Question

Using the premium schedules provided in Exhibits 8.2, 8.3, and 8.5, how much in annual premiums would a 25-year-old male have to pay for $100,000

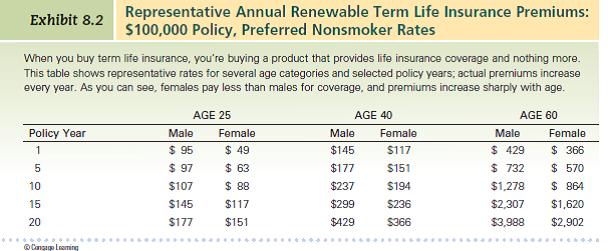

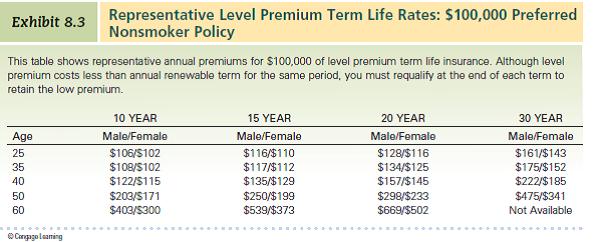

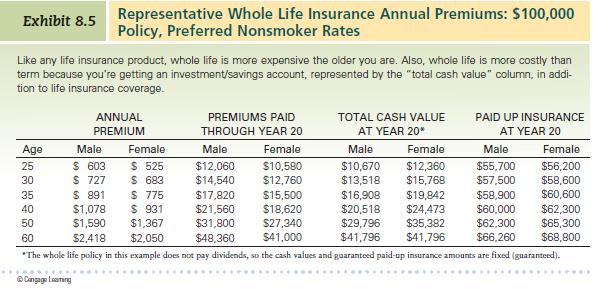

Using the premium schedules provided in Exhibits 8.2, 8.3, and 8.5, how much in annual premiums would a 25-year-old male have to pay for $100,000 of annual renewable term, level premium term, and whole life insurance? (Assume a five-year term or period of coverage.) How much would a 25-year-old woman have to pay for the same coverage? Consider a 40-year-old male (or female): Using annual premiums, compare the cost of 10 years of coverage under annual renewable and level premium term options and whole life insurance coverage. Relate the advantages and disadvantages of each policy type to their price differences.

(Reference Exhibits 8.2, 8.3, and 8.5)

Representative Annual Renewable Term Life Insurance Premiums: S100,000 Policy, Preferred Nonsmoker Rates Exhibit 8.2 When you buy term life insurance, you're buying a product that provides life insurance coverage and nothing more. This table shows representative rates for several age categories and selected policy years; actual premiums increase every year. As you can see, females pay less than males for coverage, and premiums increase sharply with age. AGE 25 AGE 40 AGE 60 Policy Year Male Female Male Female Male Female 1 $ 95 $ 49 $145 $117 $ 429 $ 366 $ 97 $ 8 $ 570 $ 864 $ 63 $177 $151 $ 732 10 $107 $237 $194 $1,278 15 $145 $117 $299 $236 $2,307 $1,620 20 $177 $151 $429 $366 $3,988 $2,902 O Cangap Lnaming

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Using the premium schedules provided in Exhibits 82 83 and 85 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started