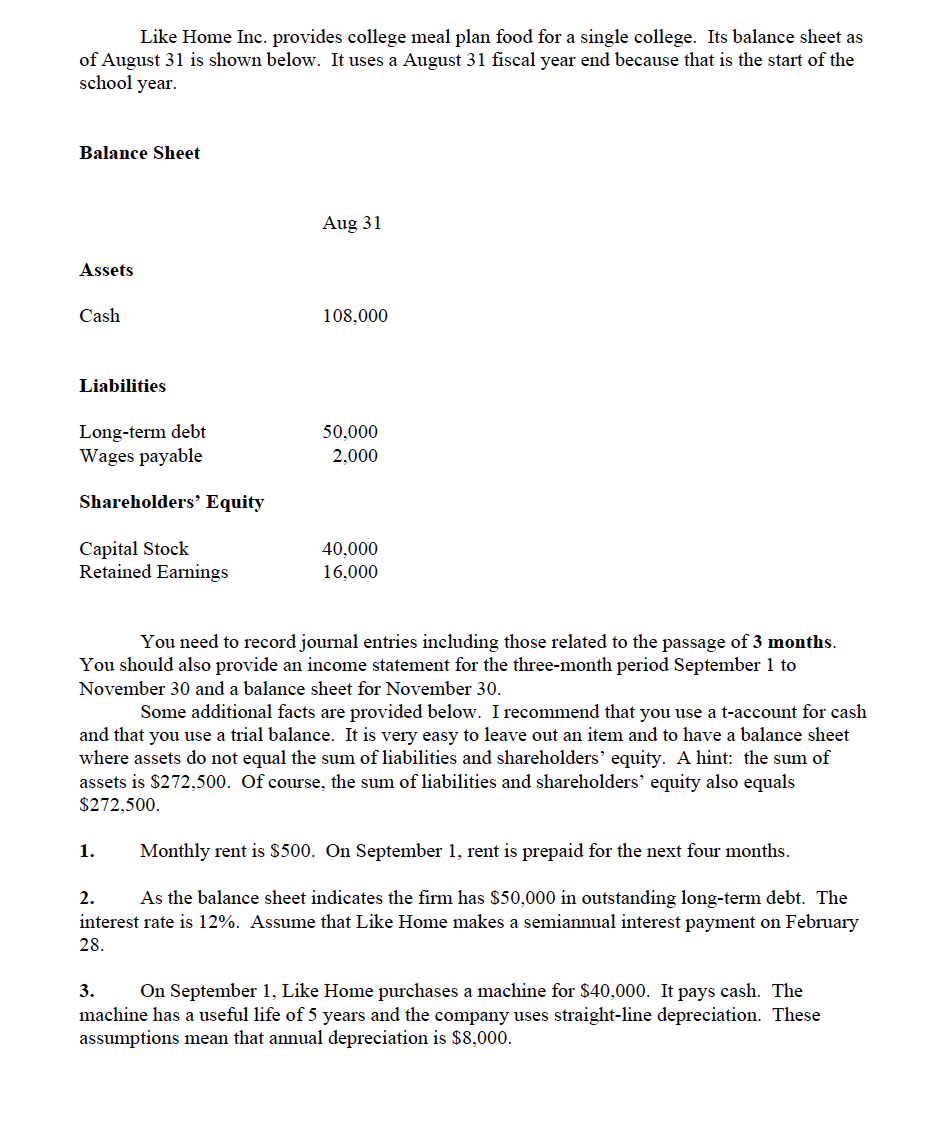

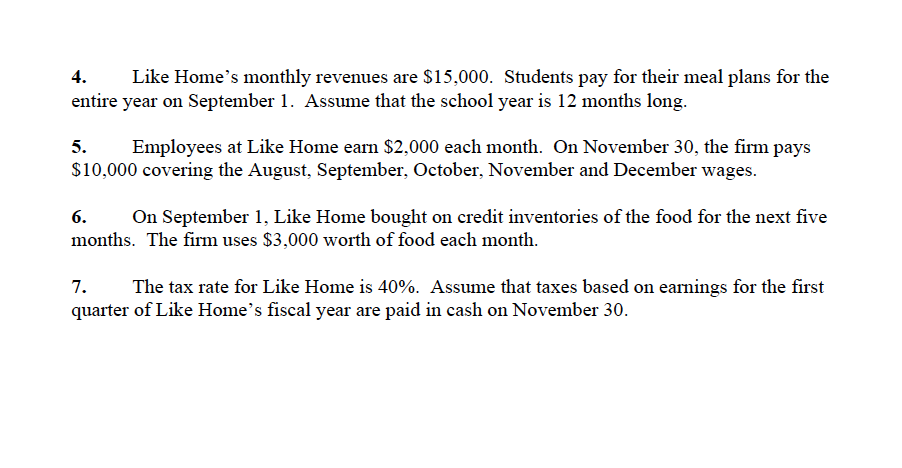

Like Home Inc. provides college meal plan food for a single college. Its balance sheet as of August 31 is shown below. It uses a August 31 fiscal year end because that is the start of the school year. Balance Sheet Aug 31 Assets Cash 108.000 Liabilities Long-term debt Wages payable 50,000 2,000 Shareholders' Equity Capital Stock Retained Earnings 40,000 16,000 You need to record journal entries including those related to the passage of 3 months. You should also provide an income statement for the three-month period September 1 to November 30 and a balance sheet for November 30. Some additional facts are provided below. I recommend that you use a t-account for cash and that you use a trial balance. It is very easy to leave out an item and to have a balance sheet where assets do not equal the sum of liabilities and shareholders' equity. A hint: the sum of assets is $272,500. Of course, the sum of liabilities and shareholders' equity also equals $272,500. 1. Monthly rent is $500. On September 1, rent is prepaid for the next four months. 2. As the balance sheet indicates the firm has $50,000 in outstanding long-term debt. The interest rate is 12%. Assume that Like Home makes a semiannual interest payment on February 28. 3. On September 1, Like Home purchases a machine for $40,000. It pays cash. The machine has a useful life of 5 years and the company uses straight-line depreciation. These assumptions mean that annual depreciation is $8,000. 4. Like Home's monthly revenues are $15,000. Students pay for their meal plans for the entire year on September 1. Assume that the school year is 12 months long. 5. Employees at Like Home earn $2,000 each month. On November 30, the firm pays $10,000 covering the August, September, October, November and December wages. 6. On September 1, Like Home bought on credit inventories of the food for the next five months. The firm uses $3,000 worth of food each month. 