Answered step by step

Verified Expert Solution

Question

1 Approved Answer

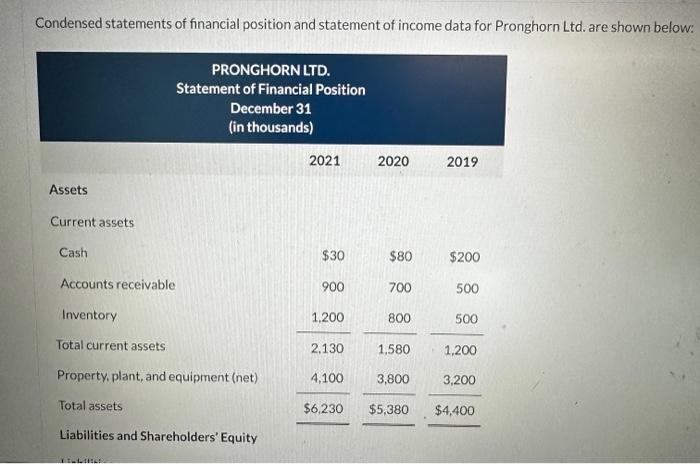

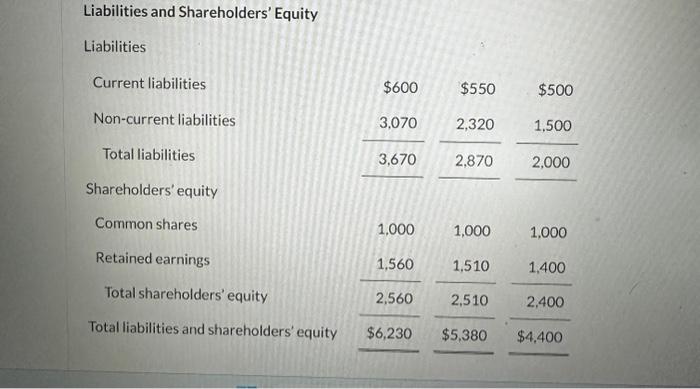

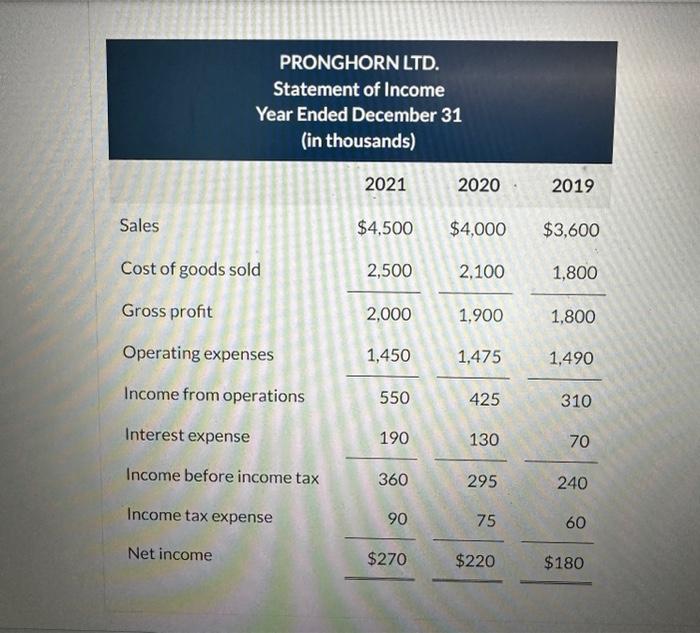

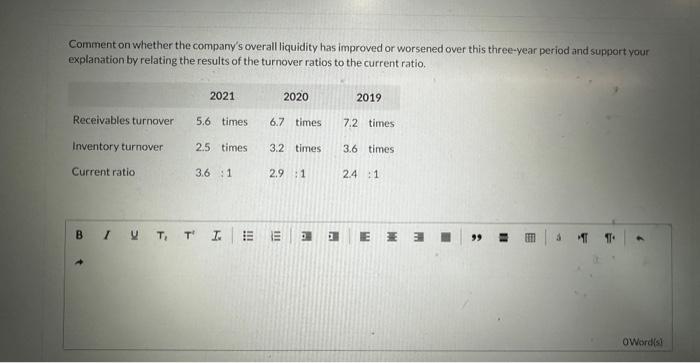

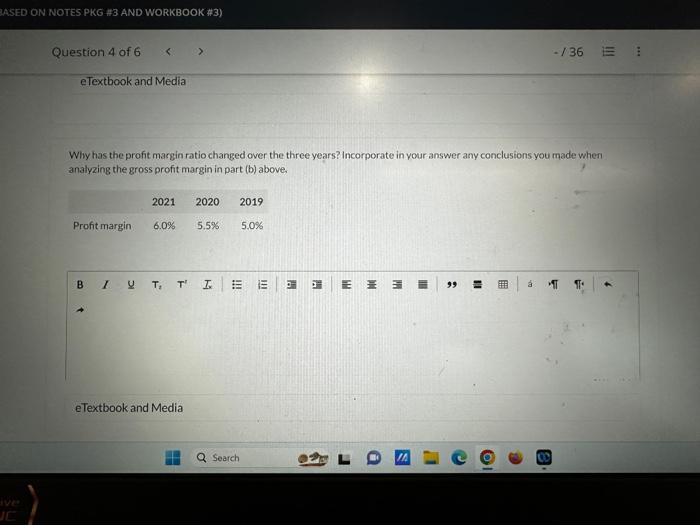

Liabilities and Shareholders' Equity Why has the profit margin ratio changed over the three years? Incorporate in vour answer any conclusions you made when analyzing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started