Answered step by step

Verified Expert Solution

Question

1 Approved Answer

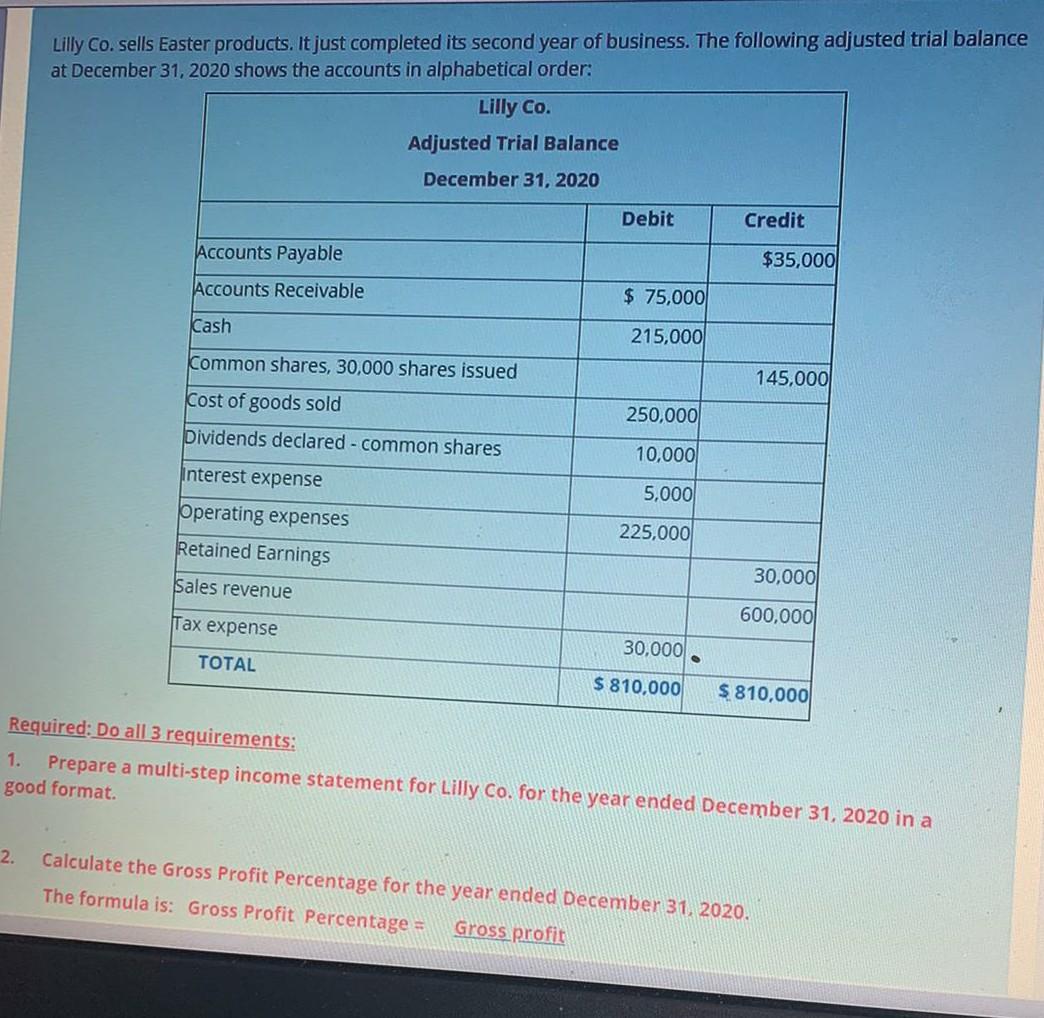

Lilly Co. sells Easter products. It just completed its second year of business. The following adjusted trial balance at December 31, 2020 shows the accounts

Lilly Co. sells Easter products. It just completed its second year of business. The following adjusted trial balance at December 31, 2020 shows the accounts in alphabetical order: Lilly Co. Adjusted Trial Balance December 31, 2020 Debit Credit Accounts Payable $35,000 Accounts Receivable $ 75,000 Cash 215,000 Common shares, 30,000 shares issued 145,000 Cost of goods sold Dividends declared - common shares 250,000 10,000 5,000 Interest expense Operating expenses Retained Earnings 225,000 30,000 Sales revenue 600,000 Tax expense 30,000/ TOTAL $ 810,000 $ 810,000 Required: Do all 3 requirements: 1. Prepare a multi-step income statement for Lilly Co. for the year ended December 31, 2020 in a good format. 2. Calculate the Gross Profit Percentage for the year ended December 31, 2020. The formula is: Gross Profit Percentage = Gross profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started