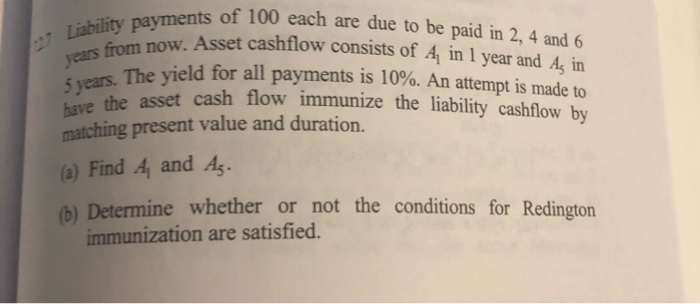

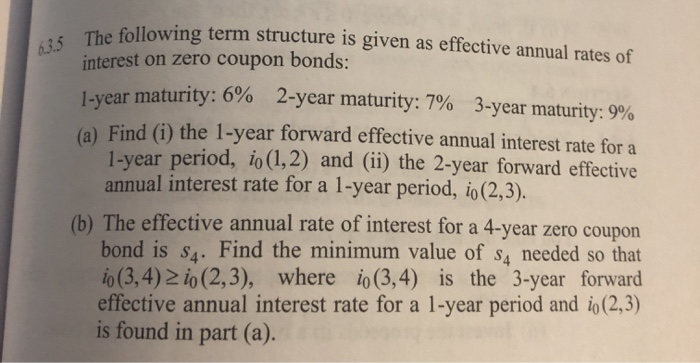

Liability payments of 100 years from now. Asset cashfil 5 years. The yield for all ne have the asset cash flow im matching present value and duration (a) Find 4, and As. nents of 100 each are due to be paid in 2, 4 and 6 ow. Asset cashflow consists of 4 in 1 year and Ag in The vield for all payments is 10%. An attempt is made to et cash flow immunize the liability cashflow by h) Determine whether or not the conditions for Redington immunization are satisfied. 635 The following terms following term structure is given as effective annual rates of interest on zero coupon bonds: wear maturity: 6% 2-year maturity: 7% 3-year maturity: 9% Find (1) the 1-year forward effective annual interest rate for a 1-year period, io (1,2) and (ii) the 2-year forward effective annual interest rate for a 1-year period, io (2,3). (b) The effective annual rate of interest for a 4-year zero coupon bond is SA. Find the minimum value of 4 needed so that 1.(3,4) i, (2,3), where io (3,4) is the 3-year forward effective annual interest rate for a 1-year period and io (2,3) is found in part (a). Liability payments of 100 years from now. Asset cashfil 5 years. The yield for all ne have the asset cash flow im matching present value and duration (a) Find 4, and As. nents of 100 each are due to be paid in 2, 4 and 6 ow. Asset cashflow consists of 4 in 1 year and Ag in The vield for all payments is 10%. An attempt is made to et cash flow immunize the liability cashflow by h) Determine whether or not the conditions for Redington immunization are satisfied. 635 The following terms following term structure is given as effective annual rates of interest on zero coupon bonds: wear maturity: 6% 2-year maturity: 7% 3-year maturity: 9% Find (1) the 1-year forward effective annual interest rate for a 1-year period, io (1,2) and (ii) the 2-year forward effective annual interest rate for a 1-year period, io (2,3). (b) The effective annual rate of interest for a 4-year zero coupon bond is SA. Find the minimum value of 4 needed so that 1.(3,4) i, (2,3), where io (3,4) is the 3-year forward effective annual interest rate for a 1-year period and io (2,3) is found in part (a)