accounts required at June 30, 2020, is 1709 Requirement 3. Show how Li Dental would report its accounts receivable on its June 30, 2020, balance sheet. Wha amounts would be reported on an income statement prepared for the six-month period ended June 30, 2020? Balance Sheet (Partial): Accounts receivable 12900 Less: Allowance for doubtful accounts 1709 Accounts receivable, net 11209 Requirement 4. If Dr. Erb's account needed to be written off in September 2020, how accurate is LI Dental at estimating its bad debts? Li Dental is normal guidelines for estimating bad debts. It has allowed for delinquent accounts and if it needs of that to absorb the write-off, it have room to allow for any subsequent write-offs. X 0 Transactions he n Jan Feb Mar. Apr. May Jun. 15 Sold appliances to Dr. Holtz on account for $31,000; cost 56,800 22 Received payment in full from Dr. Holtz 4 Sold merchandise to Dr. Erb on account for 55.400 cost $1,650. 20 Sold merchandise to Dr. Marks on account for $7.900, cost $3,200. 31 Sold merchandise to Dr. Kirvin on account for $4,200, cost $1.200 28 Received $4,600 on account from Dr. Erb. ks nel ha Print Done nel WO SH i Required bul nel 1. Complete the aged listing of customer accounts as of June 30, 2020. 2. Estimate the Allowance for Doubtful Accounts required at June 30, 2020, assuming the following uncollectible rates 30 days, 2% 60 days, 4%, 90 days, 15%; >90 days 55%. 3. Show how Li Dental would report its accounts receivable on its June 30 2020, balance sheet. What amounts would be reported on an income statement prepared for the six-month period ended June 30, 2020? 4. If Dr. Erb's account needed to be written off in September 2020, how accurate is Li Dental at estimating its bad debts? is uel on Print Done Later