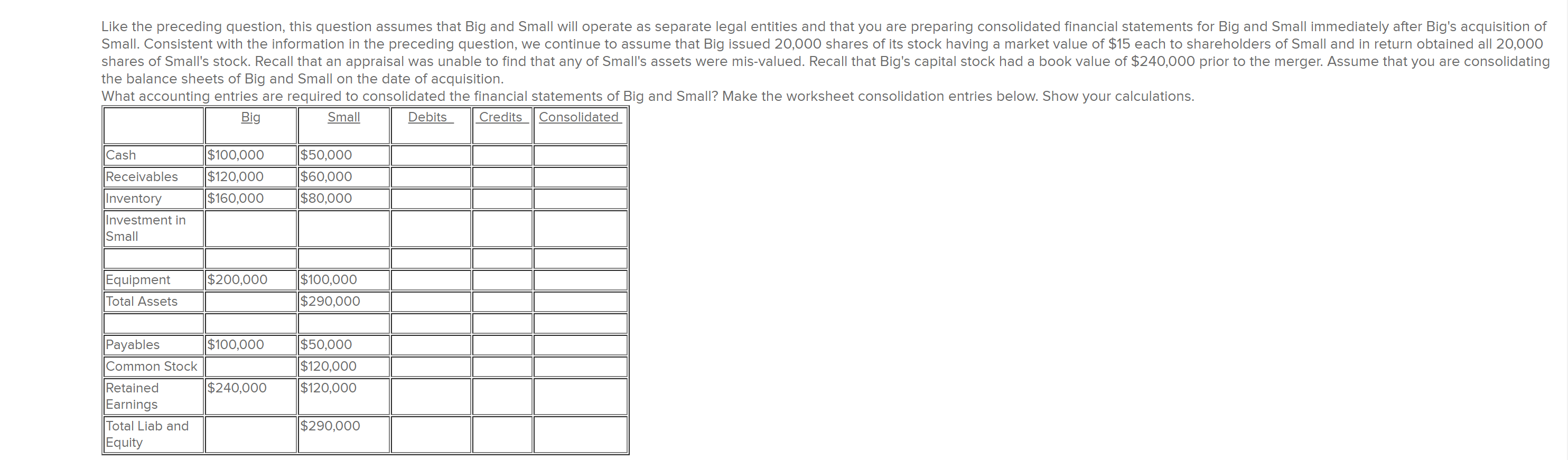

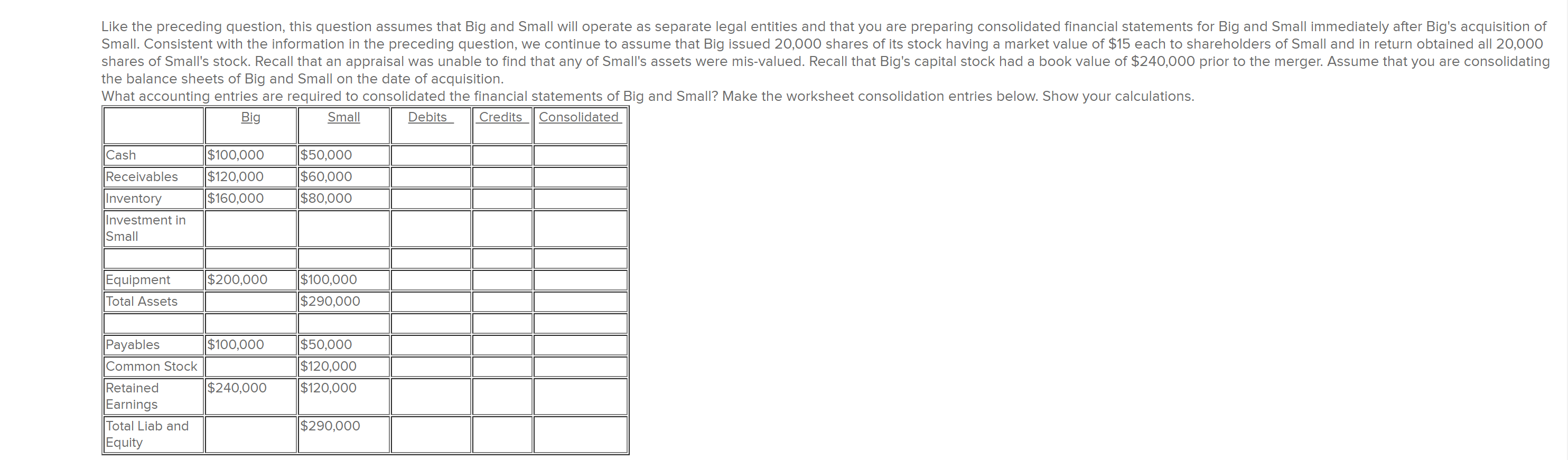

Like the preceding question, this question assumes that Big and small will operate as separate legal entities and that you are preparing consolidated financial statements for Big and Small immediately after Big's acquisition of Small. Consistent with the information in the preceding question, we continue to assume that Big issued 20,000 shares of its stock having a market value of $15 each to shareholders of Small and in return obtained all 20,000 shares of Small's stock. Recall that an appraisal was unable to find that any of Small's assets were mis-valued. Recall that Big's capital stock had a book value of $240,000 prior to the merger. Assume that you are consolidating the balance sheets of Big and Small on the date of acquisition. What accounting entries are required to consolidated the financial statements of Big and Small? Make the worksheet consolidation entries below. Show your calculations. Big Small Debits Credits Consolidated Cash Receivables $100,000 $120,000 $160,000 $50,000 $60,000 |$80,000 Inventory Investment in Small $200,000 $100,000 Equipment Total Assets $290,000 Payables $100,000 Common Stock Retained $240,000 Earnings Total Liab and Equity $50,000 |$120,000 $120,000 $290,000 Like the preceding question, this question assumes that Big and small will operate as separate legal entities and that you are preparing consolidated financial statements for Big and Small immediately after Big's acquisition of Small. Consistent with the information in the preceding question, we continue to assume that Big issued 20,000 shares of its stock having a market value of $15 each to shareholders of Small and in return obtained all 20,000 shares of Small's stock. Recall that an appraisal was unable to find that any of Small's assets were mis-valued. Recall that Big's capital stock had a book value of $240,000 prior to the merger. Assume that you are consolidating the balance sheets of Big and Small on the date of acquisition. What accounting entries are required to consolidated the financial statements of Big and Small? Make the worksheet consolidation entries below. Show your calculations. Big Small Debits Credits Consolidated Cash Receivables $100,000 $120,000 $160,000 $50,000 $60,000 |$80,000 Inventory Investment in Small $200,000 $100,000 Equipment Total Assets $290,000 Payables $100,000 Common Stock Retained $240,000 Earnings Total Liab and Equity $50,000 |$120,000 $120,000 $290,000