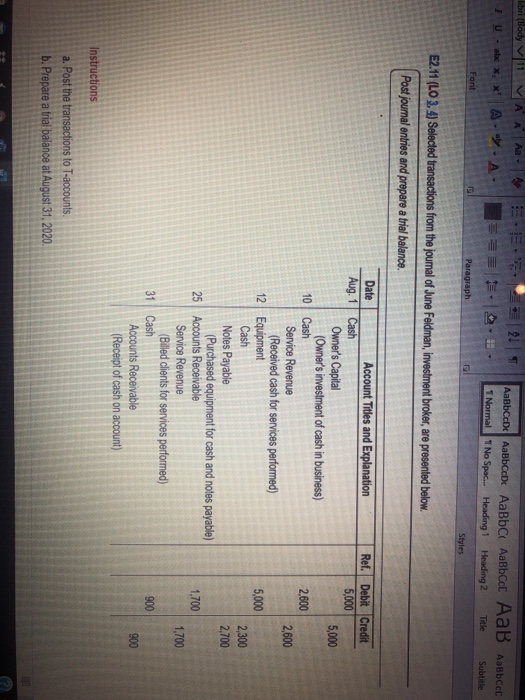

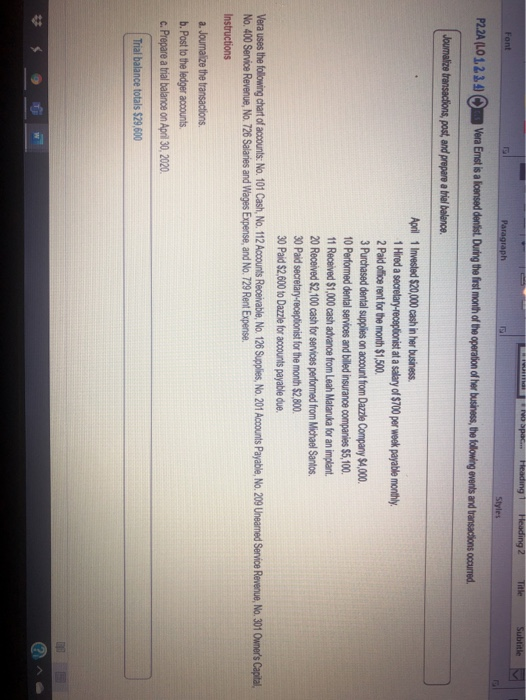

libri (Body 11 A Aa- A. IU - ab *, * A..A . 1 Normal T No Spac... Heading 1 Heading 2 Title Subtitle SH Font Paragraph Styles E2.11 (LO 3. 4) Selected transactions from the joumal of June Feldman, investment broker, are presented below. Postjournal entries and prepare a trial balance. Aug. 1 Ref. Debit Credit 5,000 5,000 2,600 2,600 5,000 Date Account Titles and Explanation Cash Owner's Capital (Owner's investment of cash in business) 10 Cash Service Revenue (Received cash for services performed) 12 Equipment Cash Notes Payable (Purchased equipment for cash and notes payable) 25 Accounts Receivable Service Revenue (Billed clients for services performed) 31 Cash Accounts Receivable (Receipt of cash on account) 2,300 2,700 1,700 1,700 900 900 Instructions a. Post the transactions to T-accounts. b. Prepare a trial balance at August 31, 2020, Spac. Heading 1 Heading 2 Title Subtitle Font Paragraph Styles P2.2A (L01234 Vera Emst is a licensed dentist. During the first month of the operation of her business, the following events and transactions occurred. Joumalize transactions, post and prepare a trial balance. April 1 Invested $20,000 cash in her business 1 Hired a secretary-receptionist at a salary of $700 per week payable monthly 2 Paid office rent for the month $1,500 3 Purchased dental supplies on account from Dazzle Company $4,000. 10 Performed dental services and billed insurance companies $5,100. 11 Received $1,000 cash advance from Leah Mataruka for an implant. 20 Received $2,100 cash for services performed from Michael Santos. 30 Paid secretary-receptionist for the month $2,800. 30 Paid $2,600 to Dazzle for accounts payable due. Vera uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 209 Uneared Service Revenue, No. 301 Owner's Capital, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Instructions a. Joumalize the transactions b. Post to the ledger accounts. c. Prepare a trial balance on April 30, 2020. Trial balance totals $29,600