7. The tax rate for Like Home is 40%. Assume that taxes based on earnings for the first quarter of Like Home's fiscal year are paid in cash on November 30. Like Home Inc. provides college meal plan food for a single college. Its balance sheet as of August 31 is shown below. It uses a August 31 fiscal year end because that is the start of the school year. Balance Sheet Aug 31 Assets Cash 108.000 Liabilities Long-term debt Wages payable 50,000 2,000 Shareholders' Equity Capital Stock Retained Earnings 40,000 16,000 You need to record journal entries including those related to the passage of 3 months. You should also provide an income statement for the three-month period September 1 to November 30 and a balance sheet for November 30. Some additional facts are provided below. I recommend that you use a t-account for cash and that you use a trial balance. It is very easy to leave out an item and to have a balance sheet where assets do not equal the sum of liabilities and shareholders' equity. A hint: the sum of assets is $272,500. Of course, the sum of liabilities and shareholders' equity also equals $272,500. 1. Monthly rent is $500. On September 1, rent is prepaid for the next four months. 2. As the balance sheet indicates the firm has $50,000 in outstanding long-term debt. The interest rate is 12%. Assume that Like Home makes a semiannual interest payment on February 28. 3. On September 1, Like Home purchases a machine for $40,000. It pays cash. The machine has a useful life of 5 years and the company uses straight-line depreciation. These assumptions mean that annual depreciation is $8,000. 4. Like Home's monthly revenues are $15,000. Students pay for their meal plans for the entire year on September 1. Assume that the school year is 12 months long. 5. Employees at Like Home earn $2,000 each month. On November 30, the firm pays $10,000 covering the August, September, October, November and December wages. 6. On September 1, Like Home bought on credit inventories of the food for the next five months. The firm uses $3,000 worth of food each month. 7. The tax rate for Like Home is 40%. Assume that taxes based on earnings for the first quarter of Like Home's fiscal year are paid in cash on November 30