Answered step by step

Verified Expert Solution

Question

1 Approved Answer

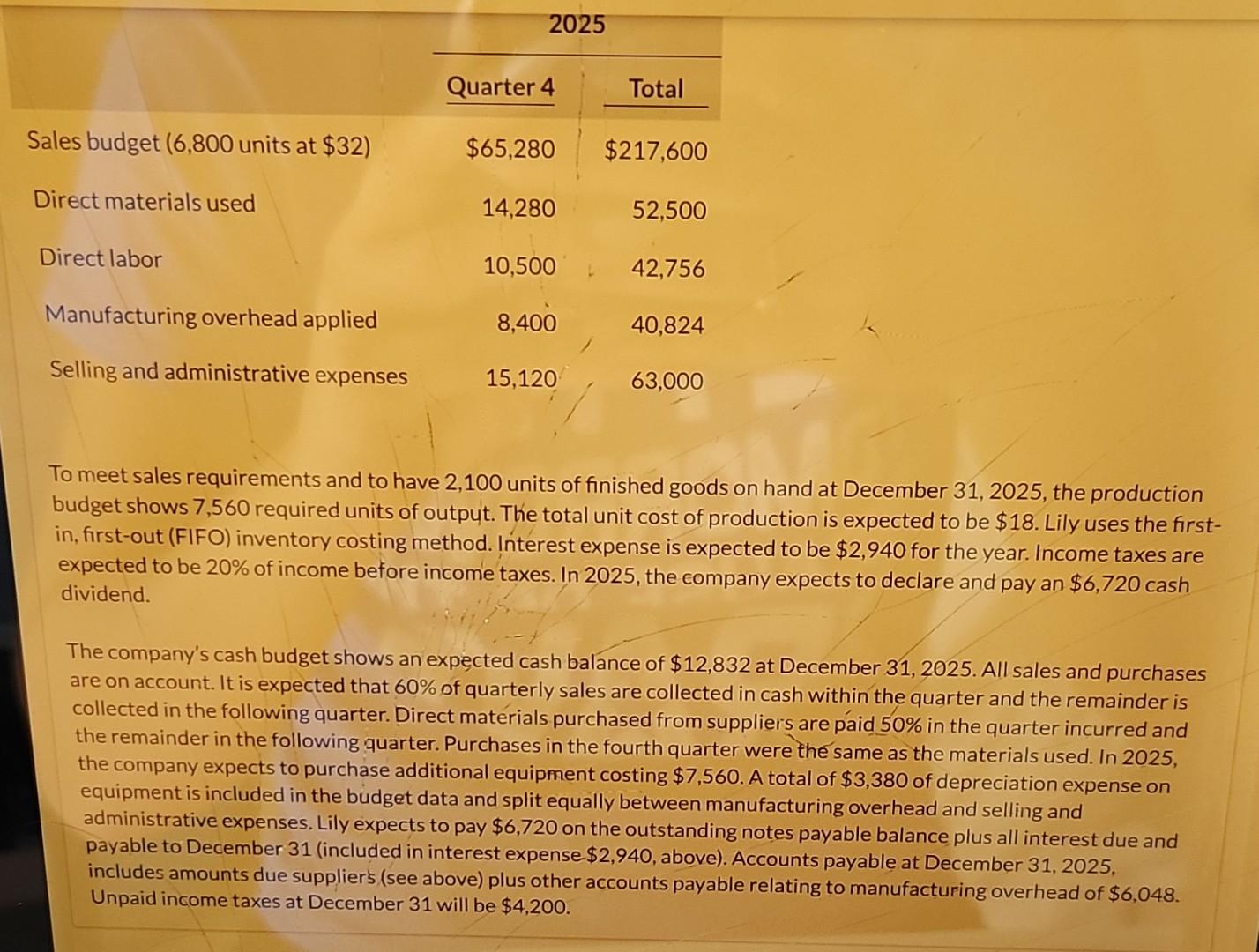

Lil To meet sales requirements and to have 2,100 units of finished goods on hand at December 31,2025 , the production budget shows 7,560 required

