Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Libby operates a mobile dog grooming service called Pups ' n ' Suds. She provided the following information and asked you to prepare her company's

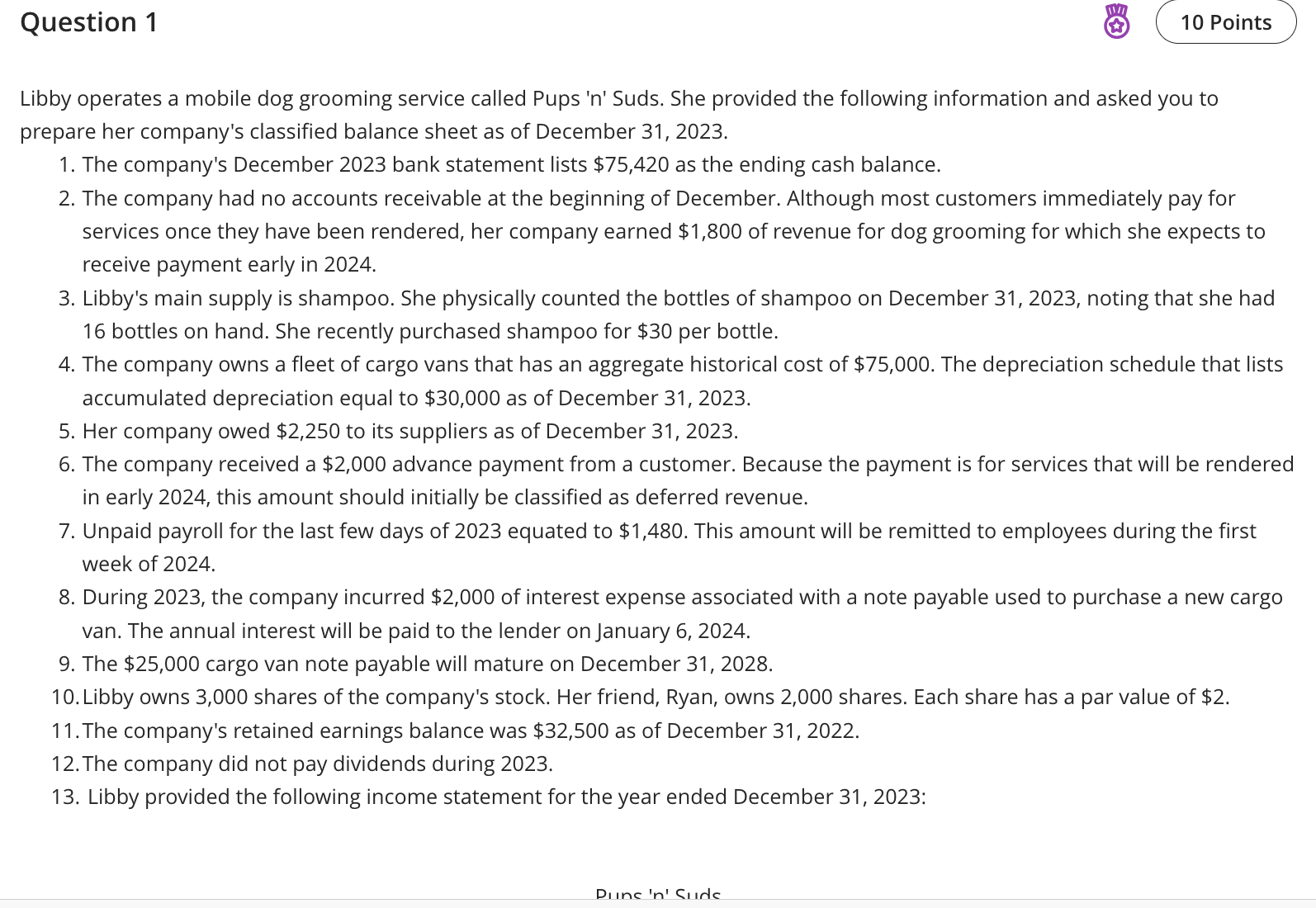

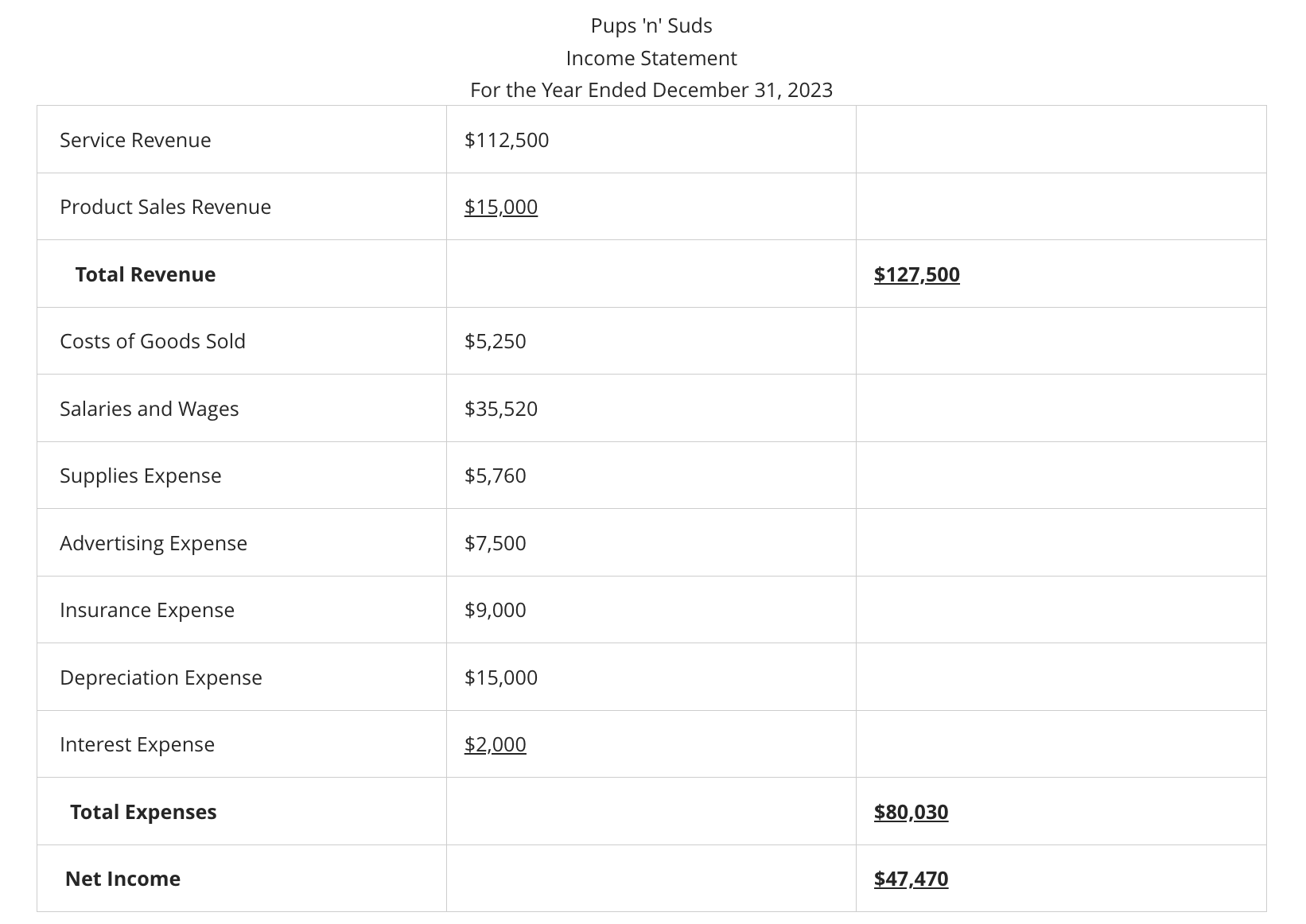

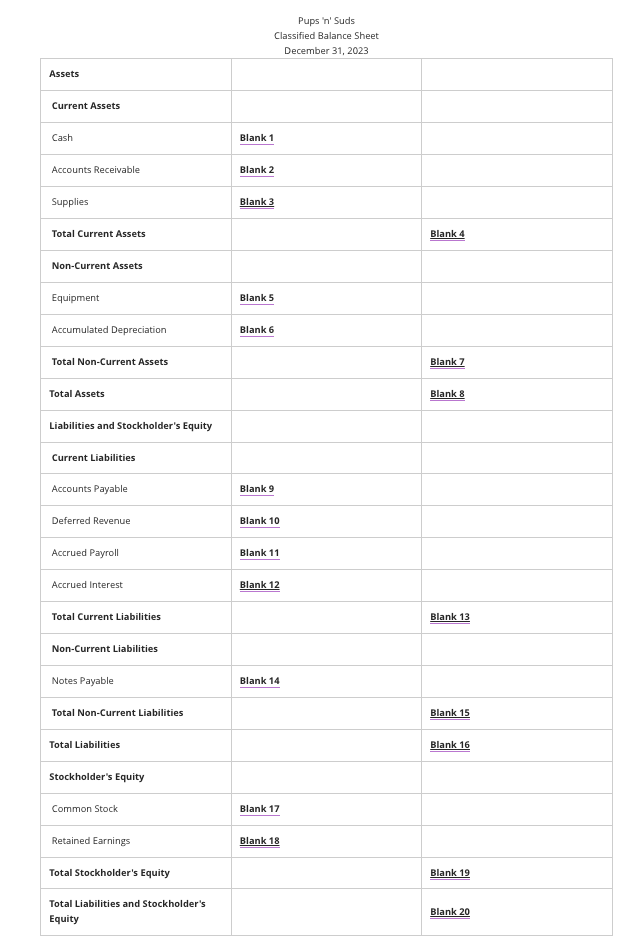

Libby operates a mobile dog grooming service called Pups ' n ' Suds. She provided the following information and asked you to prepare her company's classified balance sheet as of December 31, 2023. 1. The company's December 2023 bank statement lists $75,420 as the ending cash balance. 2. The company had no accounts receivable at the beginning of December. Although most customers immediately pay for services once they have been rendered, her company earned $1,800 of revenue for dog grooming for which she expects to receive payment early in 2024. 3. Libby's main supply is shampoo. She physically counted the bottles of shampoo on December 31, 2023, noting that she had 16 bottles on hand. She recently purchased shampoo for $30 per bottle. 4. The company owns a fleet of cargo vans that has an aggregate historical cost of $75,000. The depreciation schedule that lists accumulated depreciation equal to $30,000 as of December 31, 2023. 5. Her company owed $2,250 to its suppliers as of December 31, 2023. 6. The company received a $2,000 advance payment from a customer. Because the payment is for services that will be rendered in early 2024, this amount should initially be classified as deferred revenue. 7. Unpaid payroll for the last few days of 2023 equated to $1,480. This amount will be remitted to employees during the first week of 2024. 8. During 2023 , the company incurred $2,000 of interest expense associated with a note payable used to purchase a new cargo van. The annual interest will be paid to the lender on January 6,2024. 9. The $25,000 cargo van note payable will mature on December 31, 2028. 10. Libby owns 3,000 shares of the company's stock. Her friend, Ryan, owns 2,000 shares. Each share has a par value of $2. 