Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Libur Sdn Bhd makes gaming devices using latest automated technology. The company uses a joborder costing system and applies manufacturing overhead cost to products on

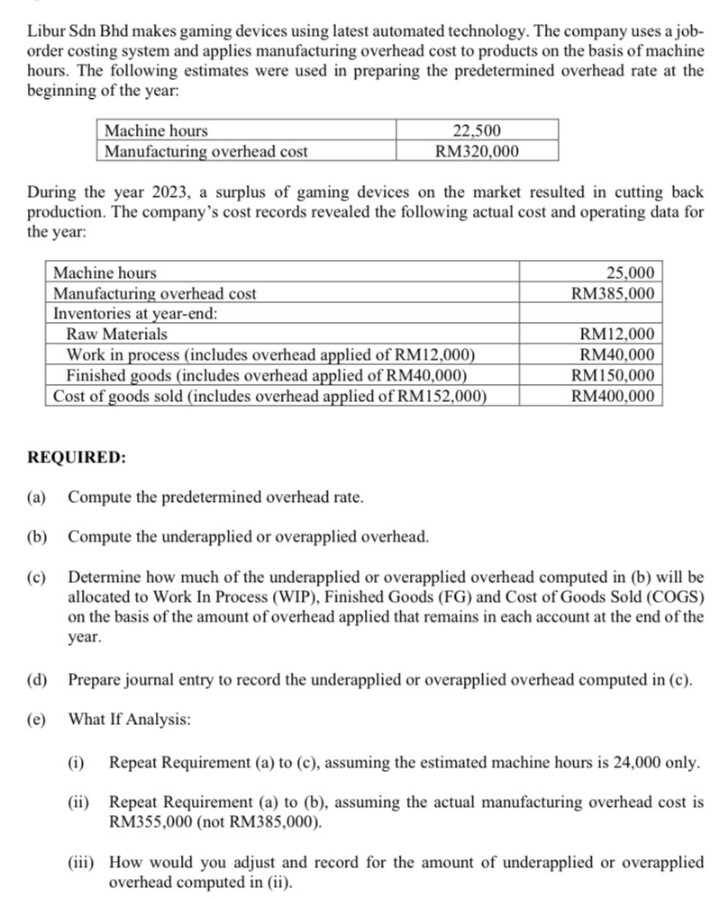

Libur Sdn Bhd makes gaming devices using latest automated technology. The company uses a joborder costing system and applies manufacturing overhead cost to products on the basis of machine hours. The following estimates were used in preparing the predetermined overhead rate at the beginning of the year: During the year 2023, a surplus of gaming devices on the market resulted in cutting back production. The company's cost records revealed the following actual cost and operating data for the year: REQUIRED: (a) Compute the predetermined overhead rate. (b) Compute the underapplied or overapplied overhead. (c) Determine how much of the underapplied or overapplied overhead computed in (b) will be allocated to Work In Process (WIP), Finished Goods (FG) and Cost of Goods Sold (COGS) on the basis of the amount of overhead applied that remains in each account at the end of the year. (d) Prepare journal entry to record the underapplied or overapplied overhead computed in (c). (e) What If Analysis: (i) Repeat Requirement (a) to (c), assuming the estimated machine hours is 24,000 only. (ii) Repeat Requirement (a) to (b), assuming the actual manufacturing overhead cost is RM355,000 (not RM385,000). (iii) How would you adjust and record for the amount of underapplied or overapplied overhead computed in (ii)

Libur Sdn Bhd makes gaming devices using latest automated technology. The company uses a joborder costing system and applies manufacturing overhead cost to products on the basis of machine hours. The following estimates were used in preparing the predetermined overhead rate at the beginning of the year: During the year 2023, a surplus of gaming devices on the market resulted in cutting back production. The company's cost records revealed the following actual cost and operating data for the year: REQUIRED: (a) Compute the predetermined overhead rate. (b) Compute the underapplied or overapplied overhead. (c) Determine how much of the underapplied or overapplied overhead computed in (b) will be allocated to Work In Process (WIP), Finished Goods (FG) and Cost of Goods Sold (COGS) on the basis of the amount of overhead applied that remains in each account at the end of the year. (d) Prepare journal entry to record the underapplied or overapplied overhead computed in (c). (e) What If Analysis: (i) Repeat Requirement (a) to (c), assuming the estimated machine hours is 24,000 only. (ii) Repeat Requirement (a) to (b), assuming the actual manufacturing overhead cost is RM355,000 (not RM385,000). (iii) How would you adjust and record for the amount of underapplied or overapplied overhead computed in (ii) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started