Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Like-kind exchange tax questionThe problem I am having is the answer says that parcel B has a recognize loss of $0. I came up with

Like-kind exchange tax questionThe problem I am having is the answer says that parcel B has a recognize loss of $0. I came up with $15,000. Please show the calculation details to get to the answer

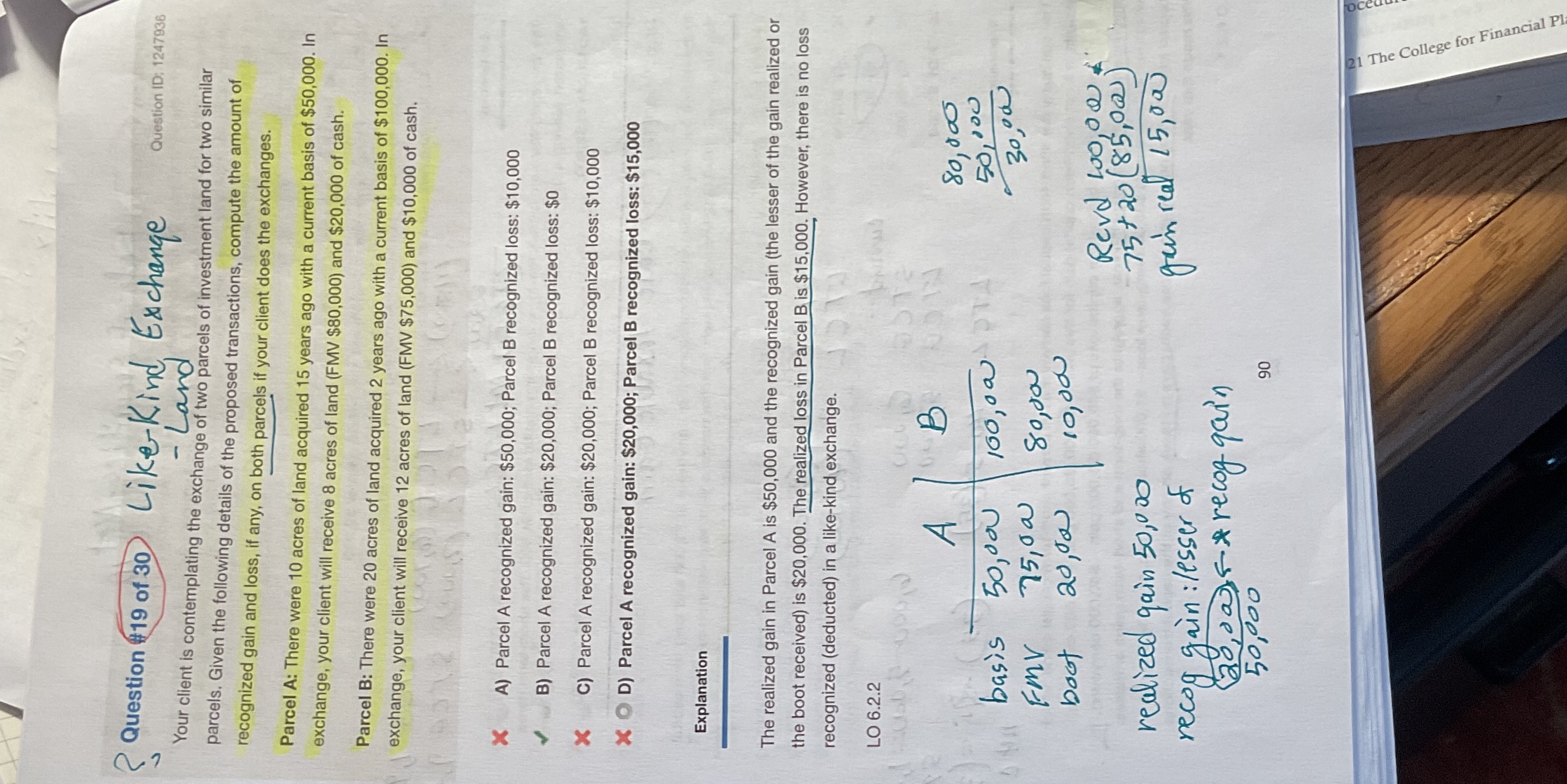

3 Question #19 of 30 Like-Kind, Exchange Land Your client is contemplating the exchange of two parcels of investment land for two similar parcels. Given the following details of the proposed transactions, compute the amount of recognized gain and loss, if any, on both parcels if your client does the exchanges. Parcel A: There were 10 acres of land acquired 15 years ago with a current basis of $50,000. In exchange, your client will receive 8 acres of land (FMV $80,000) and $20,000 of cash. Parcel B: There were 20 acres of land acquired 2 years ago with a current basis of $100,000. In exchange, your client will receive 12 acres of land (FMV $75,000) and $10,000 of cash. X A) Parcel A recognized gain: $50,000; Parcel B recognized loss: $10,000 B) Parcel A recognized gain: $20,000; Parcel B recognized loss: $0 C) Parcel A recognized gain: $20,000; Parcel B recognized loss: $10,000 XOD) Parcel A recognized gain: $20,000; Parcel B recognized loss: $15,000 X Explanation The realized gain in Parcel A is $50,000 and the recognized gain (the lesser of the gain realized or the boot received) is $20,000. The realized loss in Parcel B is $15,000. However, there is no loss recognized (deducted) in a like-kind exchange. LO 6.2.2 050 000) A basis 50,000 75,00 20,000 FMV boot Question ID: 1247936 B 100,000 14 80,000 10,000 realized gain 50,000 recog gain : lesser of 20,005 A recog gain 50,000 90 80,000 50,000 30,000 Revd 100,00; 75+20 (85,00) gain real 15,00 21 The College for Financial PL

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the recognized gain or loss in a likekind exchange for both parcels we need to compa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started