11. The company's retained earnings balance was $32,500 as of December 31, 2022. 12. The company did not pay dividends during 2023. 13. Libby provided the following income statement for the year ended December 31, 2023: \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{\begin{tabular}{c} Pups ' n ' Suds \\ Income Statement \end{tabular}} \\ \hline Service Revenue & $112,500 & \\ \hline Product Sales Revenue & $15,000 & $127,500 \\ \hline Total Revenue & $5,250 & \\ \hline Costs of Goods Sold & $35,520 & \\ \hline Salaries and Wages & $5,760 & \\ \hline Supplies Expense & $7,500 & \\ \hline Advertising Expense & $9,000 & $47,470 \\ \hline Insurance Expense & $15,000 & \\ \hline Depreciation Expense & $2,000 & \\ \hline Interest Expense & & \\ \hline Notal Expenses & & \\ \hline \end{tabular} Pups ' n ' Suds Classified Balance Sheet December 31, 2023 \begin{tabular}{|c|c|c|} \hline Assets & & \\ \hline \multicolumn{3}{|l|}{ Current Assets } \\ \hline Cash & Blank 1 & \\ \hline Accounts Receivable & Blank2 & \\ \hline Supplies & Blank 3 & \\ \hline Total Current Assets & & Blank 4 \\ \hline \multicolumn{3}{|l|}{ Non-Current Assets } \\ \hline Equipment & Blank 5 & \\ \hline Accumulated Depreciation & Blank 6 & \\ \hline Total Non-Current Assets & & Blank 7 \\ \hline Total Assets & & Blank 8 \\ \hline \multicolumn{3}{|l|}{ Liabilities and Stockholder's Equity } \\ \hline \multicolumn{3}{|l|}{ Current Liabilities } \\ \hline Accounts Payable & Blank 9 & \\ \hline Deferred Revenue & Blank 10 & \\ \hline Accrued Payroll & Blank 11 & \\ \hline Accrued Interest & Blank 12 & \\ \hline Total Current Liabilities & & Blank 13 \\ \hline \multicolumn{3}{|l|}{ Non-Current Liabilities } \\ \hline Notes Payable & Blank 14 & \\ \hline Total Non-Current Liabilities & & Blank 15 \\ \hline Total Liabilities & & Blank 16 \\ \hline \multicolumn{3}{|l|}{ Stockholder's Equity } \\ \hline Common Stock & Blank17 & \\ \hline Retained Earnings & Blank 18 & \\ \hline Total Stockholder's Equity & & Blank 19 \\ \hline \begin{tabular}{l} Total Liabilities and Stockholder's \\ Equity \end{tabular} & & Blank 20 \\ \hline \end{tabular}