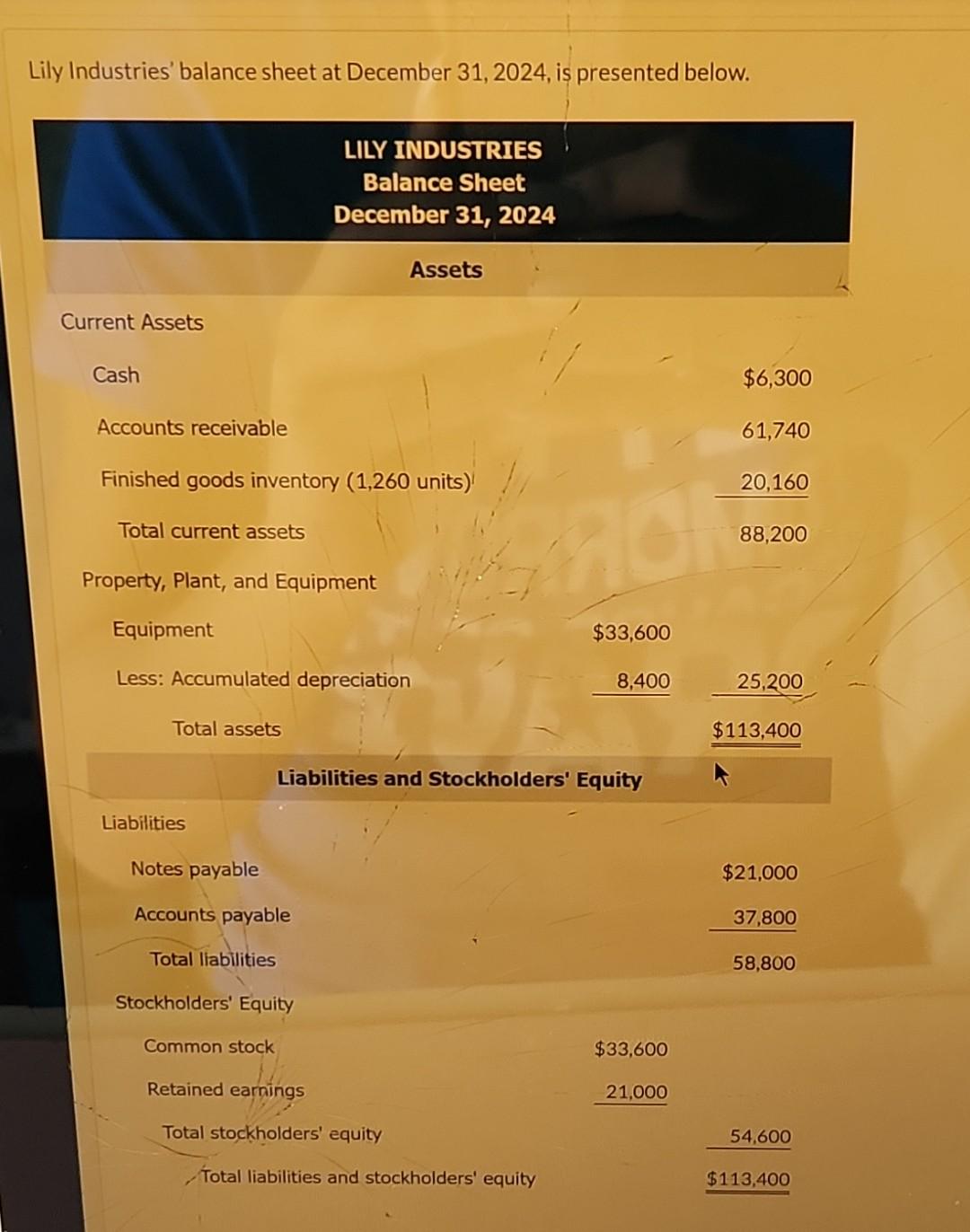

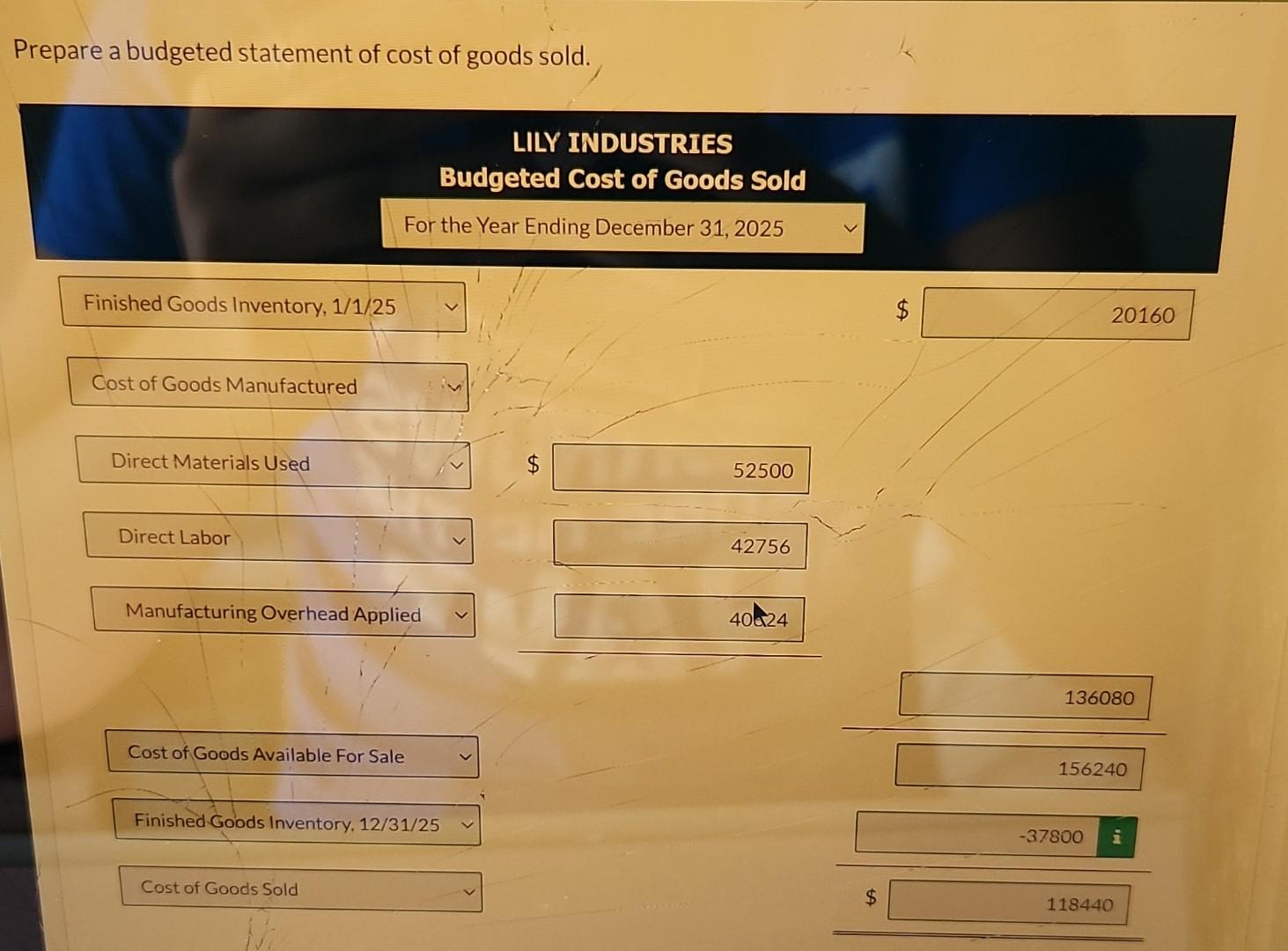

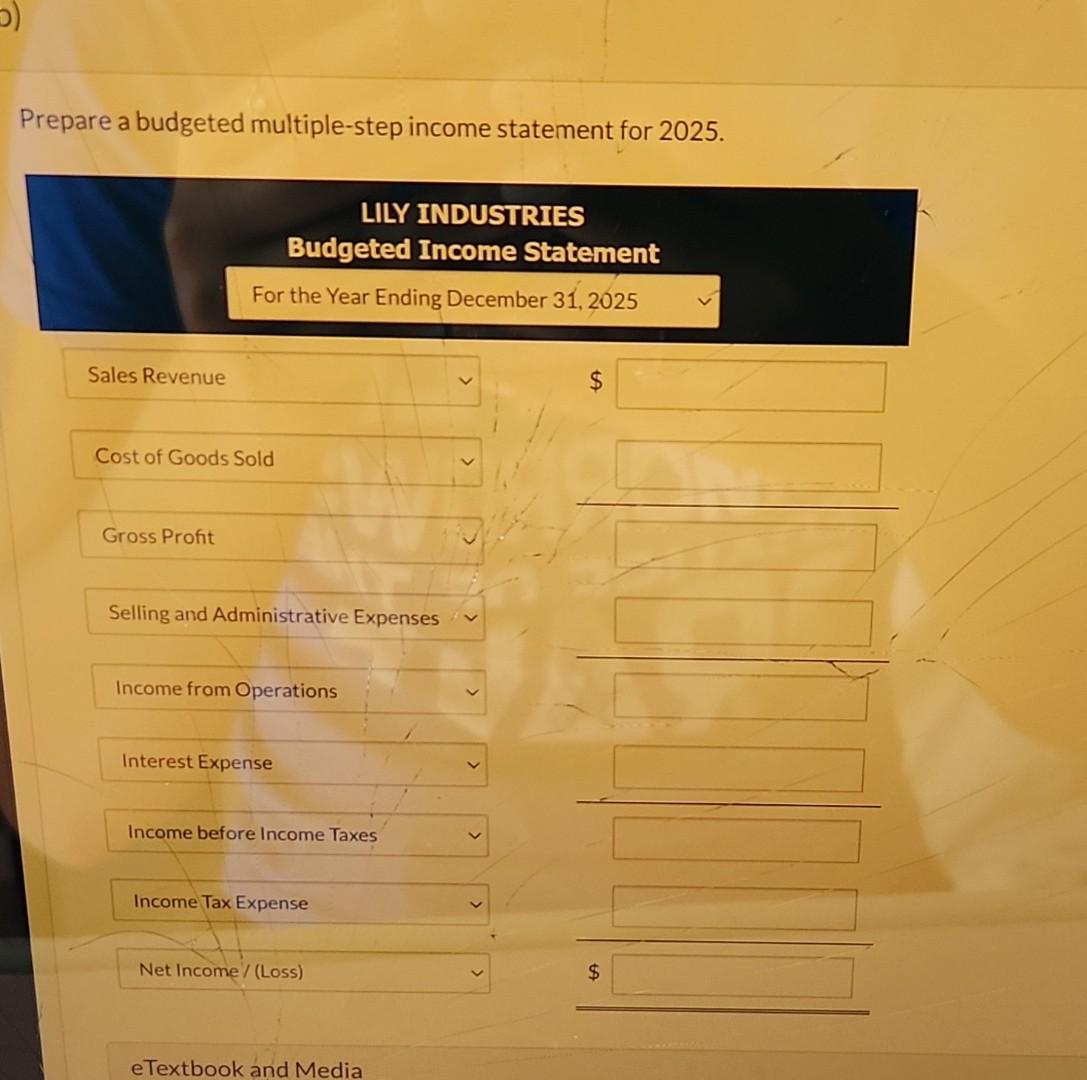

Lil To meet sales requirements and to have 2,100 units of finished goods on hand at December 31,2025 , the production budget shows 7,560 required units of output. The total unit cost of production is expected to be $18. Lily uses the firstin, first-out (FIFO) inventory costing method. Interest expense is expected to be $2,940 for the year. Income taxes are expected to be 20% of income before income taxes. In 2025 , the company expects to declare and pay an $6,720 cash dividend. The company's cash budget shows an expected cash balance of $12,832 at December 31,2025 . All sales and purchases are on account. It is expected that 60% of quarterly sales are collected in cash within the quarter and the remainder is collected in the following quarter. Direct materials purchased from suppliers are paid 50% in the quarter incurred and the remainder in the following quarter. Purchases in the fourth quarter were the same as the materials used. In 2025 , the company expects to purchase additional equipment costing $7,560. A total of $3,380 of depreciation expense on equipment is included in the budget data and split equally between manufacturing overhead and selling and administrative expenses. Lily expects to pay $6,720 on the outstanding notes payable balance plus all interest due and payable to December 31 (included in interest expense $2,940, above). Accounts payable at December 31,2025 , includes amounts due suppliers (see above) plus other accounts payable relating to manufacturing overhead of $6,048. Unpaid income taxes at December 31 will be $4,200. Prepare a budgeted statement of cost of goods sold. Prepare a budgeted multiple-step income statement for 2025. LILY INDUSTRIES Budgeted Income Statement For the Year Ending December 31, 2025 eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started