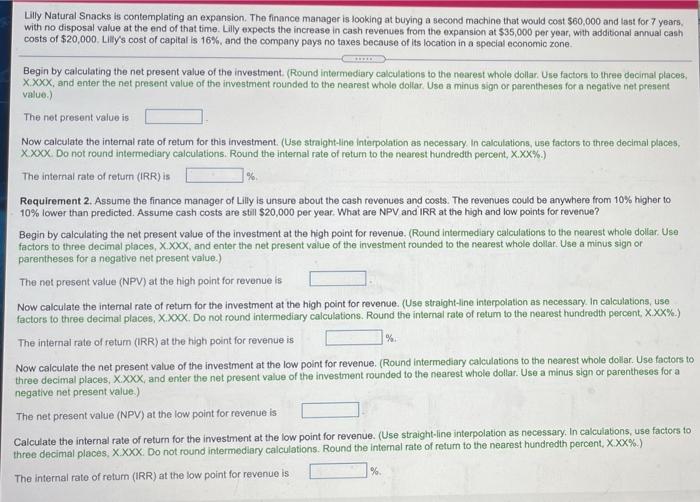

Lilly Natural Snacks is contemplating an expansion. The finance manager is looking at buying a second machine that would cost $60,000 and last for 7 years, with no disposal value at the end of that time. Lilly expects the increase in cash revenues from the expansion at $35,000 per year with additional annual cash costs of $20,000 Lilly's cost of capital is 16%, and the company pays no taxes because of its location in a special economic zone Begin by calculating the net present value of the investment. (Round intermediary calculations to the nearest whole dollar. Une factors to three decimal places, xxxx, and enter the net present value of the investment rounded to the nearest whole dollar. Use a minus sign or parentheses for a negative net present value.) The not present value is Now calculate the internal rate of return for this investment. (Use straight-line Interpolation as necessary. In calculations, use factors to three decimal places, Xxxx. Do not round intermediary calculations. Round the internal rate of return to the nearest hundredth percent, X.XX%) The internal rate of return (IRR) is Requirement 2. Assume the finance manager of Lilly is unsure about the cash revenues and costs. The revenues could be anywhere from 10% higher to 10% lower than predicted. Assume cash costs are still $20,000 per year. What are NPV and IRR at the high and low points for revenue? Begin by calculating the net present value of the investment at the high point for revenue. (Round Intermediary calculations to the nearest whole dollar. Use factors to three decimal places, X.XXX, and enter the net present value of the investment rounded to the nearest whole dollar. Use a minus sign on parentheses for a negative net present value.) The not present value (NPV) at the high point for revenue is Now calculate the internal rate of return for the investment at the high point for revenue. (Use straight-line interpolation as necessary. In calculations, use factors to three decimal places, X.XXX. Do not round intermediary calculations. Round the internal rate of retum to the nearest hundredth percent XXX%.) The internal rate of retur (IRR) at the high point for revenue is % Now calculate the net present value of the investment at the low point for revenue. (Round intermediary calculations to the nearest whole dollar. Use factors to three decimal places, XXXX, and enter the net present value of the investment rounded to the nearest whole dollar. Use a minus sign or parentheses for a negative net present value) The net present value (NPV) at the low point for revenue is Calculate the internal rate of return for the investment at the low point for revenue. (Use straight-line interpolation as necessary. In calculations, use factors to three decimal places, XXXX. Do not round intermediary calculations. Round the Internal rate of return to the nearest hundredth percent, XXX%) The internal rate of return (IRR) at the low point for revenue is