Libby operates a mobile dog grooming service called Pups ' n ' Suds. She provided the following information and asked you to prepare her company's classified balance sheet as of December 31, 2023. 1. The company's December 2023 bank statement lists $75,420 as the ending cash balance. 2. The company had no accounts receivable at the beginning of December. Although most customers immediately pay for services once they have been rendered, her company earned $1,800 of revenue for dog grooming for which she expects to receive payment early in 2024. 3. Libby's main supply is shampoo. She physically counted the bottles of shampoo on December 31, 2023, noting that she had 16 bottles on hand. She recently purchased shampoo for $30 per bottle. 4. The company owns a fleet of cargo vans that has an aggregate historical cost of $75,000. The depreciation schedule that lists accumulated depreciation equal to $30,000 as of December 31, 2023. 5. Her company owed $2,250 to its suppliers as of December 31, 2023. 6. The company received a $2,000 advance payment from a customer. Because the payment is for services that will be rendered in early 2024, this amount should initially be classified as deferred revenue. 7. Unpaid payroll for the last few days of 2023 equated to $1,480. This amount will be remitted to employees during the first week of 2024. 8. During 2023 , the company incurred $2,000 of interest expense associated with a note payable used to purchase a new cargo van. The annual interest will be paid to the lender on January 6,2024. 9. The $25,000 cargo van note payable will mature on December 31, 2028. 10. Libby owns 3,000 shares of the company's stock. Her friend, Ryan, owns 2,000 shares. Each share has a par value of $2. 11. The company's retained earnings balance was $32,500 as of December 31, 2022. 12. The company did not pay dividends during 2023. 