Answered step by step

Verified Expert Solution

Question

1 Approved Answer

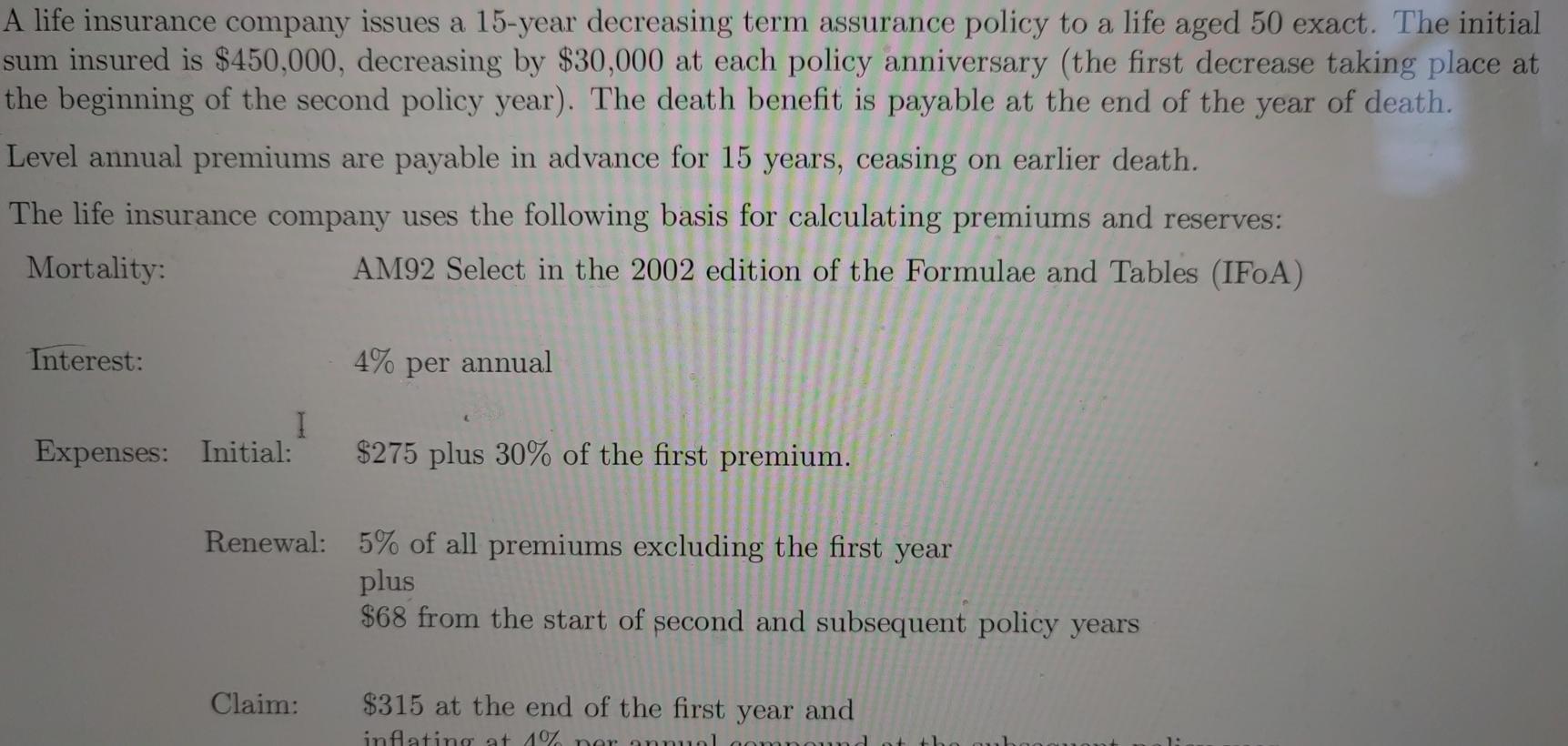

life insurance company issues a 15-year decreasing term assurance policy to a life aged 50 exact. The initial ium insured is $450,000, decreasing by $30,000

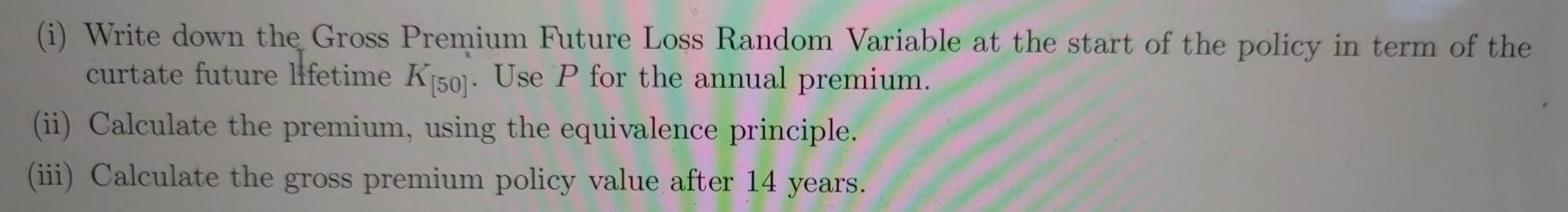

life insurance company issues a 15-year decreasing term assurance policy to a life aged 50 exact. The initial ium insured is $450,000, decreasing by $30,000 at each policy anniversary (the first decrease taking place at the beginning of the second policy year). The death benefit is payable at the end of the year of death. Level annual premiums are payable in advance for 15 years, ceasing on earlier death. The life insurance company uses the following basis for calculating premiums and reserves: Mortality: AM92 Select in the 2002 edition of the Formulae and Tables (IFoA) Interest: 4% per annual Expenses: Initial: $275 plus 30% of the first premium. Renewal: 5% of all premiums excluding the first year plus $68 from the start of second and subsequent policy years Claim: $315 at the end of the first year and (i) Write down the Gross Premium Future Loss Random Variable at the start of the policy in term of the curtate future lffetime K[50]. Use P for the annual premium. (ii) Calculate the premium, using the equivalence principle. (iii) Calculate the gross premium policy value after 14 years. life insurance company issues a 15-year decreasing term assurance policy to a life aged 50 exact. The initial ium insured is $450,000, decreasing by $30,000 at each policy anniversary (the first decrease taking place at the beginning of the second policy year). The death benefit is payable at the end of the year of death. Level annual premiums are payable in advance for 15 years, ceasing on earlier death. The life insurance company uses the following basis for calculating premiums and reserves: Mortality: AM92 Select in the 2002 edition of the Formulae and Tables (IFoA) Interest: 4% per annual Expenses: Initial: $275 plus 30% of the first premium. Renewal: 5% of all premiums excluding the first year plus $68 from the start of second and subsequent policy years Claim: $315 at the end of the first year and (i) Write down the Gross Premium Future Loss Random Variable at the start of the policy in term of the curtate future lffetime K[50]. Use P for the annual premium. (ii) Calculate the premium, using the equivalence principle. (iii) Calculate the gross premium policy value after 14 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started