Liddy Inc. just issued 10-year, 8% coupon bon ds at par. Limbaugh Inc. bonds, which have a mat urity of 10 years, sell at

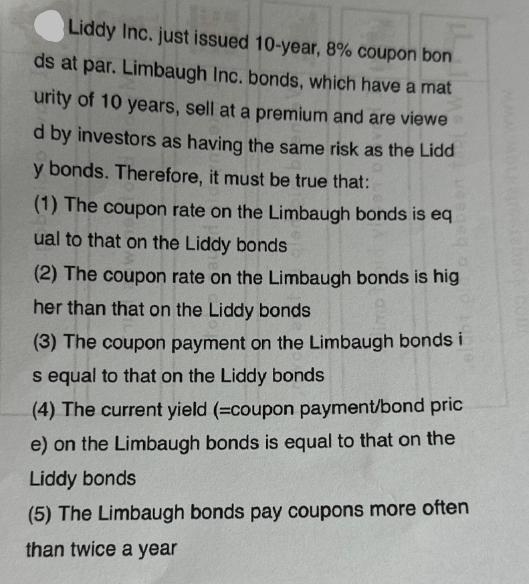

Liddy Inc. just issued 10-year, 8% coupon bon ds at par. Limbaugh Inc. bonds, which have a mat urity of 10 years, sell at a premium and are viewe d by investors as having the same risk as the Lidd y bonds. Therefore, it must be true that: (1) The coupon rate on the Limbaugh bonds is eq ual to that on the Liddy bonds (2) The coupon rate on the Limbaugh bonds is hig her than that on the Liddy bonds (3) The coupon payment on the Limbaugh bonds i s equal to that on the Liddy bonds (4) The current yield (=coupon payment/bond pric e) on the Limbaugh bonds is equal to that on the Liddy bonds (5) The Limbaugh bonds pay coupons more often than twice a year LEWAT qo.

Step by Step Solution

3.23 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided b...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started