Question

In this discussion, we will analyze the case of Starting Right, a hypothetical company created by Julia Day after quitting a successful corporate career to

In this discussion, we will analyze the case of “Starting Right”, a hypothetical company created by Julia Day after quitting a successful corporate career to start a high-quality baby food company. During the initial start-up process, Julia was able to establish a team experienced in finance, marketing, and production to develop prototypes of the new product and conduct pilot testing that was highly successful. The final stage required finding investors to acquire the capital necessary to fund the launch of the company. The following information was provided to potential investors, and based on their own personal circumstances, advice and recommendations are established for each investor in the final Discussion Questions.

Discussion Questions

Sue Pansky

1. Sue Pansky, a retired elementary school teacher, is considering investing in Starting Right. She is very conservative and is a risk avoider. What do you recommend?

Ray Cahn

2. Ray Cahn, who is currently a commodities broker, is also considering an investment, although he believes that there is only a 15% chance of success. What do you recommend?

Lila Battle

3. Lila Battle has decided to invest in Starting Right. While she believes that Julia has a good chance of being successful, Lila is a risk avoider and very conservative. What is your advice to Lila?

George Yates

4. George Yates believes that there is an equally likely chance for success. What is your recommendation?

Peter Metarko

5. Peter Metarko is extremely optimistic about the market for the new baby food. What is your advice for Pete?

Julia Day

6. Julia Day has been told that developing the legal documents for each fundraising alternative is expensive. Julia would like to offer alternatives for both risk-averse and risk-seeking investors. Can Julia delete one of the financial alternatives and still offer investment choices for risk seekers and risk avoiders?

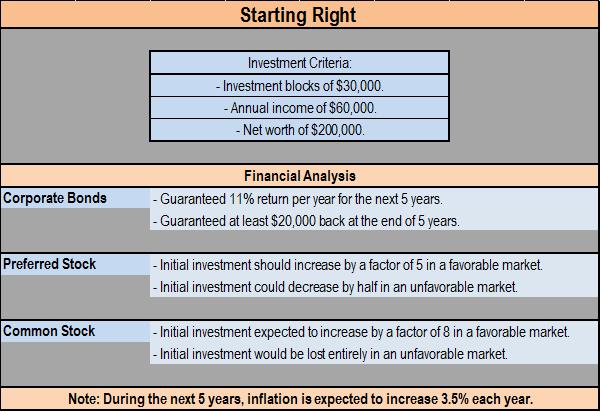

Starting Right Investment Criteria: - Investment blocks of $30,000. - Annual income of S60,000. - Net worth of $200,000. Financial Analysis Corporate Bonds - Guaranteed 11% return per year for the next 5 years. - Guaranteed at least $20,000 back at the end of 5 years. Preferred Stock - Initial investment should increase by a factor of 5 in a favorable market. - Initial investment could decrease by half in an unfavorable market. Common Stock - Initial investment expected to increase by a factor of 8 in a favorable market. - Initial investment would be lost entirely in an unfavorable market Note: During the next 5 years, inflation is expected to increase 3.5% each year. Starting Right Investment Criteria: - Investment blocks of $30,000. - Annual income of S60,000. - Net worth of $200,000. Financial Analysis Corporate Bonds - Guaranteed 11% return per year for the next 5 years. - Guaranteed at least $20,000 back at the end of 5 years. Preferred Stock - Initial investment should increase by a factor of 5 in a favorable market. - Initial investment could decrease by half in an unfavorable market. Common Stock - Initial investment expected to increase by a factor of 8 in a favorable market. - Initial investment would be lost entirely in an unfavorable market Note: During the next 5 years, inflation is expected to increase 3.5% each year.

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

This is a decisionmakingunderuncertainty case There are two events a favorable market event 1 and an ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e38247b0c8_182461.pdf

180 KBs PDF File

635e38247b0c8_182461.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started