Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Life expectancy for soldiers is between 68-72. 1) Suppose a 55-year old soldier has earned a military retirement that begins at age 60 with an

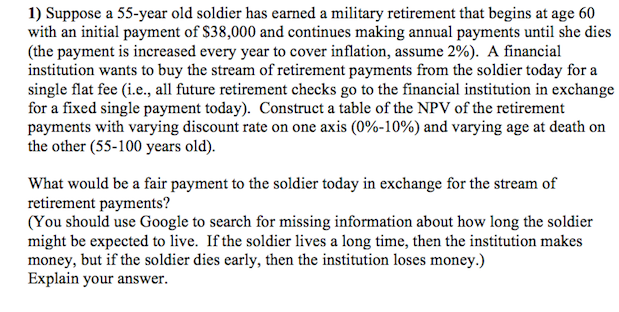

Life expectancy for soldiers is between 68-72.

1) Suppose a 55-year old soldier has earned a military retirement that begins at age 60 with an initial payment of S38,000 and continues making annual payments until she dies (the payment is increased every year to cover inflation, assume 2%). A financial institution wants to buy the stream of retirement payments from the soldier today for a single flat fee (i.e., all future retirement checks go to the financial institution in exchange for a fixed single payment today). Construct a table of the NPV of the retirement payments with varying discount rate on one axis (0%-10%) and varying age at death on the other (55-100 years old) What would be a fair payment to the soldier today in exchange for the stream of retirement payments? (You should use Google to search for missing information about how long the soldier might be expected to live. If the soldier lives a long time, then the institution makes money, but if the soldier dies early, then the institution loses money.) Explain yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started