13. Libby provided the following income statement for the year ended December 31, 2023: \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{\begin{tabular}{c} Pups ' n ' Suds \\ Income Statement \end{tabular}} \\ \hline Service Revenue & $112,500 & \\ \hline Product Sales Revenue & $15,000 & $127,500 \\ \hline Total Revenue & $5,250 & \\ \hline Costs of Goods Sold & $35,520 & \\ \hline Salaries and Wages & $5,760 & \\ \hline Supplies Expense & $7,500 & \\ \hline Advertising Expense & $9,000 & $47,470 \\ \hline Insurance Expense & $15,000 & \\ \hline Depreciation Expense & $2,000 & \\ \hline Interest Expense & & \\ \hline Notal Expenses & & \\ \hline \end{tabular} Pups ' n ' Suds Classified Balance Sheet December 31, 2023 \begin{tabular}{|c|c|c|} \hline Assets & & \\ \hline \multicolumn{3}{|l|}{ Current Assets } \\ \hline Cash & Blank 1 & \\ \hline Accounts Receivable & Blank2 & \\ \hline Supplies & Blank 3 & \\ \hline Total Current Assets & & Blank 4 \\ \hline \multicolumn{3}{|l|}{ Non-Current Assets } \\ \hline Equipment & Blank 5 & \\ \hline Accumulated Depreciation & Blank 6 & \\ \hline Total Non-Current Assets & & Blank 7 \\ \hline Total Assets & & Blank 8 \\ \hline \multicolumn{3}{|l|}{ Liabilities and Stockholder's Equity } \\ \hline \multicolumn{3}{|l|}{ Current Liabilities } \\ \hline Accounts Payable & Blank 9 & \\ \hline Deferred Revenue & Blank 10 & \\ \hline Accrued Payroll & Blank 11 & \\ \hline Accrued Interest & Blank 12 & \\ \hline Total Current Liabilities & & Blank 13 \\ \hline \multicolumn{3}{|l|}{ Non-Current Liabilities } \\ \hline Notes Payable & Blank 14 & \\ \hline Total Non-Current Liabilities & & Blank 15 \\ \hline Total Liabilities & & Blank 16 \\ \hline \multicolumn{3}{|l|}{ Stockholder's Equity } \\ \hline Common Stock & Blank17 & \\ \hline Retained Earnings & Blank 18 & \\ \hline Total Stockholder's Equity & & Blank 19 \\ \hline \begin{tabular}{l} Total Liabilities and Stockholder's \\ Equity \end{tabular} & & Blank 20 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started